A Message from Rob Willett:

Cognex is positioned for growth

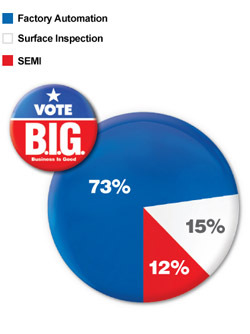

Revenue by Market(Click to Enlarge) |

(Click to Enlarge) |

(Click to Enlarge) |

Even protesters benefit

|

Dear Shareholders:

Cognex has a motto, “To preserve and enhance vision,” that refers to our tireless effort to make the world’s best machine vision products. It also signifies our commitment to preserve and enhance our vision of what a great company can be…innovative, dynamic, successful and a reliable and trustworthy partner to all its stakeholders. As I wrap up my first year as CEO, I am pleased to report our progress toward both goals.

Let’s start by examining our financial results. By all counts, 2011 was another outstanding year for Cognex. The impressive numbers delivered by hard-working Cognoids are proof that business is good. At Cognex, the B.I.G. Campaign is off the ground...and picking up steam!

Key highlights in 2011 include:

- Record revenue of $322 million, an 11% increase over last year’s record of $291 million;

- Record net income of $70 million, a 14% increase over the $61 million reported in 2010; and

- Record earnings per share of $1.63, up 7% from the record $1.52 we reported in 2010.

We continued to deliver a high level of profitability in 2011:

- Gross margin was 76%, a 250 basis point increase over 2010. We’re especially proud of our gross

margin because it reflects the value Cognex customers recognize in our technology; - Operating margin was 27%, an improvement over 26% in 2010, despite significant

investments to drive future growth; and - Net margin was 22%, an increase over the 21% reported in 2010.

The factory automation market served by our Modular Vision Systems Division (MVSD) drove the lion’s share of growth. Factory automation revenue was a record $236 million in 2011, an 18% increase over $200 million in 2010.1 We saw gains especially in automotive as well as in consumer electronics, pharmaceuticals and medical devices. These industries rely increasingly on machine vision to reduce product liability, streamline manufacturing and ensure quality.

“We launched the largest number of new products in

Cognex history in 2011...”

Our Surface Inspection Systems Division (SISD) also had a great year, growing revenue 12% to a record $48 million. Under new senior leadership, SISD’s product margins expanded from 48% in 2010 to 53% in 2011 thanks to decreased costs and improved pricing. In 2011, business increased substantially from paper industry customers who upgraded their factories, and Chinese steel manufacturers who installed surface inspection systems to capitalize on their growing share of the global steel market.

Unfortunately, certain segments of our business slowed in 2011 due to situations beyond our control, such as the devastating earthquake and tsunami in Japan. Although no Cognoids were hurt by these catastrophic events, the fallout from the disasters and a cyclical downturn in the semiconductor and electronics capital equipment (SEMI) market combined to drive down revenue from Japan by $10 million, 17% below 2010. Good news in what was a difficult year for Japan is that business through our collaboration with Mitsubishi grew by more than 30% over 2010, helping us gain market share on the Japanese factory floor. Sales also softened in the second half of 2011 in the solar industry as a result of reduced government subsidies, and in consumer electronics due to weaker demand.

As our sales force and channel partners were bringing in business, Cognex engineers were designing products to fuel future growth. In fact, we launched the largest number of new products in Cognex history in 2011, and we have a strong product pipeline slated for introduction over the next 18 months. Our most exciting product launch in 2011 was the DataMan 500 ID reader, which marked our entry into the $150 million logistics barcode reading market, consisting of online retailers like Amazon.com and Staples.com, and the companies that handle their shipping, including the U.S. Postal Service, UPS and FedEx.

DataMan 500 is an image-based 1-D barcode reader that was designed from the ground up to have reading capabilities superior to laser-based systems regarded as the industry standard. Powered by our unique vision system-on-a-chip (Cognex VSoC™) and proprietary algorithms, DataMan 500 can read damaged, distorted, blurred, scratched, low-height and low-contrast codes on package labels both faster and more reliably than existing readers. The market response to the DataMan 500 has been fantastic. Soon after the product launched we received several large orders, all from customers new to Cognex!

Broadening our barcode-reading product line is a strategic focus for Cognex. Thanks to continued investment in engineering and sales channel development, we launched a record number of ID products over the last few years. The return on that investment has been outstanding. Revenue from ID products was $60 million in 2011, representing 38% growth over 2010, and compound annual growth of 48% over the past 3 years.

Our In-Sight and Checker product lines generated a combined $139 million of factory automation revenue in 2011, an increase of 18% over 2010. Not too shabby, for sure…but our marketing and engineering teams think we can do even better. So in true Cognoid spirit they’re working hard to add new features and functionality, which we expect will expand the use of Cognex vision on the factory floor.

“Cognex is now recognized as the leading

machine vision brand in China.”

When the dust had settled on 2011, Cognex successfully grew our global presence in developed machine vision markets and emerging regions that we believe hold high potential for future growth. The most exciting of these is China, which we define as the Peoples’ Republic of China (PRC), Hong Kong and Taiwan. China’s large manufacturing base is investing heavily in state-of-the art, highly-automated facilities that incorporate machine vision.

We aim to win the majority of this business, so we added Cognoids to our existing Chinese sales and service organization, and opened new offices in major industrial centers. What’s more, we expanded our network of partners. This includes both local distributors to complement our direct sales force and system integrators who provide greater access to the Chinese factory floor.

These investments in China are already paying off. Our Chinese factory automation business in 2011 increased 65% year over year, and Cognex is now recognized as the leading machine vision brand in China. Although the weaker consumer electronics industry has cooled our white-hot pace in China, it is still growing faster than the rest of our business and we expect strong growth from China over the medium and long term.

Is our future bright? We think so. Although I can’t predict the future, my management team and I took several steps in 2011 to increase the likelihood of a bright one for Cognex. We invested nearly $41 million in research, development and engineering, up almost $8 million over 2010. This is indicative of our commitment to innovation and our willingness to invest in our business for long-term growth. We increased our investment in sales by $11 million, adding salesmen and channel partners around the globe. And we increased our marketing investment by $3 million to target and raise visibility with new customers and early adopters of machine vision.

Even with those significant investments, we were highly profitable, delivering 22% of revenue to the bottom line. As Doctor Bob describes in his Chairman’s letter, we shared our success with those who contributed to it, both inside and outside the company. As a candidate of the B.I.G. Campaign, I’m proud of the good Cognex has done for our customers, employees, vendors and shareholders, and for the communities where we live and work.

Now we look forward to 2012. Though many companies are facing challenges due to global economic uncertainty, Cognex is well positioned to deliver on our strategic initiatives. And regardless of the economic climate, we will stay true to our core values and the unique “Work Hard, Play Hard, Move Fast” entrepreneurial culture that fueled our previous successes.

Thank you…and remember to vote B.I.G.!

Robert J. Willett

President and Chief Executive Officer