S&P Investment Services:

Contributing to Transparent, Efficient Financial Markets

Standard & Poor’s Investment Services offers a spectrum of modular and

integrated products and services that contribute to transparent, efficient

markets and meet the specific needs of the global investment community.

From value-added data and information to insightful analysis, research and

models, information is delivered via client-integrated workflow platforms,

specific applications, and data feeds that clients can customize to meet

their specific distribution requirements.

| Valuation & Risk Strategies |

Capital IQ | S&P Indices | Equity Research Services |

|

| Description | Offers a broad suite of cross-asset risk analytics, market research services and data sets that are used by institutional investors for risk mitigation, cost control and alpha-generation. | Provides high-impact information, fundamental analysis, and workflow solutions to over 4,200 leading financial institutions, advisory firms, and corporations. | Offers investment professionals around the world an array of choices, from broad comprehensive benchmarks to liquid, investable indices. | Provides actionable, multi-asset class global research to wealth management institutions and financial advisors. |

| Example Products and Services | RatingsDirect® on the Global Credit Portal® Securities classifications and intrinsic valuations Market, credit, and risk strategies Credit risk and structured finance analysis |

Capital IQ Platform Xpressfeed Compustat® ClariFI® Alphaworks |

S&P 500® S&P/Case-Shiller® HomePrice Indices* S&P GSCI® Commodities S&P Credit Default Swap U.S. Indices S&P/Experian Consumer Credit Default Indices S&P Global BMI S&P Index Data Platform S&P Custom Indices |

MarketScope® Advisor Stock research and tools Fund management ratings Exchange-traded fund Mutual fund research Portfolio tools |

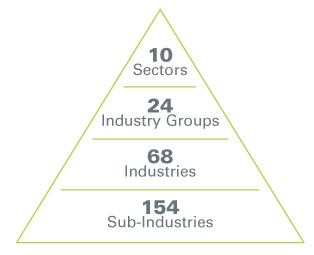

Creating a Global Standard

Global Industry Classification Standard (GICS®)

GICS® is an enhanced industry classification system that was jointly developed by Standard & Poor’s and MSCI Barra in 1999. Developed in response to the global financial community’s need for one complete, consistent set of global sector and industry definitions, GICS® has become a standard that is widely recognized by market participants worldwide. It sets a foundation for the creation of replicable, custom-tailored portfolios and enables meaningful comparisons of sectors and industries globally. More than 40,000 companies worldwide are classified in accordance with GICS®, with each company classified at the sub-industry level.