Summary of items affecting comparability of results

2009 Operating profit for the Financial Services segment in the second quarter of 2009 includes a pre-tax loss of $13.8 million ($8.8 million after-tax, or $0.03 per diluted share) on the sale of Vista Research, Inc. Operating profit for the Information & Media segment in the fourth quarter of 2009 includes a pre-tax gain of $10.5 million ($6.7 million after-tax, or $0.02 per diluted share) on the sale of BusinessWeek. Income from operations before taxes in the second quarter of 2009 includes a net pre-tax restructuring charge of $15.2 million ($9.7 million after-tax, or $0.03 per diluted share), which is reflected in segment operating profit as follows:

McGraw-Hill Education: Net pre-tax charge of $11.6 million

Financial Services: Net pre-tax (benefit) of ($0.4) million

Information & Media: Net pre-tax charge of $4.0 million

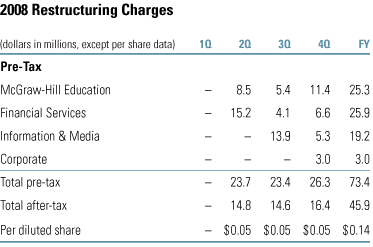

2008 Income from operations before taxes includes pre-tax restructuring charges totaling $73.4 million ($45.9 million after-tax, or $0.14 per diluted share), which are reflected in segment operating profit and Corporate expense as follows:

2007 Operating profit for the Financial Services segment in the first quarter of 2007 includes a pre-tax gain of $17.3 million ($10.3 million after-tax, or $0.03 per diluted share) on the sale of the Corporation’s mutual fund data business. Income from operations before taxes in the fourth quarter of 2007 includes a pre-tax restructuring charge of $43.7 million ($27.3 million after-tax, or $0.08 per diluted share), which is reflected in segment operating profit and Corporate expense as follows:

McGraw-Hill Education: Pre-tax charge of $16.3 million

Financial Services: Pre-tax charge of $18.8 million

Information & Media: Pre-tax charge of $6.7 million

Corporate: Pre-tax charge of $1.9 million

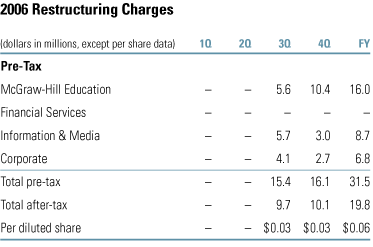

2006 Income from operations before taxes includes pre-tax restructuring charges totaling $31.5 million ($19.8 million after-tax, or $0.06 per diluted share), which are reflected in segment operating profit and Corporate expense as follows:

In 2006, as a result of a new accounting standard for share-based payments, the Corporation incurred stock-based compensation expense of $136.2 million ($85.5 million after-tax, or $0.23 per diluted share). Included in this expense is a one-time pre-tax charge in the first quarter of 2006 for the elimination of the Corporation’s restoration stock option program of $23.8 million ($14.9 million after-tax, or $0.04 per diluted share), which is reflected in segment operating profit and Corporate expense as follows:

McGraw-Hill Education: Pre-tax charge of $4.2 million

Financial Services: Pre-tax charge of $2.1 million

Information & Media: Pre-tax charge of $2.7 million

Corporate: Pre-tax charge of $14.8 million

Revenue and operating profit for the Information & Media segment in the fourth quarter of 2006 reflect deferrals of $23.8 million and $21.1 million, respectively, due to the transformation of Sweets from a primarily print product catalog to a bundled print and online service

2005 Income from operations before taxes includes a pre-tax restructuring charge of $23.2 million ($14.6 million after-tax, or $0.04 per diluted share), which is reflected in segment operating profit and Corporate expense as follows:

McGraw-Hill Education: Pre-tax charge of $9.0 million

Financial Services: Pre-tax charge of $1.2 million

Information & Media: Pre-tax charge of $10.2 million

Corporate: Pre-tax charge of $2.8 million

Operating profit for the Financial Services segment includes a pre-tax gain of $6.8 million ($4.2 million after-tax, or $0.01 per diluted share) on the sale of the Corporate Value Consulting business. Operating profit for the Information & Media segment includes a pre-tax loss of $5.5 million ($3.3 million after-tax) on the sale of the Healthcare Information Group. Net income reflects a $10.0 million ($0.03 per diluted share) increase in income taxes on the repatriation of funds

2004 Net income reflects a non-cash benefit of approximately $20.0 million ($0.05 per diluted share) as a result of the Corporation’s completion of various federal, state and local, and foreign tax audit cycles

2003 Corporate expense includes a $131.3 million pre-tax gain ($58.4 million after-tax, or $0.15 per diluted share) on the sale of real estate

Revenue and operating profit of S&P ComStock and the juvenile retail publishing business historically included in the Financial Services and McGraw-Hill Education segments, respectively, were restated as discontinued operations, as follows:

- Discontinued operations in 2004 reflect the net after-tax loss from the operations of the juvenile retail publishing business in January of 2004 before the sale of the business

- Discontinued operations in 2003 include $87.5 million on the divestiture of S&P ComStock ($57.2 million after-tax gain, or $0.15 per diluted share), and an $81.1 million loss on the planned disposition of the juvenile retail publishing business ($57.3 million after-tax loss, or $0.15 per diluted share), which was subsequently sold on January 30, 2004

- Discontinued operations in years 2002–2000 reflect net after-tax earnings/(loss) from the operations of S&P ComStock and the juvenile retail publishing business, and 1999 reflects net after-tax earnings from the operations of S&P ComStock

2002 Operating profit for the Financial Services segment includes a $14.5 million pre-tax loss ($2.0 million after-tax benefit, or $0.01 per diluted share) on the disposition of MMS International

2001 Income from operations before taxes includes a $159.0 million pre-tax charge ($112.0 million after-tax, or $0.29 per diluted share) for restructuring and asset write-down, which is reflected in segment operating profit and Corporate expense as follows:

McGraw-Hill Education: Pre-tax charge of $62.1 million

Financial Services: Pre-tax charge of $43.1 million

Information & Media: Pre-tax charge of $34.9 million

Corporate: Pre-tax charge of $18.9 million

Income from operations before taxes also includes a $6.9 million pre-tax gain ($0.01 per diluted share) on the sale of real estate. Operating profit for the Financial Services segment includes an $8.8 million pre-tax gain ($26.3 million after-tax, or $0.07 per diluted share) on the sale of DRI and a $22.8 million pre-tax charge ($21.9 million after-tax, or $0.06 per diluted share) for the write-down of certain assets, the shutdown of Blue List and the contribution of Rational Investors

2000 Operating profit for the Information & Media segment includes a $16.6 million gain ($10.2 million after-tax, or $0.03 per diluted share) on the sale of Tower Group International. Net income includes a cumulative adjustment which reflects the adoption of FASB ASC 605, “Revenue Recognition”

1999 Operating profit for the Information & Media segment includes a $39.7 million gain ($24.2 million after-tax, or $0.06 per diluted share) on the sale of the Petrochemical publications