Comerica continued to execute its Growth Strategy in 2007 despite a challenging economic environment

Dear Shareholders,

Dear Shareholders,

Comerica continued to execute its growth strategy in 2007 despite a challenging economic environment.

It was a year that saw the entire financial services sector grapple with rocky market conditions. Fortunately, the issues that have caused the greatest volatility in the marketplace fall largely outside the parameters of Comerica’s business. As a result, we weren’t distracted by them and were able to build positive momentum, as evidenced by our strong loan growth, particularly in our high-growth markets; the continuation of our successful banking center expansion program; and the relocation of our corporate headquarters to Dallas, Texas.

We also were able to control expenses in 2007, and at the end of the year entered into a multi-year procurement services contract with an outsource provider to reduce our operating expense base, enhance our current procurement capabilities and further enable efficient growth.

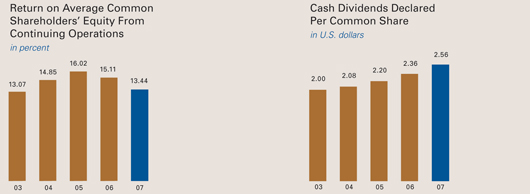

Our capital position remained solid, providing us with ample cushion to weather the continued challenging economic environment, while also providing us with the flexibility to continue to invest in our growth markets. We increased our annual dividend for the 39th consecutive year in 2007.

We were able to move forward in the year, even as a challenged residential real estate market, particularly in Michigan and California, affected our overall financial performance.

For the full year 2007, Comerica reported income from continuing operations of $682 million, or $4.40 per diluted share, compared to $782 million, or $4.81 per diluted share, for 2006. The provision for loan losses was $212 million for 2007, compared to $37 million for 2006. Return on average common shareholders’ equity from continuing operations was 13.44 percent for 2007 and 15.11 percent for 2006.

While Comerica doesn’t have subprime mortgage programs, the widely reported subprime meltdown clearly had an impact on our residential real estate development exposure in 2007. We believe we have taken the appropriate actions to manage these risks and provide appropriate reserves.

Our pursuit of long-term value for shareholders is embodied by our sharp focus on managing and mitigating risk. In fact, we have not created any structured investment vehicles, off-balance-sheet conduits or other forms of high-risk, sophisticated financing vehicles that drew headlines in 2007.

To the contrary, in recent years we have invested significant resources into enhancing our credit and risk processes. We view our credit quality and focus on risk management as a key differentiator for our company and take a view that this philosophy must remain a constant regardless of where we are in a credit or economic cycle.

These enhanced credit processes are helping us navigate the swift currents and manage through cycles like the one we saw in 2007 and expect in 2008.

In addition to risk management, there are many other important differentiators that contribute to our success. Perhaps most significant is our focus on relationships.

Comerica offers all the products of a large nationwide bank, but we do it with the customer service, care and market knowledge of a community bank (see customer profiles on the following pages). Our banking professionals are local experts who are known for their ingenuity, flexibility, responsiveness and attention to detail. We are committed to delivering the highest quality financial services.

During the year, Comerica continued its strategic expansion into the nation’s highest growth markets. While we celebrate our Michigan-based roots, Comerica has extended its footprint to include the attractive highgrowth markets of Texas, California, Florida and Arizona, which are expected to account for more than half of the country’s entire population growth between 2000 and 2030.

We firmly believe that our expansion, which also diversifies our revenue mix, is the right strategy at the right time for our company.

Comerica is aligned into three business segments: the Business Bank, the Retail Bank, and Wealth & Institutional Management.

We view our Business Bank focus as a natural entry point to cross-sell products and services of our Retail Bank and Wealth & Institutional Management. We are not a mass-market retail bank. We have a refined strategy that maximizes the opportunity for our banking centers to support all of our lines of business.

We opened 30 new banking centers during the year, 28 of them in our high-growth markets of Texas, California and Arizona. We have generated nearly $1.8 billion in new deposits in the banking centers that have opened since late 2004.

Our three major business segments were important contributors to our growth in 2007.

In the Business Bank, our efforts to provide outstanding cash management services were recognized in the Phoenix-Hecht 2007 Middle Market survey, in which we received 16 A+ grades, more than any other bank measured.

Comerica also was among more than a dozen banks in 2007 that competed for the opportunity to serve as financial agent to the U.S. Department of the Treasury for a program that will provide debit card services to Social Security recipients. Comerica was selected, in part, because of our experience as a pre-paid card issuer for a number of state government programs. This should provide us with significant deposit growth and fee income over time.

In the Retail Bank, we completed refurbishments to 27 banking centers in 2007: 22 in Michigan, three in Texas and two in California. We also streamlined and enhanced Comerica’s personal checking account product line into five packages designed to fulfill specific consumer needs. And, we introduced enhanced Web Bill Pay features, which made it easier for individuals and small businesses to manage their online bill payments.

In Wealth & Institutional Management, we launched Wealth Station – an open architecture investment platform fully integrated with financial planning. We also rolled out insurance, 401(k) and financial planning in Texas, Florida and California. In addition, we successfully converted to a state-of-the art capital markets platform.

You can read more about our business segment achievements and competitive advantages on pages 2 and 3 of this report.

During the year, we relocated our corporate headquarters from Detroit, Michigan, to Dallas, Texas. The relocation of our corporate headquarters positions our company in a more central location with greater accessibility to all of our markets. It advances our strategy to diversify our customer base and extend our reach into high-growth markets.

Comerica has maintained a presence in Texas for 20 years, and we are now the largest banking company headquartered in the state – an important differentiator as we work to enhance customer relationships and build new ones.

Michigan and the city of Detroit are still key markets for us, and our customers there know they can continue to rely on the same Comerica people who provide exceptional customer service and who they’ve come to know and trust.

Comerica’s commitment to the communities it serves also was enhanced in 2007. We provided more than $16 million to not-forprofit organizations nationwide, including more than $8 million from the Comerica Charitable Foundation, which we fund. Our employees also raised more than $2.3 million for the United Way and Black United Fund.

Our commitment to diversity was recognized in 2007 by, among others, the national business magazines DiversityInc and Hispanic Business, which ranked Comerica 37th among the “Top 50 Companies for Diversity” and sixth on the “Diversity Elite 60 List,” respectively. DiversityInc also ranked us third for our commitment to supplier diversity.

Looking ahead to 2008, we expect the banking industry to continue to be challenged, but we plan to navigate our way through these swift currents as we have in the past. We will continue to execute our growth strategy in 2008. We expect our banking center expansion program to keep pace with our 2007 openings, and once again be focused on our growth markets of Texas, California, Arizona and Florida.

As part of our corporate strategy, we also are making a commitment to conduct our business and operations in a way that enhances the well being of people and the communities in which they live, and protects and preserves the environment for future generations. More information about our sustainability efforts can be found online at www.comerica.com.

You can be assured that we will continue to be guided by our vision to help people be successful by delivering the highest quality financial services, providing outstanding value and building enduring customer relationships. We are committed to providing attractive long-term returns for you, our shareholders.