This year was truly one for the record books, albeit many of the records we broke were set internally. The spirit of Progressive people is to set audacious goals, and we find that doing so intensifies our collaboration and strengthens our relationships as a collective team. That may sound pedestrian, but it is fundamental to our identity and allows us to consider the enterprise in its entirety and not as siloed functional areas. This isn’t something that we can visibly quantify, but it has worked for over 80 years, and we believe it allows us to balance our achievements with a strong sense of togetherness with our Core Values as the backdrop.

To that end, in 2018 we achieved the following:

- We moved up one position to become the #3 company in the private passenger auto market. As we’ve stated time and time again, this gets us one step closer to achieving our ultimate vision.

- We crossed the $30 billion net premiums written (NPW) threshold after celebrating $20 billion in NPW only a few years earlier.

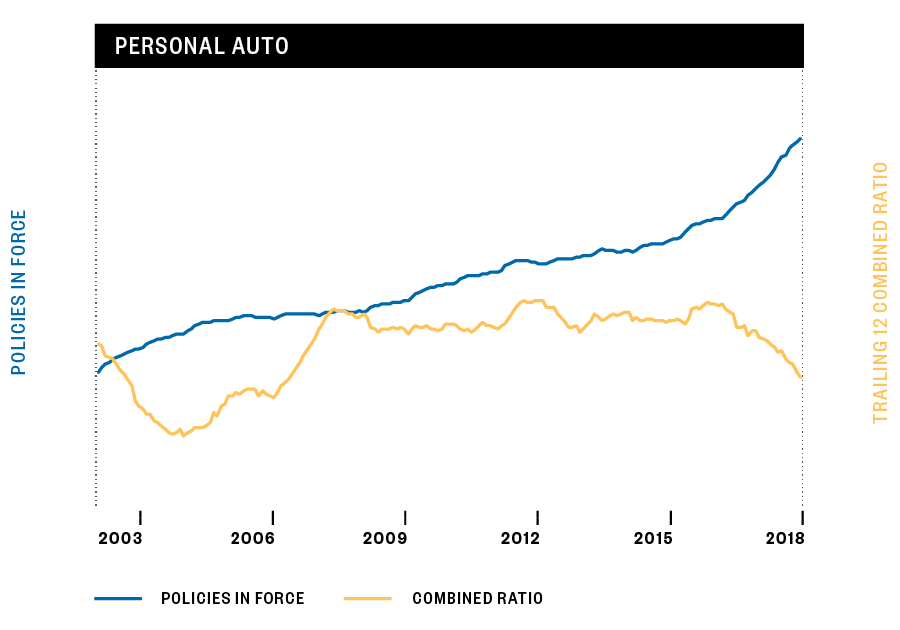

- We surpassed 20 million total policies in force (PIF) and 13 million auto PIFs allowing us to be in more homes where we can continue to grow, especially with the Robinsons (customers with auto + home). That rate of growth is incredible and could not have been achieved had we all not been in sync on hiring and training well in advance of need in order to service these new customers.

- We have continued to mount a full court press on retention and now serve over 2 million customers who have been with us for a decade or longer. We do not take this for granted and are acutely aware that we need to earn their business each and every day.

- We now serve over a million Robinsons and see so much more opportunity to grow in this consumer segment. Having started at Progressive over 31 years ago, it’s a thrill to see how we have evolved from our nonstandard roots and are able to serve every demographic.

- We concluded a multi-year investment in a new policy processing system, which now manages all auto and special lines policies.

In a Nutshell

We wrapped up the year with a combined ratio (CR) of 90.6 and NPW growth of 20%. The results are extraordinary and especially solid coming off of two very successful prior years of profitable growth. We added over $5 billion in NPW in 2018 after adding $3.8 billion in 2017 and $2.8 billion in 2016.

Our Personal Lines CR was 90.3, with NPW growth of 18% and auto PIF growth of 14%. Both the Agency and Direct channels contributed to these stellar results. Our special lines products PIF growth was relatively flat year-over-year, reflecting our already significant share of this market, specifically with our motorcycle and boat products.

A significant contributor to our results came from our Commercial Lines area. We ended 2018 with a CR of 86.7 and nearly 30% NPW growth and PIF growth just shy of 8%.

While growth was also strong in Property with NPW and PIF growth of 33% and 32%, respectively, our profit results were vastly affected by weather and natural catastrophes. Our catastrophe reinsurance program limited our retained losses and loss adjustment expenses from Hurricane Michael to $60 million. Unfortunately, our retained catastrophe losses and loss adjustment expenses from hurricanes, hail, winter storms, and the California wildfires totaled $295 million, accounting for 23 points of our Property combined ratio of 106.9. We continue to take rate to get us in line with our profitability target, but this will take time to earn in, since Property policies have annual terms.

In addition to rate, we are using underwriting rules and coverage restrictions to manage our portfolio in high risk areas. We remain confident that we will course correct, that is if the elements cooperate.

On the investment side we produced a 2018 total return of 1.2%. The year was characterized by a return of volatility to the financial markets after a relatively placid period in the previous 12 months. Our fixed-income portfolio was able to earn 1.5%, as our relatively shorter interest rate exposure and conservative asset allocation allowed us to earn a positive return in a period of rising rates. Following several years of strong returns, our equity portfolio returned -4.4% in 2018, as domestic equity markets saw a steep drop in the fourth quarter.

The size of our investment portfolio has grown from $27 billion at the beginning of the year to over $33 billion at the end of 2018. Even as financial markets may offer us more attractive investment opportunities than a year ago, our focus on protecting the balance sheet has not changed. When adding risk to our investment portfolio, we will continue to pursue investments that provide a favorable risk-return profile to Progressive over the long term.

“Working with Progressive employees from around the country to help our customers recover from catastrophes has been the most meaningful experience of my time at Progressive.”

C. Grube

We accessed the capital markets twice in 2018 in order to support the company’s strong operating growth and for other general corporate purposes. In March, we issued $600 million of 4.20% 30-year senior notes and $500 million of 5.375% cumulative perpetual preferred stock. We returned to the capital markets in October to issue $550 million of 4.00% 10-year senior notes. The combination of internally generated profits and these external financings will both support our future growth and allow us to maintain flexibility in our capital allocation decisions. As in previous years, we bought back enough Progressive shares to neutralize dilution from equity-based compensation. We continue to believe the most efficient use of our capital is to reinvest it into our fast-growing operating business.

We ended 2018 with a Gainshare score of 1.91. This is the best result since 2004 and the 7th year in a row that the score has increased. We declared an annual dividend of $2.514 per common share, based on 2018 results and the formula that we communicated publicly. As previously announced and effective in 2019, we have revised our dividend policy (details below).

As we head into 2019, we will continue to focus on policy or unit growth, as we often refer to it, while pursuing our goal of earning at least four cents of underwriting profit. We will watch trends closely to stay ahead of them and not shock our customers with rate increases. Meanwhile, our investment team will continue to focus on their goal of protecting the balance sheet and supporting the growth of the operating side of Progressive.

Looking to the Horizons

You may recall that in the August 2017 Investor Relations Webcast, we outlined the three Horizons construct. We believe that investing concurrently in the near-, mid-, and long-term future of Progressive will ensure that we create and sustain an enduring business. Our stance is that when we are executing on the core business so well, it is exactly the time to devote time, energy, and dollars to advancing our future business opportunities. We internally refer to this as an “always growing” mindset.

Horizon One (Execute): This has been our focus since the company was founded in 1937 and, in more recent years, we have been more surgically focused on growth and gaining a larger share of both the auto and home markets, as well as creating more Robinsons. This focus has clearly paid off and we believe there is much more room for growth, so this will continue to be an area of concentration.

Horizon Two (Expand): In this horizon, we are focusing on adjacencies—building upon our existing capabilities and market position to offer more products and services to our current and potential customers. We have made large investments in developing a business owners policy product, which we expect to launch this year, as well as offering other coverages for small businesses that desire to shop directly with Progressive. We’ve made people, systems, and brand investments and see this as an area where we can excel and profitably grow. In another sector, we continue to deepen our relationship with Uber and have gone from 1 state in 2016 to 4 in 2018 and expect to expand to 13 states in total in early 2019.

Horizon Three (Explore): As I communicated in last year’s letter to shareholders, in December of 2017, we formed an internal eleven-person, part-time Strategy Council to take some time to understand future trends and market shaping forces. The team focused on opportunities where we can use our skills to define ideas for future business initiatives and invest in areas where we believe we can win. In July of 2018, we named Andrew Quigg our Chief Strategy Officer. He has created a new full-time strategy team that will concentrate on designing products that solve unmet consumer needs. We are excited to explore, test, and invest in this horizon to achieve our goal of always growing.

Managing Capital for the Future

We take great pride in our transparency around communicating significant changes. Although we provided some detailed Q&A with our November earnings release, I would like to expand upon our capital management philosophy and how we plan to use that capital.

At Progressive, effective capital management is an important component of our financial brand. When considering how to deploy capital, we have consistently said that we will look first to invest to support the growth of the current and future earnings power of Progressive. If we have capital beyond what is needed to fund growth and innovation, that is, when we have “underleveraged capital,” we will return it to shareholders. We have historically used three tools to send underleveraged capital back to our shareholders: an annual dividend, share repurchases, and special dividends. We believe this approach is a strong indicator of our thoughtful stewardship of capital.

Many years ago, we articulated a formula for calculating our annual variable dividend, which considered the business and investment results. At that time, we had moderate growth expectations and attractive investment returns and routinely generated more capital than we needed. Our formulaic variable dividend, and special dividends when warranted, served us very well, returning on average about 50% of comprehensive income annually. Since the inception of the variable dividend program, we produced an annual return on shareholders’ equity of 17% and grew our book value just over 100%, which is among the best in the industry, even after the significant amount of cash we returned to shareholders over that same time. We are very proud of these results.

More recently, we have been experiencing faster growth in a very low-return investment environment, creating a need for more capital to underpin growth. While our business does not consume massive capital for property, plant, or equipment, the regulatory construct and need for contingent capital, due to weather and other unforeseen circumstances, requires significant capital reserves. Given our strong growth and outlook, we decided that it was a good time to take a step back and reassess our dividend policy, especially given the fact that our business model is evolving as we think about our long-term growth potential. We are committed to investing our capital when we have compelling opportunities to do so and to being flexible and nimble to drive shareholder value and to attract a broad and diverse set of shareholders. Given the current business environment, our opportunities to grow, and our commitment to shareholder value, we decided to alter our approach to our annual dividend.

It is difficult to forecast the amount of capital that we will need to invest to pursue the opportunities that will be developed in all three Horizons and, therefore, we believe that a flexible dividend policy is appropriate for Progressive. At the same time, we recognize that many of our shareholders and prospective shareholders value a predictable cash return from their investments. Therefore, we adopted a new dividend policy that will pay a regular quarterly dividend, which we expect to be $0.10 per common share through 2019, with the potential for an annual, variable dividend at year end. The variable component of the dividend will reflect the performance of the business and the growth and investment opportunities we see and will be determined by the Board of Directors. While the old dividend formula was affected by the company’s Gainshare factor, the new approach will not be so influenced. We found that the Gainshare factor reflects performance and does not capture growth and investment opportunities, which had the potential to increase dividend payouts when it could be advantageous to retain the capital in the business to support growth. While less formulaic than our previous variable dividend approach, the new variable dividend will avoid the binary nature of the current dividend’s payout based on the restriction of comprehensive income necessarily exceeding after-tax underwriting income.

We have been pleased with how our variable dividend has complemented our overall capital strategy for the past decade and are equally excited about the modified dividend policy and the flexibility it affords us to pursue sustained growth for the benefit of shareholders. We remain committed to investing our assets to grow our business and maximize value and, when our growth does not require all of the capital we have available, to returning underleveraged capital to shareholders.

“When we volunteer as a team in the community, this is when I feel closest to my teammates because we’re working together to benefit others and learning more about each other at the same time.”

W. Shippy

Our Four Cornerstones

On many occasions, we’ve shared the construct we use to think about having a competitive advantage and we fittingly named it our four cornerstones. The first three make up the foundation and reflect who we are (Core Values), why we’re here (Our Purpose), and where we’re headed (Our Vision). The last, and where I will provide a few highlights of several of the investments we’ve made, we refer to as our four Strategic Pillars (how we’ll get there).

Pillar 1: Progressive people and our culture are collectively our most powerful source of competitive advantage.

Sufficiently describing our unique and special culture continues to elude me. Maybe it’s the pride of knowing that we are making a difference in each other’s lives and doing our best to be there for our customers when they need us the most. It might be the small, subtle gestures that are witnessed so frequently that it would take a novel to share every kind action that takes place within and outside our walls. What we do know is that the basis of our distinct culture starts with our Core Values and we follow them diligently in order to get great results in the right way.

I often comment about there not being a spreadsheet that I can reference to prove how incredible our culture is (and you know we like our spreadsheets). That said, we did receive countless recognitions from outside sources. I won’t name them all, but they came in the form of accolades like best company to work for, best workplace for diversity, best workplace for women, parents, veterans, and millennials. Lists don’t define us and we wouldn’t change what we do just to be put on those lists. We do strongly believe that if you treat people like they want to be treated and create a workplace where you can feel comfortable bringing your whole self to work, you tend to get noticed.

Pillar 2: Meeting the broader needs of our customers throughout their lifetime.

We continued heavy investment in our digital customer service products in 2018. We recognize that when someone decides to start a relationship with Progressive, we must support that relationship with world-class experiences and treatment in all areas, especially digital. This includes a focus and investment on a smart, simple, and satisfying digital offering that meets our customers’ needs wherever, whenever, and however they choose. As such, we continued a large commitment to revamp our self-service website experience in conjunction with extending our mobile app offering. This undertaking included not just a new web interface, look, and set of features, but also a new technology stack. With these investments, going forward we’ll be better positioned to continue advancing in innovative ways, across all digital touchpoints, in a way that builds stronger and longer relationships with our customers.

We also leveraged new technologies to meet the evolving expectations of customers and to drive additional expense reduction. Of note here, we launched our virtual assistant in our mobile app in November. Leveraging the star of our Superstore marketing campaign, we dubbed this virtual assistant “Ask Flo.” It allows customers to get instant support by interacting with an automated bot in a chat-like interface—with the heart and personality of our brand as personified by “Flo.”

To deliver our ideal customer experience, we also believe it’s critical to understand and recognize that different customers have different needs and preferences. In order to personalize at scale, we have been working on a project to personalize the renewal experience and give customers a compelling reason to continue their relationship with Progressive. To that end, we’re standing up a technology platform that will enable us to test personalized experiences, deployed in a coordinated fashion across all of our customer communication channels. Our vision is to create truly customized journeys, aligned with how each customer prefers to interact with us.

We understand that price is critical to insurance consumers, so we need to do all we can to lower costs to enable competitive prices. Of course, this can’t be at the expense of a positive customer experience. With this in mind, we’ve been able to find solutions that properly balance lower costs and a great customer experience.

We’re also heavily experimenting and utilizing artificial intelligence (AI). One example of this is in a new chatbot application where we use AI to interpret incoming chat requests and provide automated responses based on the perceived intent of the customer. In some cases, the response provides answers to the most commonly asked questions related to that topic, and in other cases it provides a phone number so that the customer can contact the group best positioned to address their issue. The model reduces the effort required to deliver straightforward answers on simple issues.

Another example of our use of AI is a Progressive-built application we call Docuflash. It uses artificial intelligence to discern document content to forward incoming documents without human intervention. Docuflash leverages optical character recognition (OCR) to “read” incoming documents, classify them appropriately, and forward them to the appropriate group for additional work as needed. Eliminating this more rudimentary work generates expense savings and creates the opportunity for our people to focus on the more complex tasks of acting on the incoming documents.

We also introduced new technology into our voice experience by replacing our legacy touch-tone interactive voice response (IVR) system with one where our customers can speak naturally when calling Progressive. Our new experience is easier and allows more self-service options for customers to interact with us without a Progressive consultant getting involved. We believe these advancements allow us to meet customers’ needs by providing a superior customer experience while giving us an expense benefit.

“For me, togetherness at Progressive means enjoying the company of my team at lunch. We share stories, laugh a lot, and bond over what we have in common and value what we have that is different.”

M. Falcone

Pillar 3: Maintaining a leading brand recognized for innovative offerings and supported by experiences that instill confidence.

We designed and released an all-new quoting experience for and on behalf of our agents to make it easier to support quoting bundled policies for our customers. Our For Agents Only (FAO) Portfolio quoting (also referred to as Portfolio), is now live for all agents appointed to write new business in three states with plans for future state releases and expectations to share Portfolio with agents countrywide by mid-2020.

Portfolio offers the following:

- Less data entry: Portfolio reduces quote time by finding available customer, vehicle, and property information. In addition, Portfolio auto-fills customer information across products so agents can spend less time typing and more time forming relationships with their customers.

- The more (products) the merrier: Thanks to Portfolio, FAO can now support bundled quotes for the first time. When agents start a quote from the FAO homepage, Portfolio’s product picker displays all available products, allowing agents to select multiple products right from the beginning. Supported products—those that agents can quote and sell within Portfolio—include auto, special lines, home, condo, and renters.

- The power of choice: Rather than working directly through an insurance company’s quoting system, many agents use comparative rater software to shop multiple companies for their customers. Agents can easily add products to a rater quote before completing the sale in Portfolio.

- It all comes together: The namesake Portfolio page gives agents and their customers an overview of premium, bundle savings, and applied discounts. Agents can add or remove a product with one click, speeding up the sales process.

Our highly recognized brand grants us a venue to clearly communicate our innovative offerings to our customers and consumers alike. Few brands have sustained a single icon for over a decade. Flo is one of the longest-running brand characters, appearing in over 150 ads that take place in our alternate-reality “Superstore.” To keep our flagship show fresh, this year we introduced Flo’s Squad, her ever-expanding crew of colleagues who represent our long-lasting commitment to providing impressive service and protection at an affordable price.

In addition to expanding our characters, we also expanded our messages, in order to more firmly align them with the needs of our customers. As an example, in new ads like “Fluent in Insurance,” we promoted our online insurance jargon translator, Progressive Answers. We doubled the number of media impressions focused on auto/home bundle messages in 2018, compared to 2015. And, in partnership with national media outlets, including “The Today Show,” we more widely publicized our Keys to Progress® program, which in recent years donated, on average, 100 refurbished cars per year, to veterans in need.

Creative was not the only area of optimization. We also delivered some exciting portfolio shopping experiences, including Progressive HomeQuote Explorer® (HQX) and Progressive BusinessQuote Explorer® (BQX), leading digital home and business insurance marketplaces.

Pillar 4: Offering competitive prices driven by industry-leading segmentation, claims accuracy, and operational efficiency.

Our auto policies in force grew over 14%. As we shared with you during our third quarter webcast, our expanding ability to segment has accelerated policy growth in recent periods. During the time frame from 2013 to 2016, it took us 30 months to add a million auto policies in force. The next million policies took us 15 months with the subsequent million taking only 8 months. Most recently, we added 1 million policies in force in a mere six months. We attribute this to our large investments in our product design focused on segmentation and risk selection (matching rate to risk).

In addition, we continue to evolve our usage-based insurance segmentation. We introduced, in 10 states, a new algorithm that adds distracted driving to the other already powerful variables we track, and we plan to roll it out more broadly in 2019.

Operational efficiency is a key component of our competitive prices strategy pillar. At 20.4%, our expense ratio is among the lowest in our industry. A bit more than half of that ratio is comprised of commissions paid to our agents and advertising costs, or what we refer to as acquisition costs. We view increasing these acquisition costs as generally requisite to growing profitably. To grow and ensure the viability of the agency distribution channel, we pay competitive commissions and we target aggregate commission at around 10.5% of agency premium. We’ve grown advertising costs to over $1.4 billion in 2018 and have done so optimizing incremental spend at the lowest level possible. We did this not only in digital media but increasingly in mass media and even down to cost per incremental sale metrics at the television show and daypart level. We buy the majority of our media in-house and analyze massive amounts of data, often in real-time, to ensure very competitive advertising spend.

We also focus on non-acquisition costs as we believe lowering these costs while still providing great service and a great work environment allows us to grow faster. We invest in technology to drive cost out of our processes while improving the customer and agent experience and allowing for our people to focus on higher value-added work. Policies in force per FTE (full-time equivalent) and revenues per FTE are key metrics in driving towards a lower cost structure and we’ve made great progress on both of these. Our ultimate metric of underwriting cost effectiveness is what we call our non-acquisition expense ratio (NAER). For 2018, we reduced our Personal Lines NAER by 0.7 points to 9.1% and for our Commercial Lines business, we reduced NAER by 0.8 points to 11.0%. These improvements allow us to continue to keep our rates competitive and meet or exceed our profitability targets.

The costs to settle a claim, or loss adjustment expense (LAE), is balanced along with customer service, work environment, and settling the claim accurately. We are extremely pleased that our accuracy performance improved in a year with significant growth in both claim counts and claim employees, while lowering the cost to settle our average auto, special lines, and commercial lines claim features by over 2%. In concert with growing average premium per policy, this lower cost per claims feature allowed us to lower our loss adjustment expense ratio by 0.7 points for the year to 10.2%.

That’s a wrap

As we put a bow on 2018 and reflect on the numerous celebrations that took place over the year, it reminded me of something that Peter B. Lewis always said—make sure to have fun. We all worked hard and together achieved a tremendous amount on the business front, but along the way we had a lot of fun, which exemplifies the spirit of Progressive.

We are so thankful for our partners, our agents, and the customers that motivate us to do better every day. You all have our commitment that we will work hand in glove to excel as we sprint into 2019.

I am especially grateful to the over 38 thousand Progressive people that inspire me daily. The accomplishments that we collectively achieved this year mean so much more when they are attained with people you enjoy working with side-by-side.

Thanks for all that you do.

Tricia Griffith

President and Chief Executive Officer