Operating Environment and Strategy

Operating environment

“Our strategy, as set out in May 2006, continues to address the changing operating environment”

Arun Sarin

Chief Executive

The industry landscape continues to evolve

Vodafone is seeing significant change in its operating environment. Traditional market boundaries are shifting as customers benefit from a growing choice in communications services, devices and providers that span mobile, broadband and the internet. This change is being driven by evolving customer needs, the emergence of new technologies, intensifying price competition from both new and established competitors and regulatory pressures.

Customers

Customers’ needs are changing, including the desire for faster access to services, simple and value driven tariffs and easy to use devices. Customers increasingly want mobile data services, such as email and internet access, so that they can use the internet on their mobile devices in much the same way as they use it on their PC. In order to meet customers’ evolving needs, the Group is building upon its traditional services of voice and messaging to include newer offerings such as mobile and fixed broadband.

Technology

Technology within the mobile industry is evolving rapidly. Vodafone has been upgrading its networks to enable the provision of high speed mobile internet and broadband in addition to core voice and messaging services. Ongoing network enhancements are expected to provide even faster access and a better user experience. In addition, the range and capability of mobile devices continues to evolve in terms of speed, data capacity and multi-function capability. Against this background, the Group continues to carefully assess, select and deploy the appropriate technology and devices in order to improve both operational efficiency and customer service.

Competition

The communications market is very competitive, with a number of providers in most countries. The Group’s principal competitors are existing mobile network operators (“MNOs”) in each of its geographic markets. In addition, the Group competes with mobile virtual network operators (“MVNOs”) that lease network capacity from MNOs and fixed line operators offering combined fixed and mobile services. New competitors are also beginning to enter the communications market, including internet based companies, handset manufacturers and software providers. These companies are being encouraged by the relative attractiveness of the industry and the opportunity to extend their services to mobile.

Vodafone’s core European market has high mobile penetration of over 100% due to some customers owning more than one subscriber identity module (“SIM”), which limits customer growth. The combination of high penetration and competitive intensity is expected to continue to place significant downward pressure on prices.

Regulation

Regulatory activities by both national and EU authorities continue to have a significant impact on the telecommunications sector. Around 20% of the Group’s revenue is directly subject to regulation – mainly related to termination rates and international voice roaming. The competitive environment is also impacted by regulation in a number of areas, including the allocation of radio spectrum, the provision of network access to third parties and network sharing. Regulation is anticipated to continue to have a major influence on both the Group and the telecommunications industry.

Strategy

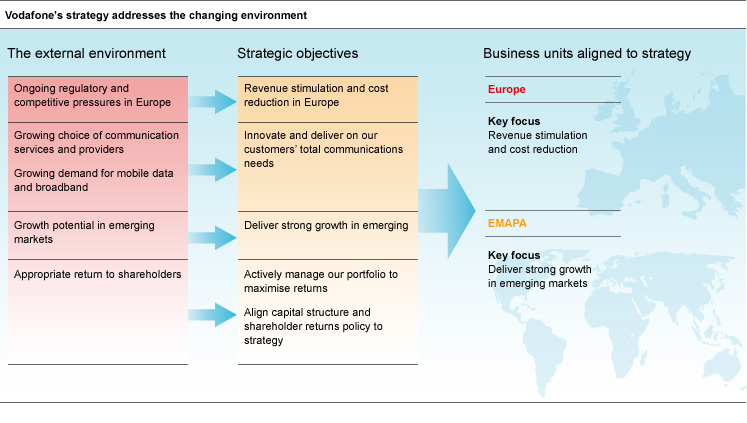

Vodafone’s five key strategic objectives were set out in May 2006 to address the mobile industry’s changing environment and to draw upon the Group’s strengths.

Revenue stimulation and cost reduction in Europe

| Estimated mobile penetration Europe (%) At 31 December 2007 |

|

|---|---|

| Germany | 117 |

| Italy | 153 |

| Spain | 122 |

| UK | 122 |

Competition and regulation in Europe are placing significant pressure on pricing. In order to offset these pressures, the Group’s strategy is to drive additional revenue and reduce costs.

Revenue stimulation is focused on ways to encourage additional usage and revenue from core voice and messaging services in Europe, where only around 40% of voice traffic is carried over mobile networks and customers use their mobiles for around 170 minutes per month, around a quarter of comparable US levels. The strategy is based on a market by market approach of targeted propositions for key customer segments. Consumer offers include a range of attractive tariffs, which are designed to offer both simplicity and value. Business propositions are focused on leveraging Vodafone’s market leading presence among European business customers. For roaming customers, Vodafone’s wide European footprint enables it to offer competitive and transparent price tariffs.

Cost reduction is being driven by leveraging the Group’s local and regional scale. Key initiatives are focused on centralising, sharing and outsourcing certain activities.

| Estimated mobile penetration EMAPA (%) At 31 December 2007 |

|

|---|---|

| Egypt | 42 |

| India | 21 |

| Romania | 103 |

| Turkey | 80 |

| US | 86 |

The Group has centralised bulk purchasing of networks, IT and services to drive cost efficiencies. Parts of the networks have been shared with other operators to reduce the costs, as well as the environmental impact, of network expansion and maintenance. In addition, certain functions have been outsourced in markets where industry leading partners are able to realise greater scale and cost efficiencies.

Innovate and deliver on our customers’ total communications needs

The communications environment is constantly evolving and customers increasingly want solutions to meet all their communications needs from one provider. In this environment, Vodafone has broadened its offerings beyond core voice and messaging to include total communications solutions, which is comprised of data, fixed location services, fixed broadband and advertising.

Vodafone continues to benefit from strong data revenue growth, particularly due to mobile devices and services that connect business and consumer users to their email and the internet. In addition, through partnerships with leading internet companies, the Group provides products and services that integrate the mobile and PC environments. This enables consumers to use their mobiles to replicate fixed line internet activities.

Fixed location services have been developed to encourage customers to substitute fixed line usage for mobile within their home and office environments. This includes services that allow customers to make mobile calls from designated locations at prices similar to fixed line providers.

Vodafone offers fixed broadband services as a complement to its mobile broadband products. This combination enables customers to have alternative means to access their internet applications either at home, in the office or on the move. Fixed broadband is provided through a mixture of owned assets and wholesale relationships with leading partners.

Mobile advertising is still in its infancy, but offers a potentially significant future revenue stream. By using mobile devices, both advertisers and consumers have the opportunity to create and receive adverts that are more targeted to users’ interests and preferences than traditional media. The Group’s current focus is on building the appropriate distribution channels and content.

Total communications services contributed 13% of Group revenue during the year and are expected to represent around 20% by the 2010 financial year.

Deliver strong growth in emerging markets

Emerging markets are expected to represent an increasing proportion of the Group in the next few years due to organic growth and new investments.

Existing markets continue to benefit from strong customer growth due to low mobile penetration rates of 36% on average. Additional value is being driven by measures to reduce costs and stimulate revenue by leveraging the Group’s global scale and best practice from within its more established European operations.

The Group continues to pursue selective opportunities to invest in new markets as well as taking opportunities to increase its stakes in existing markets. The focus is on attractive growth regions such as the Middle East, Africa and Asia.

Actively managing our portfolio to maximise returns

The Group seeks to optimise its portfolio of assets by either disposing of assets when a superior return cannot be earned or acquiring assets when substantial additional value for shareholders can be achieved. Potential acquisitions are subject to strict criteria including appropriate financial returns, a strong local position and an identifiable path to control.

Align capital structure and shareholder policy to strategy

The Group’s capital structure and returns policy has been aligned to its operational strategy. The key targets are low single A long term credit ratings and 60% of adjusted earnings per share distributed as dividends.