By design, 2013 was an important and transformative year for the company. We remained dedicated to serving the needs of our customers while strategically growing our Servicing portfolio, with a focus on building on our historically high level of performance. And as we profitably grew the Servicing business, we launched our Originations platform and extended our core competencies in servicing to our Reverse Mortgage platform.

Additionally, we reached a number of important milestones in 2013, including boarding more than 1 million loans. We received upgrades or reaffirmations of our strong servicing ratings from Standard & Poors, Moody’s, and Fitch, and were awarded a Four STAR service rating by Fannie Mae, the best-in-class among our peers.

2013 was an exceptional year for Walter Investment Management Corp., marked by strong operational execution leading to strong financial results. We are proud to report that we achieved, and in many respects exceeded the goals of the strategic plan we introduced at the beginning of the year for accelerating growth and earnings to drive sustainability for the business and our shareholders.

In leveraging a positive economic environment and favorable industry trends, our management team executed effectively across each of the Company’s segments, growing a robust pipeline while also delivering strong performance from our recent acquisitions.

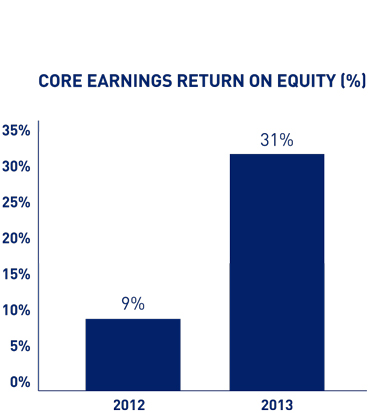

For the year, we posted net income of $254 million, or $6.63 per diluted share, an increase of $276 million over the prior year. Core earnings increased over 337 percent from 2012 to $363 million after taxes, or $9.63 per diluted share and Adjusted EBITDA of $692 million in 2013, grew $450 million as compared to the prior year. Our strong performance resulted in a core earnings return on equity of over 30 percent, up from 9 percent in 2012. I want to applaud our management team for their hard work and significant contributions this year.

opportunities within our ResCap and Bank of America portfolio acquisitions. We played an important role for customers and the industry, helping more than 63,000 homeowners gain access to affordable refinancing, while funding approximately $16 billion in loans during the year. Originations promises to be a long-term contributor to earnings as our core retention, retail and correspondent channels mature, generating highquality, low-cost mortgage servicing rights for our core servicing operations.

Meanwhile, every day, nearly 11,000 baby boomers become eligible for our reverse mortgage product. Our Reverse Mortgage platform is a market leader in the reverse originations sector and was the leading Ginnie Mae issuer in 2013, positioning us to take advantage of this demographic and consumer demand.

With 2013’s success, the acceleration of portfolio acquisition opportunities and the maturation of our forward and reverse originations businesses, the timing was perfect to launch a capital vehicle. To accomplish this, we are finalizing Walter Capital Opportunity Corp. in partnership with York Capital Management, with plans to provide up to $220 million of capital to grow and fund new acquisition opportunities.

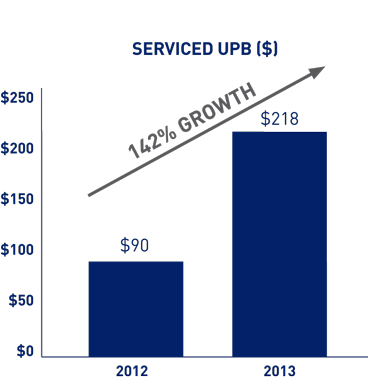

We substantially grew our Servicing portfolio, more than doubling our book of business to over $200 billion of UPB, with exceptional performance from the Green Tree servicing platform coupled with an increase in the value of our acquired mortgage servicing rights (MSR). We remain focused on capitalizing on current trends in the specialty servicing sector, uniquely positioning Walter Investment to benefit from the ongoing movement of non-core servicing assets to those servicers best equipped to support customers and drive improved performance from at-risk assets.

We worked diligently to achieve our goals of serving our customers and ensuring they have a positive customer experience as they are supported through some of the most challenging aspects of home ownership. During 2013, our Servicing group modified the loans of nearly 39,000 customers through investor and government sponsored modification programs, providing our customers with affordable solutions that allowed them to stay in their homes and demonstrating our commitment to providing best-in-class service and mortgage product offerings to our customers.

In the first quarter of 2013, we launched our Originations segment, successfully growing the business from the ground up to maximize the HARP

This year, the Company will continue to leverage the historically low interest-rate environment and drive continued growth in our Servicing book of business. In 2014, we anticipate strong growth of our recurring, feebased revenue streams across our business segments, which we expect will increase by more than 25 percent this year, fueling our long-term success and supporting the sustainability of our business model.

We’re also focused on continuing to grow our key asset management revenue stream with Walter Capital Opportunity Corp. and maximizing the remaining HARP retention opportunity embedded in our serviced portfolio.

Our Walter Investment team will continue to expand the number of channels we use to reach customers, with best-in-class capabilities across the mortgage value chain – from originations to REO. Our full suite of products and capabilities uniquely positions the Company for continued success in the evolving mortgage market.

That is why, I believe, our greatest success still lies ahead. We are well positioned to take advantage of opportunities as we continue to drive substantial growth, provide superior customer service and deliver excellent shareholder value.

Mark J. O'Brien

Chairman and Chief Executive Officer

We also took significant steps towards diversifying our capital structure through the issuance of $575 million of senior unsecured notes and we refinanced our $1.5 billion term loan at a reduced rate and under a covenant light structure.

I’m extremely excited about the important steps that we have taken over the past year, all of which are designed to drive both near and long-term growth for the Company.

OUTLOOK

Our outlook for 2014 is strong, as we are poised to continue delivering outstanding results for you, our shareholders.

Walter Investment remains uniquely positioned to capitalize on the trends in our industry. Specifically, we’re prepared to capitalize on the potential $1 trillion of servicing rights that are expected to transfer to specialty servicers over the next several years. And though there continues to be an elevated level of regulatory scrutiny of the mortgage sector, we believe this is a natural part of the evolution and maturation of the industry and that ultimately this oversight will prove beneficial to our customers and clients. We maintain strong relationships with our state and federal regulators and we seek to align ourselves with them as we refine and improve our operational processes, resulting in a better servicing experience for our customers. Providing outstanding service to our customers and finding the best solutions to meet their needs are among the most important goals for our organization.