In recent years we have centered our growth on the ‘core’ area of the Company: Grain, Plant Nutrient, Ethanol and Rail. Our company is stronger for it.

Pictured above (left to right):

Mike Anderson, CEO

Hal Reed, COO

John Granato, CFO

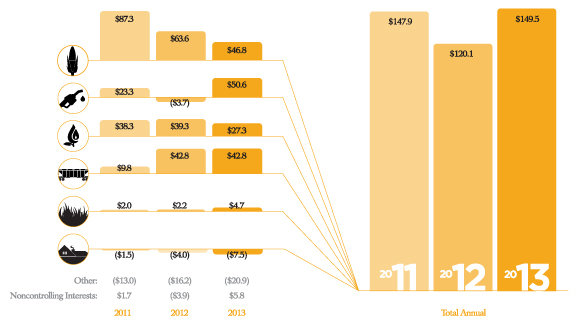

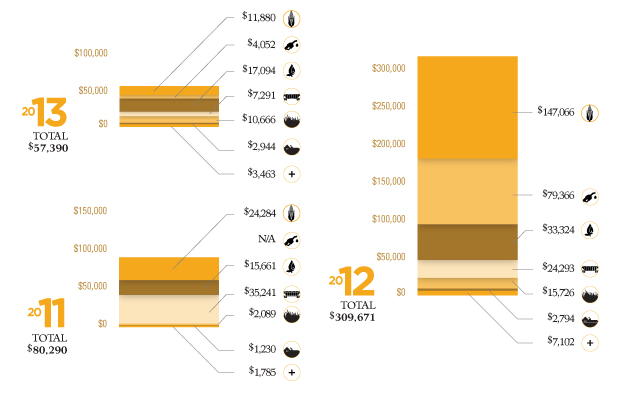

Our 2013 results, led by outstanding earnings in our Ethanol and Rail groups, reflect this strength. We achieved $4.77 in diluted earnings per share using our 2013 stock outstandings, or $3.18 in diluted earnings per share adjusted for our February 2014 three-for-two stock split, and net income of $89.9 million on $5.6 billion in revenue. Additionally, we are pleased our net income attributable to the company during the past five years has grown at a compounded annual growth rate (CAGR) of 22 percent. In 2013, we also recorded our best EBITDA of $219.9 million, and delivered back-to-back years of more than 15 percent return on beginning equity.

In last year’s letter, we cautioned that earnings could be challenged in 2013—primarily in the Grain and Ethanol groups—resulting from the historic drought of 2012. Although the drought did make it challenging on our Grain operations, we are pleased to report that the year turned out much better than we initially expected. Our team really came through, achieving our second best year in EPS and best EBITDA.

The combination of favorable market conditions and an exceptional performance by the Ethanol team led to record earnings for the Group. In addition, we benefitted from strong demand for our distillers dried grains (DDGS) and corn oil co-products. Rail Group earnings remained very strong in 2013, led primarily by significantly higher lease and utilization rates.

Impacted by the residual effects of the 2012 drought, our Grain operations earned about what we expected in the first three quarters, but had lower than expected earnings in the fourth quarter. The Grain Group did benefit from our Lansing Trade Group (LTG) investment. While the Plant Nutrient Group experienced decreased income due primarily to lower volume for the year, the Group managed the lower price trends and increased volatility well.

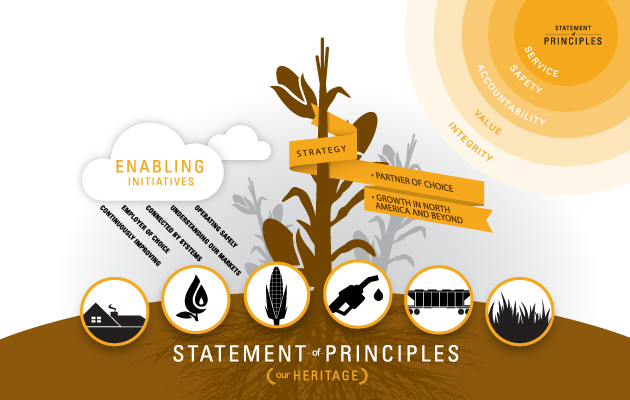

We will continue to strengthen our company by building from the core to meet global agricultural-related demand while at the same time reaping the benefits of our diversification across adjacent businesses. This focus on the core business drives our ongoing process of managing our portfolio allocation, defining investment viability and return expectations, and further improving our timing and execution.

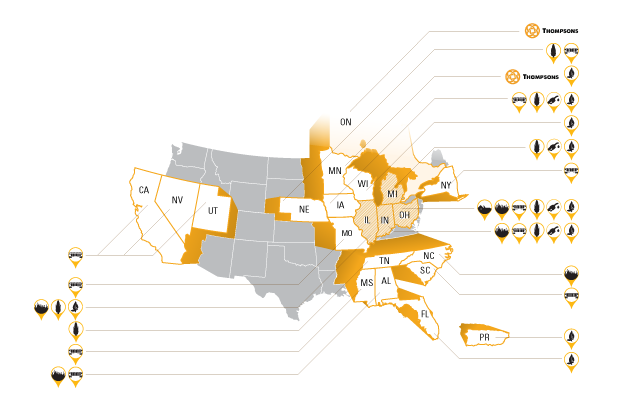

The purchase of Thompsons Limited, a grain and food-grade bean handler and agronomy input provider headquartered in Blenheim, Ontario, Canada, expanded our North American footprint in 2013. As a 50/50 joint venture with LTG, Thompsons will continue operating its 12 locations, while leveraging the strengths of all three companies. The purchase of Mile Rail, a railcar repair and cleaning provider based in Kansas City, Missouri, complements the company’s existing railcar repair network. With locations in Missouri, Nebraska and Indiana, and mobile units across the central Midwest, this acquisition provided geographic expansion as well as increased capabilities to repair and clean virtually all types of railcars. The successful integration of the cob facilities we acquired in late 2012 and the recent acquisition of a production facility in North Carolina will help us leverage our cob and turf product diversification.

Also supporting our growth initiatives, we reinvested in our operations as well as expanded products and services to enhance value for new and existing customers. In our Ethanol Group we continued to add technology and capabilities to all of our plants that improve efficiencies and increase production capacity. We added rail-loading capacity at three Grain Group locations and entered into agreements that enhance our crop marketing and insurance services. In the Rail Group we extended our railcar repair network by four locations and added certifications enabling us to refurbish tank cars in our Maumee shop. Our modern cleaning and paint facility, which opened in May, literally transforms the appearance and value of railcars.

To better serve our customers with greater efficiency and with more products and services, our Plant Nutrient Group added liquid fertilizer capabilities at three locations and made them 24/7 capable to assure we can meet customers’ needs when the demand calls for our product. In Wisconsin, we added nearly 30,000 tons of dry fertilizer storage capacity that enables us to better serve customers in northern and central Wisconsin. Interest is increasing in the agricultural arena for our Turf & Specialty Group’s dispersible granular products, such as HumicDG, as we continue to expand the application of this technology. In our Retail operations, we refined our store configuration and redirected our product offering. All this was done while we strengthened our balance sheet as is evidenced by the reduction in our long-term funded debt to equity ratio to 0.5 to 1.

Amidst our growth initiatives and commitment to bring value to customers, we must continue to challenge ourselves to improve our safety performance. Despite a 30 percent improvement in our lost time case rate last year, early in 2014 an accident in one of our Michigan Grain facilities claimed the life of a 30-year-old employee. This man was a husband, father, active community member and veteran. This is a tragic loss for his family, his friends and all of us at The Andersons. Any accident, but especially those of this magnitude, underscores why we all must be ever vigilant to be safe in our daily activities.

We will continue to pursue appropriate growth through acquisition and expansion in our existing operations to strengthen the value proposition we provide to our customers. The first phase of our new corporate ERP system—designed to connect employees, customers and information—is scheduled for deployment in 2014 and 2015. We are committed to a quality system for our company and our customers.

Our focus on customers is one of the tenets of the corporate strategy we implemented a few years ago. Building upon our heritage of providing exceptional customer service, we seek to become the Partner of Choice to our customers, focusing on opportunities to cultivate and nurture mutually beneficial relationships in North America.

Our financial position remains strong and we continue to sustain strong cash flows. As a result we have rapidly de-levered our balance sheet, following major investments in Iowa, Tennessee and Ontario during the past 18 months, and are poised to support future growth. Our positive financial results and confidence in our earnings capacity going forward led us to increase our 2014 first quarter dividend three percent to 16.5 cents per share, or 11 cents per share adjusted for our February 2014 three-for-two stock split. Earlier this year we also agreed to modestly reduce our stake in LTG, allowing us to monetize a portion of the investment while continuing to retain most of our interest in this successful partnership.

Our agribusiness roots extend nearly 70 years, and this continues to be at the core of what we do. As we look to the future, we see strong demand for the types of products and services we provide. We will build toward the future by providing the necessary services, products, handling and transportation that ultimately feed and fuel the world.

With gratitude for your continued support,

Mike Anderson

Chief Executive Officer

Hal Reed

Chief Operating Officer

John Granato

Chief Financial Officer

We will continue to strengthen our company by building from the core to meet global agricultural-related demand while at the same time reaping the benefits of our diversification across adjacent businesses.

We will continue to pursue appropriate growth through acquisition and expansion in our existing operations to strengthen the value proposition we provide to our customers.