- Operating income* was $1.9 billion, 7% above 2008, despite a second year of high catastrophe losses.

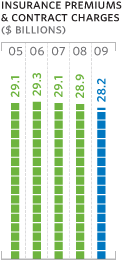

- Our Property-Liability business had a combined ratio of 96.2 for 2009, which means that our underwriting margin was 3.8% of premiums. We also met our underlying combined ratio* outlook for the year.

Letter to Shareholders

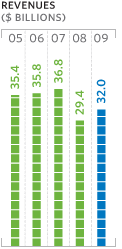

Fellow shareholders: Allstate’s proactive approach to managing your business served us well in 2009, despite another unprecedented year of volatile conditions. In the first quarter of 2009, the financial markets further deteriorated, which compounded the damage done in 2008. Rather than dwell on the causes, we did what we always do: proactively used our capabilities, people and market position to protect and enhance your investment. As we discussed last year, we had three goals for 2009: keeping Allstate strong financially, improving customer loyalty and continuing to reinvent our business. We had exceptional performance on the first two goals and made further progress in aligning our businesses around our customers.

Achieved Our 2009 Financial Goals

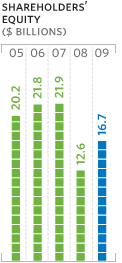

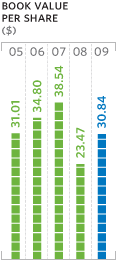

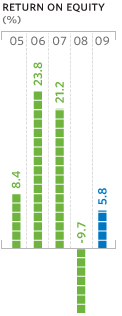

In volatile financial markets, a recession and a period of extreme weather it was imperative that we keep Allstate strong financially. Despite a high level of catastrophes and investment losses in 2008, we entered 2009 in a position of financial strength. We built capital and book value during the year through our proactive approach to investing and managing costs and margins.

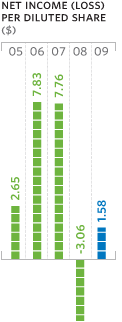

- Net income improved to $854 million, or $1.58 per share. This was a dramatic improvement over a loss of $3.06 per share in 2008, reflecting a significant reduction in the level of investment losses.

- Investment returns on our $100 billion portfolio were outstanding, as our strategy of staying heavily invested in corporate bonds paid off. We achieved these results while lowering real estate investments by another 30% and protecting the fixed income investments from the negative impact of higher interest rates.

- We continued to reduce costs to deliver great value at affordable prices. As a result, employment declined 5% to 36,000. Allstate Financial’s cost reduction programs are ahead of schedule and will reposition this business for profitable growth.

The net of all of these results is that book value increased by 32% in 2009, to $16.7 billion at year-end.

Exceptional Progress In Improving Customer Loyalty

Customer loyalty is core to achieving our strategic goal of differentiating ourselves to drive long-term growth. We had significant improvement in customer loyalty on an absolute basis, in virtually every market and relative to the competition. In 2009 we began calculating the 401(k) contribution to employees based on customer loyalty, not operating profits. This aligns rewards with the responsibility of each employee to treat customers well. Agency compensation programs are also tied to measures that reflect customer loyalty. We improved accountability so that employees or agencies that underperform no longer have the opportunity to represent Allstate.

Long-Term Growth Will Be Supported By Reinvention

Reinventing products and services we provide for customers will differentiate Allstate and lead to long-term profitable growth. While we remain focused on reinvention, the operational focus needed in such a volatile environment resulted in less progress than planned. Your Choice Auto® continued to grow with over 5.7 million items sold. The direct business, which sells to consumers through call centers and the Internet, now writes over $600 million of premium annually and helps local Allstate agencies by answering calls after hours and providing other services. The Next Gen claims system provides an infrastructure to further improve our ability to service our customers’ claims effectively and efficiently. While much has been done, our competitors are on the move, so we will further accelerate these reinvention efforts in 2010.

Watch Video

Hear Tom Wilson discuss the role that reinvention has played in Allstate’s history.

The senior management team adapted to this environment and remains a core strength of your company. Although George Ruebenson, President of Allstate Protection, decided to retire after almost 40 years of dedicated service, Allstate’s market leadership, brand and record of success enabled us to strengthen our team. We welcomed Joe Lacher as the new president of Allstate Protection, and Matt Winter as the new president of Allstate Financial. We will also benefit from the skills of Mark LaNeve, who joined us as chief marketing officer. They and the rest of our team are proactively driving our business forward.

Watch Videos

Allstate recruited Joe Lacher and Matt Winter in 2009 to head its property-casualty and financial services businesses, respectively. Hear them speak about 2009 successes and plans for meeting customer needs in 2010 and beyond.

Creating Shareholder Value

Total shareholder return was highly volatile throughout 2009. When the financial markets fell during the first quarter of 2009, the stock tumbled to $13.77. Staying focused on our priorities and financial performance coincided with an increase to $30.04 per share by year-end, slightly below where we began the year. The net result for 2009 was unsatisfying. We will stay focused on further increasing the value of your shareholdings despite volatile markets and the recession.

Our plan to create shareholder value in 2010 is focused around three priorities: improving customer loyalty, reinventing protection and retirement for the consumer, and growing our business. We have a talented team of employees, 33,000 licensed sales professionals in Allstate agencies, and relationships with independent distributors to help make this a reality.

Further Strengthening Our Societal Leadership

Corporations such as ours should lead positive change. We are supporting efforts to better prepare America for large catastrophes through ProtectingAmerica.org. Allstate’s teen safe driving initiative is gaining momentum and we are a major proponent of creating federal graduated driver licensing requirements. The Allstate Foundation is a leading sponsor of programs to combat domestic violence and supports more than 3,000 local non-profits across the country. These efforts improve the communities in which we live and operate and also help improve Allstate’s reputation. A recent Fortune survey ranks us as fifth in overall reputation and second in social responsibility in our industry.

We will remain focused in 2010 on delivering value for our customers and shareholders.

Thomas J. Wilson

Chairman, President and Chief Executive Officer

April 1, 2010