|

|

|

Cummins Engine

Company is the leading worldwide designer and

manufacturer of diesel engines ranging from 60 to

6,000 horsepower and the largest producer of diesel

engines over 200 horsepower. The company's key

markets for these engines are automotive, power

generation and industrial. The company also

provides filtration systems and natural gas engines

as well as engine components and electronic

systems. Cummins' 1998 sales were $6.3 billion and

it employed 28,341 people.

|

|

|

Dear Fellow

Shareholders:

The theme of this 1998

report to shareholders is VALUE-the fundamental on which any

endeavor is judged by those involved or affected. For a

business enterprise, this starts with the value brought to

its shareholders.If shareholder value is to be sustained

over any period of time, it must be linked to the value

customers and partners of that enterprise receive from doing

business with it.

Clearly,

companies that deliver superior value to their shareholders

over time are the ones that deliver superior value to their

customers and partners over time.

We at Cummins firmly believe

we can deliver superior value to both shareholders and

customers and partners. In 1998, while our financial results

fell short of our goals, we took important steps towards

delivering superior value to our customers and partners and

towards meeting our financial objectives.

We believe

meeting those objectives will deliver superior value to our

shareholders.

Our financial objectives are

to achieve earnings before interest and taxes (EBIT) of 9

percent in years when a majority of our markets are healthy.

This will equate to a return on average net assets of

approximately 25 percent and a strong free cash

flow.

Our engine-related products

are associated with capital purchases by our customers and

are, therefore, affected significantly by economic

slowdowns. In recession years our earnings target before

interest and taxes is at least 3 percent.

We begin 1999 with continued economic difficulties in Asia

and Latin America and some concern about European markets,

but North American automotive and construction markets

remain generally strong. While forecasting in our business

is difficult, we currently expect relatively level revenues

in the next two-year period. That could change

rapidly.

An economic slowdown that

included Europe and North America would inevitably affect

the timing by which we will hit our targets. Regardless of

economic conditions, however, we anticipate steady progress

over the next two years as we work to meet the needs of

customers in all our markets, to reduce costs and to improve

gross margin and cash flow.

We are

confident that the actions we are taking will put us in a

position to meet our targets consistently in the

future.

Because motivated, capable

people are vital to taking care of the customer in

cost-effective ways, they are central to our achievement of

shareholder value. Sustained profitable growth that meets

the expectations of shareholders will give our people

opportunities for personal growth, bring value to our

suppliers, and provide resources that permit us to

contribute value to the countries and communities in which

we operate.

Top

of page

The Year 1998

We had solid accomplishments

in 1998. Our revenues were a record $6.266 billion, compared

to $5.625 billion in 1997. In North America, automotive,

construction, power generation and filtration markets were

strong, offsetting sales declines in Asia and in our

agricultural and other commodity-based markets around the

world. We completed our acquisition of Nelson Industries and

successfully integrated it into our Filtration Business. We

launched a record six new engines and two new fuel systems.

Our Power Generation Business made significant progress

toward improved profitability.

Excluding special charges,

earnings were $282 million before interest and taxes.

Reported results included special charges for restructuring,

product coverage and our settlement with the U.S.

Environmental Protection Agency (EPA), resulting in a net

loss of $21 million or 55 cents per share. Settling with the

EPA avoided costly litigation and disruption in the

marketplace, even though we believe firmly we were and are

in full compliance with all federal and state

regulations.

Actions we are taking to

improve profitability are described in more detail later in

this letter. They include restructuring and major

initiatives to reduce the costs of the materials and

services we buy.

Overall,

1998 was a year in which we brought more value to customers

in each of our markets and laid the foundation for

improvements in earnings and cash flow to bring more value

to our shareholders.

Value for our

Customers

Customer value derives from

three principal elements.

• Products that provide

our customers with the most cost-effective

performance

• Information that

enables our customers to run their businesses more

efficiently

• Responsive support

for all aspects of customer need

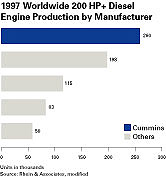

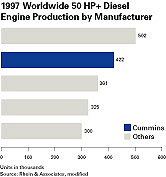

Cummins made

substantial progress in all three areas in 1998.Cummins is

the world leader in diesel engine production over 200

horsepower and is the second largest producer of engines

above 50 horsepower. We have achieved this position by

designing and producing products that meet the needs of our

customers better than our competitors' products.

We emerged from the early

1990s with improving financial performance, but recognized

that electronics and information technology had opened a

whole new horizon for our industry. Also, we knew tougher

emissions standards were likely to emerge after the year

2000. In order to continue as the industry's technical

leader, we needed to respond boldly. And we did. In the

years since 1994, we have been upgrading or replacing

engines across our entire product line - incorporating

advanced electronic controls, combustion and air handling

technology - and adding new engines on both the upper and

lower ends of the horsepower range.

1998 was the year of peak

expense in this program. We introduced a record six new

engines together with two entirely new fuel systems. New

midrange engines were the ISB and ISC, which incorporate

full-authority electronic controls and software. The ISC

uses our new CAPS fuel system. Industrial versions of these

midrange engines are being introduced in 1999.

For our customers in

heavy-duty markets, we introduced the ISM and the

revolutionary Signature 600 engine with our HPI fuel system.

In addition, we introduced two new high-horsepower engines,

the 3200-horsepower CW170, part of our Cummins Wartsila

joint venture, and the 2700-horsepower QSK60.

Both of these

high-horsepower engines are designed to increase our

penetration in the prime power generation market and to

establish leadership in mining equipment markets.

All of the

new engines are meeting marketplace objectives, and

customers report that they are delighted with the engines'

responsiveness, power and fuel economy.

This year, 1999, will see

the release of four more new engines: a version of the

Signature series for automotive fleet customers and

industrial markets; a new 9-litre engine based on advanced

electronic C-series technology; the QSK45 - a lower

horsepower version of the QSK60; and a 3.3 litre engine to

be produced at the Komatsu Cummins Engine Company in Oyama,

Japan.

The acquisition of Nelson

Industries - a major producer of air and liquid filtration

products, and exhaust and emissions control systems -

enables us to bring more product value to our OEMs. Nelson

is the leading producer of exhaust systems for diesel -

powered equipment in North America and ranks second in air

intake systems. Combined with Fleetguard, this acquisition

makes us an integrated first tier supplier of three critical

engine subsystems: air intake, fluids and exhaust. These

subsystems are required for every engine, regardless of

market or application, so we can bring additional business

to Nelson from our other businesses.

Closely

related to the value superior products bring to our

customers is the information we can provide.

Electronics and information

technology are an integral part of the operation of our

engines. We are also using information technology to enable

our customers to manage more efficiently by integrating

vehicles into their business operations and into the supply

chain. We are the principal owners of Innovative Computing

Corporation, which provides fleet management solutions and

Internet-based products, enabling customers to exchange data

throughout the entire supply chain.

Providing support is the

third critical part of creating value for our customers.

This goes beyond technology and information systems to what

we call PowerCare - powerful care for our customers. Our 31

North American - and 110 international distributors are our

partners in delivering superior support to our customers

through programs such as QuickServe, which offers one-hour

diagnosis and completion of most repairs within six hours,

and Support Plus, which guarantees instant parts access with

no service premiums.

We continue to rely on

customer councils as we develop new support programs and new

products for our heavy-duty automotive, construction, mining

and power generation markets.

Top

of page

Cummins Alliance

Our

success in creating value for our customers has made Cummins

a highly desirable alliance partner for many leading

companies around the world.

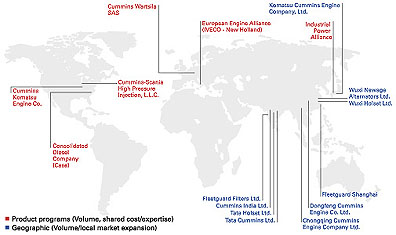

We have pursued two kinds of

partnerships. First, we have alliances with strong technical

partners with whom we can share expertise and the costs of

developing new products.

Our technical alliance

partners include Case, IVECO, Komatsu, New Holland, Scania

and Wartsila, and we are working collaboratively with them

to develop the next generation of products for the 21st

century. The second type of business alliance partnership is

with leading equipment producers in important markets for

future growth like China, India, Turkey and Japan. Our

partners provide invaluable knowledge and contacts in the

local business and political communities, as well as market

leadership.

In October, Cummins and five

other diesel engine manufacturers ended nearly a year of

intense negotiations with the U.S. Environmental Protection

Agency and the Department of Justice by signing consent

decrees. The settlement requires diesel engines to meet some

new emissions standards immediately. Substantially tougher

standards originally set for 2004 must be met 15 months

earlier, in October 2002. The major impact is on our

heavy-duty, line-haul engines.

Because

Cummins has laid a technical foundation unequaled in our

industry, we are confident of our ability to meet the new

standards.

In the markets in which we

participate, the goal of cleaner air coexists with the goal

of durable and cost-effective products. We believe these

goals are not mutually exclusive, and we have the technology

to deliver on both.

We expect to

continue as the industry leader in an environment of more

demanding emission controls.

Top

of page

Value for Our Shareholders

The second area of

accomplishment in 1998 was laying the foundation for future

improvement in earnings and cash flow. Free cash flow

provides the opportunity to reward the shareholder through

share repurchase, dividend increases and/or investment in

future growth.

We have simplified our

financial objectives based on an analysis of the nature of

our business as well as on benchmarking the world's best.

The objectives reflect profitable performance over the

business cycle.

In order to hit our

financial objective of 9 percent EBIT in good years, our

cost structure targets are 25 percent gross margin and 16

percent selling, administrative, research and engineering

(SAR) expense. We believe our goals are realistic and

attainable, and we are pursuing them on three fronts: gross

margin improvement, lower SAR expense and cash flow

improvement.

Gross Margin. In 1994 and

early in 1995, Cummins achieved a gross margin of 25

percent. As the costs of the new product development program

increased, the percentage of gross margin declined to just

above 20 percent in the fourth quarter of 1998. We intend to

return to the 25-percent gross margin level by improving

product coverage costs, lowering start-up costs,

restructuring and achieving lower material cost.

Our gross margin was lower

than planned in 1998 and below our target. A key factor was

higher costs for launching our new engines. Because of

learning curves and inevitable reliability problems

associated with any new product launch, new products cost

more than the ones they replace for some period of time.

Then, as volume builds, initial problems are corrected,

manufacturing becomes more efficient and costs come down.

We are

confident production costs for our new engines will

eventually be lower than for the products

replaced.

While we will be introducing

four new engines in 1999, the risks are considerably lower.

Three are derivatives of engines released in 1998, so the

work to improve their cost and quality is already underway.

The fourth, the 3.3 litre engine, is based upon proven

technology.

Gross margin will also be

improved as a result of the actions announced in the third

quarter when we took a charge of $114 million for

restructuring Cummins operations and those of our joint

ventures around the world. Restructuring is underway and

includes consolidating both office and manufacturing

operations and outsourcing production of non-strategic

components. Cummins staffing levels will fall by over 1,100,

and employment in joint ventures will decline by an

additional 1,200 people. Benefits began modestly in 1998,

will grow in 1999 and are expected to reach more than $50

million annually beginning in 2000, with most of these

savings contributing to gross margin improvement.

Finally, we have embarked on

a program to reduce the costs of materials that go directly

into our products. Those materials represent the largest

single item on our income statement, so the opportunity for

savings is substantial. A parallel program is in place for

goods and services like office supplies, computers, freight,

travel and health care, with some of the savings affecting

gross margin and the balance lowering SAR costs.

Top

of page

|

|

The Cummins Policy

Committee provides leadership and a real commitment

to building our business and value for you.

Members of the

Committee, from left to right:

Kiran Patel,

Jean Blackwell,

Tim Solso,

Joe Loughrey,

Jim Henderson,

Jack Edwards,

Dave Jones,

Roberto Cordaro,

Mark Gerstle and

Pamela Carter.

|

Selling, Administrative and Research (SAR) Costs. A major

success in 1998 has been the steady reduction of selling,

administrative and research costs. In 1994, these costs

totaled 18.5 percent of sales. In the first quarter of 1998

they were just below 18 percent. In the fourth quarter they

were reduced to 16 percent, which is our target. Compared to

the first quarter, fourth-quarter administrative costs were

lower by $9 million, a full point as a percent of sales.

Fourth-quarter research costs were below 4 percent.

We will

pursue opportunities to move below 16 percent in the

future.

Cash Flow. The prospect for

our business to generate increased free cash flow in the

future is excellent, even with relatively level revenues in

the next two years. First, major capital expenditures for

this cycle of new product development are behind us. Second,

improving overall profitability through restructuring and

purchasing and supply management, as we have described

above, will also contribute to cash flow. Finally, we have a

major program to improve our management of working capital -

specifically, inventory and receivables &endash; providing

another opportunity for cash flow improvement.

The cash generated will give

Cummins the flexibility to maintain a prudent capital

structure and provide a return to shareholders through

dividends and buying back Cummins shares. Over the past four

years, share repurchases have resulted in a decrease in

shares outstanding from 41.6 million to 38.4

million.

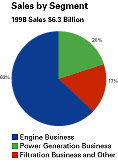

Business Results. Our Engine

Business, made up of a broad variety of automotive and

industrial markets, is the one in which we have made the

investment in new products. Therefore, its results have been

impacted significantly in the last year.

We expect to

see the improvement we have described above reflected in

returns from these markets in the next two years.

The Power Generation

Business has been making progress towards its financial

objectives primarily through restructuring and cost

reduction to date. Much of the restructuring announced in

the third quarter is directed towards further improving

Power Generation results. A continuing challenge is the

release of the Cummins-Wartsila engines in the face of Asian

market weakness. The engines will, however, permit us to

compete more effectively in the more profitable prime power

market.

Our Filtration Business and

Other includes our filtration companies, Fleetguard and

Nelson, as well as our turbocharger company, Holset, and 14

distributorships owned by Cummins. The acquisition of Nelson

Industries has proven to be very successful, adding

approximately 6 cents per share to corporate results. In

addition, the filtration and exhaust systems business

enables us to benefit from marketplace synergies with

customers of our Engine and Power Generation

businesses.

Top

of page

Corporate Values

At Cummins, our commitment

to providing value for our shareholders and customers goes

hand in hand with our commitment to corporate

responsibility. We believe firmly that acting with honesty

and integrity is sound business - absolutely essential if we

are to attract the very best people, customers, suppliers,

partners and distributors.

We are also

convinced that it is in Cummins' best interest to be

concerned about the communities and the society in which we

do business, because a healthy society provides the best

foundation for business success.

As we work to create value

for our customers and our shareholders, we recognize the

value added by our own people around the world - in our

technical centers, plants, offices and distributorships.

People are the source of innovation in our products, care

for our customers and operational improvements. We depend on

their commitment, their hard work and their ideas.

We thank our

people for helping Cummins meet the challenges of 1998, and

we will continue to rely on them in the years

ahead.

Board Changes. Another

valuable asset for Cummins is its diverse Board of

Directors. We have had two changes to the Board since our

last Annual Report. First, Don Perkins, former Chairman of

the Jewel Companies and a member of Cummins' Board of

Directors for 25 years, reaches the mandatory retirement age

for Board members in 1999 and is not, therefore, being

nominated for re-election to the Board. Over his years with

us, Don has served the Board in many roles, most recently as

Chair of the Audit Committee. Don's experience, his

understanding of worldwide business, and his leadership in

improving corporate governance are unmatched, and we have

benefited greatly from his perspective and insight.

Don has been steadfast in

his commitment to the interests of our shareholders, and all

of us have learned immeasurably from him. We will miss

him.

Second, we are pleased to

welcome a new Board member, Jim Johnson, Chairman of the

Executive Committee of the Board of Directors of the Federal

National Mortgage Association (FNMA or "Fannie Mae"), the

largest non-bank financial services company in the world.

Jim has an outstanding record of effectiveness in creating

shareholder value while chairman and chief executive officer

of Fannie Mae from 1991 through 1998 as well as a thorough

understanding of public policy issues.

Top

of page

Outlook

The future for Cummins and

its shareholders is bright. Our people are focused on

delivering superior value to shareholders by delivering

superior value to our customers and partners.

Our

investment in innovation offers our customers advanced

technology and puts Cummins in a better position than anyone

else in the industry to meet tough new emissions standards,

increase market share around the world and grow profitably.

We have clear targets for

financial return. We are confident that we will make

significant progress toward these targets in the next few

years despite a continued unsettled world economic

situation. While we are not anticipating substantial growth

in our markets for 1999, we expect to gain market share as

our new products make their mark and as growth synergies

resulting from our Nelson acquisition are

realized.

We thank you, the owners of

Cummins, for your continued support. We remain dedicated to

increasing the value of your investment and look forward to

sharing our progress and prospects with you at our Annual

Shareholders' Meeting on Tuesday, April 6, in Columbus

Indiana.

James A.

Henderson

Chairman and Chief Executive

Officer

Theodore M. Solso

President and Chief

Operating Officer

Cummins Engine Company,

Inc.

March 3, 1999

Top

of page

|

![]()