recognized in net periodic pension or postretirement benefit cost. We expect to recognize $2.4 million ($1.5 million net of tax) of prior service credit, net of actuarial losses in net periodic pension and postretirement benefit expense during 2009.

Defined Benefit Pension Plans

A September 30 measurement date is used to value plan assets and obligations for all of our defined benefit pension plans.

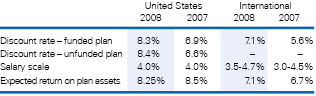

The significant assumptions used to determine benefit obligations are as follows:

The expected long-term rate of return on assets assumption is based on weighted-average expected returns for each asset class. Expected returns reflect a combination of historical performance analysis and forward-looking views of the financial markets, and include input from actuaries, investment service firms and investment managers.

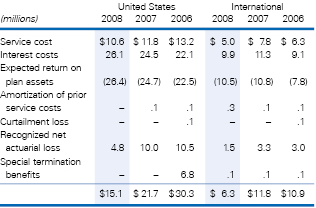

Our pension expense was as follows:

The $6.8 million expense for special termination benefits in 2006 was a result of the closing of our manufacturing facility in Salinas, California and our voluntary separation program.

|

|

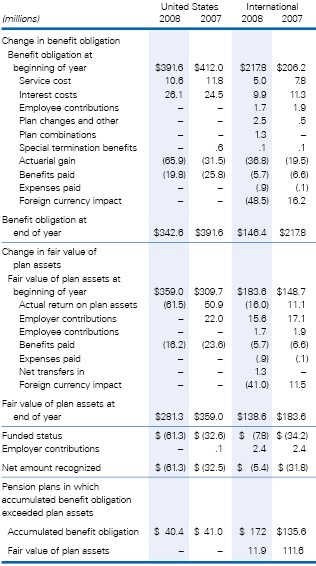

Rollforwards of the benefit obligation, fair value of plan assets and a reconciliation of the pension plans’ funded status at the measurement date, September 30, follow:

Included in the United States in the preceding table is a benefit obligation of $41.8 million and $43.2 million for 2008 and 2007, respectively, related to a nonqualified defined benefit plan pursuant to which we will pay supplemental pension benefits to certain key employees upon retirement based upon employees’ years of service and compensation. The accrued liability related to this plan was $41.8 million and $43.1 million as of November 30, 2008 and 2007,

|