dollar amounts in millions,

except per share data years ended December 31

Change | ||||

Income Statement | 2007 | 2006 | Amount | Percent |

|---|---|---|---|---|

| Net Interest Income | $2,003 | $1,983 | $20 | 1% |

| Provision for loan losses | 212 | 37 | 175 | N/M |

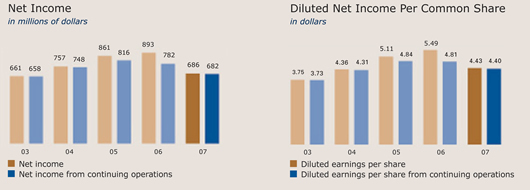

| Income from continuing operations* | 682 | 782 | (100) | (13) |

| Net Income | 686 | 893 | (207) | (23) |

| Basic earnings per common share: | ||||

| Income from continuing operations* | 4.47 | 4.88 | (0.41) | 8 |

| Net Income | 4.49 | 5.57 | (1.08) | (19) |

| Diluted earnings per common share: | ||||

| Income from coninuing operations* | 4.40 | 4.81 | (0.41) | (9) |

| Net Income | 4.43 | 5.49 | (1.06) | (19) |

| Cash dividends declared per common share | 2.56 | 2.36 | 0.20 | 8 |

| Book value per common share | 34.12 | 32.70 | 1.42 | 4 |

| Market value per common share | 43.53 | 58.68 | (15.15) | (26) |

| Average common shares outstanding - basic | 153 | 160 | (7) | (5) |

| Average common shares outstanding - diluted | 155 | 162 | (7) | (5) |

Ratios | ||||

| Return on average assets | 1.17% | 1.58% | ||

| Return on average assets from continuing operations* | 1.16 | 1.38 | ||

| Return on average common shareholders' equity | 13.52 | 17.24 | ||

| Return on average common shareholders' equity | ||||

| from continuing operations* | 13.44 | 15.11 | ||

| Average common shareholders' equity as a percentage of average assets | 8.66 | 9.15 | ||

| Tier 1 common capital as a percentage of risk-weighted assets | 6.85 | 7.54 | ||

| Tier 1 capital as a percentage of risk-weighted assets | 7.51 | 8.03 | ||

| Total capital as a percentage of risk-weighted assets | 11.20 | 11.64 | ||

Balance Sheet(at December 31) | ||||

| Total Assets | $62,331 | $58.001 | $4,330 | 7% |

| Total earning assets | 57,448 | 54,052 | 3,396 | 6 |

| Total loans | 50,743 | 47,431 | 3,312 | 7 |

| Total deposits | 44,278 | 44,972 | (649) | (1) |

| Total common shareholders' equity | 5,117 | 5,153 | (36) | (1) |

| N/M not meaningful * Income from continuing operations excludes the results of Munder Capital Management, a subsiderary sold in 2006 (after-tax gain of $108 million) and reported as a discontinued operation in all periods presented. | ||||