|

Strategic

foresight was fundamental to Winston in 2000. In a year

characterized by market uncertainty, Winston and the hotel

REIT sector in general faced several market-related

pressures and challenges: rising interest rates, reduced

availability of capital and a flattening real estate

market. Given this environment, Winston achieved the

following operating results: FFO reached $31.3 million, or

$1.72 per share, which exceeded our expectations set at

the beginning of the year by $0.01. The growth in our

fee-based revenues helped the Company maintain consistent

operating results as well as a constant annualized

dividend of $1.12, even as some of our peers were

compelled to cut their dividends. Although market

conditions were not favorable for growth, we have begun to

experience some success in developing additional sources

of income. These include a 49% ownership interest in three

joint venture projects through which we have earned, and

continue to earn, fees from development, design and asset

management services. We also have formed a strategic

alliance to co-develop two additional hotels, where

Winston also has provided mezzanine financing.

Winstonís

portfolio of assets at year-end included 49 operating

hotels with 6,723 rooms in 12 states and a 49 percent

ownership interest in three joint ventures which own two

operating upscale hotels and a third under development. We

work continually to move our portfolio toward newer,

upscale hotels through the rehabilitation of existing

properties or otherwise through divestiture and judicious

reinvestment. While some of the portfolioís upscale

hotels, such as the Hilton Garden Inns, were able to

generate a 10 percent RevPar increase for the year, there

also remain older, limited-service properties that

generated only modest growth. The performance of these

assets does not satisfy us, and we will continue to look

for ways either to improve their operating results or to

sell these properties. The geographic distribution of our

assets, while still weighted in the Southern Atlantic

states, increasingly has become diversified as management

looks to initiate a greater number of projects in the

United Statesí North Eastern, Middle Atlantic and

Pacific regions. The Companyís integrated strategy is to

continue with the accumulation and development of new and

geographically diverse, upscale projects, while improving

or selling older, limited-service properties. Moreover,

the Companyís strategy includes initiating relationships

which enable us to leverage our internal strengths

regarding development and financing services.

The

Companyís integrated strategy is to continue with the

accumulation and development of new and geographically

diverse, upscale projects, while improving or selling

older, limited-service properties. Moreover, the Companyís

strategy includes initiating relationships which enable us

to leverage our internal strengths regarding development

and financing services. The

Companyís integrated strategy is to continue with the

accumulation and development of new and geographically

diverse, upscale projects, while improving or selling

older, limited-service properties. Moreover, the Companyís

strategy includes initiating relationships which enable us

to leverage our internal strengths regarding development

and financing services.

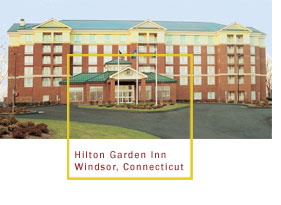

Two of the

three joint-venture upscale hotels opened during 2000. The

first was the 158-room Hilton Garden Inn in Windsor,

Connecticut, developed in partnership with Regent

Partners, Inc. The second was the 118-room Jacksonville

Hampton Inn at Ponte Vedra

Beach, Florida, which was developed with Marsh Landing

Investment, LLC. In addition to these, Winston has

commenced construction of its third joint venture

property, a 175-room Hilton Garden Inn in Evanston,

Illinois, which is scheduled to open in July 2001. The

upscale Hilton is adjacent to the campus of Northwestern

University.

Investment

only constitutes the first part of Winstonís involvement

in these projects. Our joint venture agreements also

enable Winston to earn fee income through managementís

in-house development and asset management capabilities.

Arrangements such as these allow us to exploit our core

capabilities, which become an especially important

resource when market conditions are less certain. The

resilience and foresight implicit in this strategy

highlight one of Winstonís central goals: to increase

shareholder value by creating and maintaining additional

sources of income.

Winston

entered into a strategic alliance in 2000 with Noble

Investment Group, Ltd. for the specific purpose of

developing projects requiring both mezzanine debt and

consulting services.

Noble is a leading private hotel company that, together

with Winston, is developing two Hilton Garden Inns in

Atlanta, GA and Tampa, FL. In addition to these locations,

we also intend to explore projects in other key markets

including Princeton, NJ, and Chapel Hill, NC.

Mezzanine

financing capabilities bring Winston distinctive market

advantages. A mezzanine loan provided by a managing member

of the project, like Winston, typically

bridges the gap between equity invested and senior debt by

providing 10%-15% of the projectís all-in cost through

debt. Not only does this create a lending asset with its

associated financing fees, but also it creates project

management fees, thus enhancing the Companyís FFO. To

date, such project fees already have offset the loss of

hotel revenue due to the sale of two under performing

hotels during 2000.

Winstonís

financial foresight has produced one of the most

conservative capital structures in the industry. Our

year-end outstanding debt level was 37% of the undepreciated

cost of total assets. EBITDA at year-end was 3.9 times

interest costs. The Company also announced an interest

rate swap in December 2000, which fixes our interest rate

on $50 million of debt at a rate of 5.915% until December

18, 2002. This results in an effective interest rate of

7.365% on $50 million after considering the 1.45% interest

rate spread provided for in our line of credit. The

transaction, coupled with our $69 million of outstanding

securitized debt bearing an interest rate of 7.375%,

effectively locks in approximately 70% of the Companyís

outstanding debt at very attractive rates.

|

Looking

beyond 2000, Winston plans to incorporate its more recent

sources of revenue and growth through projects that

generate development, design, purchasing and financing

fees, with the solid, long-term outlook into the "futuresites"

that drive our business. |

Meristar

Hotels and Resorts, Inc. currently leases 48 of the 51

hotels the Company either owns or holds an interest in

through joint ventures. As we mentioned throughout 2000,

in advance of the recent effective date of the REIT

Modernization Act, the Company and Meristar

held discussions regarding the Companyís acquisition of

the Meristar leases. After carefully considering all

aspects of the proposed transaction, |

Winston

believes that it is not in the best interest of its

shareholders to

acquire all of the leases at this point. The Company and

Meristar will continue to work closely together for the

benefit of the operations

of our hotels. Moreover, we have agreed with Meristar to

leave open the possibility of future discussions regarding

the Companyís acquisition of some or all of the leases

at the appropriate time.

During

the year, the Company sold two under performing limited

service assets and used the proceeds to generate greater

returns through reinvesting the proceeds in joint venture

projects and mezzanine loans. This strategy is in line

with the Companyís 2001 strategy, which is to continue

its efforts to enhance shareholder value by focusing on

newer, upscale properties, and to generate additional

sources of revenue by capitalizing on our in-house core

competencies relating to development and financing

activities. During

the year, the Company sold two under performing limited

service assets and used the proceeds to generate greater

returns through reinvesting the proceeds in joint venture

projects and mezzanine loans. This strategy is in line

with the Companyís 2001 strategy, which is to continue

its efforts to enhance shareholder value by focusing on

newer, upscale properties, and to generate additional

sources of revenue by capitalizing on our in-house core

competencies relating to development and financing

activities.

Looking

ahead to 2001, Winston again expects to meet or exceed its

operations and strategic goals through maintaining its

principles of foresight and futuresight. As in the past,

we appreciate the confidence you have expressed in the

Companyís future. While economic conditions affecting

our sector continue to challenge us, we are gratified by

the effectiveness of our response to current conditions.

We appreciate your continuing loyalty and support and look

forward to 2001 and beyond.

Charles M. Winston

Chairman of the Board

Robert W. Winston,

III

Chief Executive Officer

|