DEAR

SHAREHOLDERS

& FRIENDS

Being well-positioned is more than simply being in the right place at the right time.

It entails knowing what to do with opportunities and having the skills to do something when the time is right. In recent years we've been in a good position to grow and strengthen our company despite volatility in the commodities markets, including last year's drought, and a challenging transportation environment.

(left to right): Mike Anderson, Hal Reed, John Granato

Record earnings in our Rail and Plant Nutrient groups facilitated our 2012 results, second only to our 2011 financial performance, with $4.23 in diluted earnings per share and net income of $79.5 million on $5.3 billion in revenue. This performance is impressive considering our 2011 record results included significant pre-tax income attributable to unusually strong wheat basis appreciation, which we said was very likely not repeatable. Additionally, we are pleased our net income during the past five years has grown at a compounded annual growth rate (CAGR) of 3 percent. In 2012, we also recorded our second best EBITDA of $195.2 million.

With a proven growth strategy, diversification in complementary markets, a focused management team and strong financials, we are well-positioned to seize future opportunities resulting from global agricultural-related demand to continue growing our businesses while at the same time weathering the drought's impact on the agriculture market.

During the year we completed a series of acquisitions and expansions. In May, we acquired a 55 million gallon ethanol plant in Denison, Iowa that also included a 2.7 million bushel grain elevator. During the year, the Plant Nutrient Group acquired an Ohio-based specialty agricultural and industrial products company and also completed construction on a major upgrade at its Maumee, Ohio location that improved both its formulation capability and efficiency. The Rail Group expanded its fleet and its railcar repair business and broke ground in December on a modern railcar blast and paint facility in Maumee, Ohio. Late in the year, the Turf & Specialty Group completed an acquisition doubling the size of its cob business, which will allow for increased sales of its proprietary products and enhanced customer service.

We culminated the year by expanding our grain operations to include seven facilities in Iowa and five in Tennessee, with a combined grain storage capacity of 32 million bushels and plant nutrient storage capacity of 30,000 tons. The close proximity of the facilities to one another accelerates the socialization of our new team with our culture. This acquisition came on the heels of the opening of our newly-constructed 3.8 million bushel unit train loader in Anselmo, Nebraska. These growth initiatives demonstrate our continued ability to respond to a challenging environment in a way that drives shareholder value.

We will continue to explore additional expansion and select acquisition opportunities while maintaining a balance sheet that allows the company to capitalize on new opportunities. Additionally, we will be rolling-out the first phase of a new corporate ERP system later this year that will begin to connect employees, customers and information to support the company's relationships, growth and performance for years to come.

As the economy continued to improve, the Rail Group recorded its best year ever, more than quadrupling its 2011 results with higher lease rates and strong demand for railcar repair services. While summer weather conditions of 2012 challenged our grain and ethanol businesses, the spring and fall weather was ideal for farmers to apply nutrients without delays. With increased volume and strong margins, the Plant Nutrient Group achieved record earnings for the second year in a row. The volatility and production shifts in the grain markets along with its energy, feed ingredient and other physical commodity trading businesses enabled Lansing Trade Group to capture opportunities both domestically and internationally and post another record year. Organic growth continues to be a strong part of Lansing's focus.

Changes to the senior management team early last year positioned us well as an organization to meet challenges and embrace opportunities going forward. The new alignment enables us to be more nimble for our employees, our -customers and our shareholders. While this leadership change is proving beneficial, it is our workforce of more than 3,000 people carrying out our mission every day that gives us strength in the markets we serve. It is rewarding to lead a team that is dedicated to coming to work looking for new and better ways to do their jobs and serve the customer, in the safest manner possible.

For the fourth consecutive year we reduced our employee injury frequency with a continued emphasis on the behaviors that keep us safe at work and at home. However, any mention of safety compels us to reflect on an accident in one of our Maumee facilities early last year that eventually claimed the life of a 26-year-old employee. Life is precious, and this young man's life was precious to his family, his friends and all of us at The Andersons. While the frequency of our employee injuries continues to decline, one accident of this magnitude is a stark reminder of why we all must be ever vigilant to be safe in our daily activities.

From a financial perspective, we continued to demonstrate our sustained strong cash flows and solid EBITDA performance. Reflecting our positive financial results and our confidence in our earnings capacity going forward, we increased our 2013 first quarter dividend a penny to 16 cents per share. Overall we've increased our dividend 85 percent during the past five years.

In 2012, the U.S. agricultural community suffered the worst drought in 60 years, which was unusual both for its severity and its scale across the prin-cipal grain growing regions of the country. Nationwide, corn yield was down 24 percent, which is significant. In the face of this challenge, we are particularly heartened by the ability of our company to generate strong earnings and disciplined growth in 2012. However, we anticipate our Grain and Ethanol groups will be challenged during 2013 especially during the first half of the year due to the drought's impact on corn yield. Conversely, the outlook for both the Rail and Plant Nutrient groups is good. As a precaution, we have implemented several cost containment measures throughout the company for the majority of 2013.

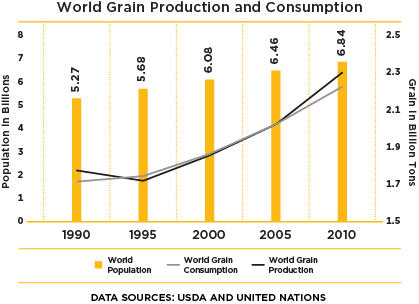

We are managing the impact of the 2012 drought from a position of strength and view this current situation as temporary. While nothing is ever certain, a return to more normal weather patterns for the spring and summer, the anticipated large corn acres and the continuing high world-wide demand for feed grains will position us nicely for the second half of 2013 and beyond. Longer term, macro trends such as expanding world population, escalating global demand for protein and increasing U.S. crop production continue to indicate strong demand for the types of products and services we provide. At the end of the day, people need to eat and products need to move. We are well-positioned to serve these needs.

With gratitude for your continued support,

Mike Anderson

CEO

Hal Reed

COO

John Granato

CFO