(dollars in millions except share and pre share data) |

2008 |

2007 |

2006 |

2005 |

2004 |

2003 |

||||||

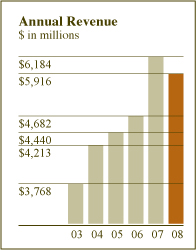

| Net sales & operating revenues | $ |

5,916 |

$ |

6,184 |

$ |

4,682 |

$ |

4,440 |

$ |

4,213 |

$ |

3,768 |

Earnings before interest expense, taxes & minority interest (EBIT) |

$ |

(3)1 |

$ |

252 |

$ |

196 |

$ |

217 |

$ |

170 |

$ |

171 |

| Depreciation & amortization | $ |

222 |

$ |

205 |

$ |

184 |

$ |

177 |

$ |

177 |

$ |

163 |

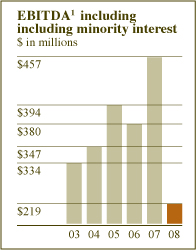

| EBITDA2 including minority interest | $ |

2191 |

$ |

457 |

$ |

380 |

$ |

394 |

$ |

347 |

$ |

334 |

| Net income (loss) before changes in accounting principles |

$ |

(415)3 |

$ |

(5) |

$ |

49 |

$ |

56 |

$ |

9 |

$ |

25 |

| Earnings (loss) per diluted share before changes in accounting principles | $ |

(8.95)3 |

$ |

(0.11) |

$ |

1.05 |

$ |

1.24 |

$ |

0.21 |

$ |

0.58 |

| Capital expenditures |

$ |

221 |

$ |

198 |

$ |

170 |

$ |

143 |

$ |

131 |

$ |

130 |

| Average diluted shares outstanding | 46,406,095 |

45,809,730 |

46,755,573 |

45,321,225 |

44,180,460 |

41,767,959 |

||||||

| Total debt | $ |

1,451 |

$ |

1,374 |

$ |

1,385 |

$ |

1,383 |

$ |

1,421 |

$ |

1,430 |

| Cash and cash equivalents | $ |

126 |

$ |

188 |

$ |

202 |

$ |

141 |

$ |

214 |

$ |

145 |

| Debt net of cash balances | $ |

1,325 |

$ |

1,186 |

$ |

1,183 |

$ |

1,242 |

$ |

1,207 |

$ |

1,285 |

|

|

|

1Includes restructuring and restructuring related charges of $40 million, a

goodwill impairment charge of $114 million and customer changeover costs of

$7 million.

2EBITDA including minority interest represents income from continuing operations before cumulative effect of changes in accounting principles, interest expense, income taxes, minority interest and depreciation and amortization. EBITDA including minority interest is not a calculation based upon generally accepted accounting principles. The amounts included in the EBITDA including minority interest calculation, however, are derived from amounts included in the historical statements of income data. In addition, EBITDA including minority interest should not be considered as an alternative to net income or operating income as an indicator of our performance, or as an alternative to operating cash flows as a measure of liquidity. We have reported EBITDA including minority interest because we believe EBITDA including minority interest is a measure commonly reported and widely used by investors and other interested parties as an indicator of a company’s performance. We believe EBITDA including minority interest assists investors in comparing a company’s performance on a consistent basis without regard to depreciation and amortization, which can vary significantly depending upon many factors. However, the EBITDA including minority interest measure presented in this document may not always be comparable to similarly titled measures reported by other companies due to differences in the components of the calculation.

3Includes restructuring and restructuring related expenses of $27 million or $0.58 per diluted share, $4 million in aftermarket changeover costs or $0.09 per diluted share, goodwill impairment charge of $114 million or $2.45 per diluted share and $290 million or $6.25 per diluted share in net tax adjustments.

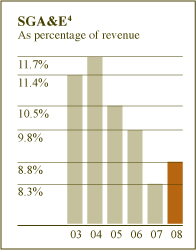

4Selling, General, Administrative and Engineering