respectively. The assets related to this plan are held in a Rabbi Trust and accordingly have not been included in the preceding table. These assets were $30.2 million and $38.1 million as of November 30, 2008 and 2007, respectively.

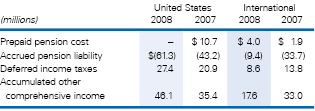

Amounts recorded in the balance sheet consist of the following:

The accumulated benefit obligation is the present value of pension benefits (whether vested or unvested) attributed to employee service rendered before the measurement date and based on employee service and compensation prior to that date. The accumulated benefit obligation differs from the projected benefit obligation in that it includes no assumption about future compensation levels. The accumulated benefit obligation for the U.S. pension plans was $307.7 million and $347.2 million as of September 30, 2008 and 2007, respectively. The accumulated benefit obligation for the international pension plans was $133.7 million and $198.0 million as of September 30, 2008 and 2007, respectively.

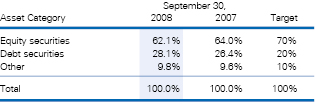

Our actual and target weighted-average asset allocations of U.S. pension plan assets as of September 30, 2008 and 2007, by asset category, were as follows:

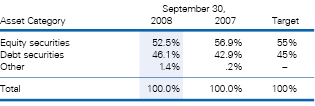

The average actual and target allocations of the international pension plans’ assets as of September 30, 2008 and 2007, by asset category, were as follows:

The investment objectives of the pension benefit plans are to secure the benefit obligations to participants at a reasonable cost to us. The goal is to optimize the long-term

|

|

return on plan assets at a moderate level of risk, by balancing higher-returning assets such as equity securities, with less volatile assets, such as fixed income securities. The assets are managed by professional investment firms and performance is evaluated quarterly against specific benchmarks.

Equity securities in the U.S. plan included McCormick stock with a fair value of $13.1 million (0.4 million shares and 5.9% of total U.S. pension plan assets) and $16.8 million (0.4 million shares and 4.8% of total U.S. pension plan assets) at November 30, 2008 and 2007, respectively. Dividends paid on these shares were $0.4 million in 2008 and $0.4 million in 2007.

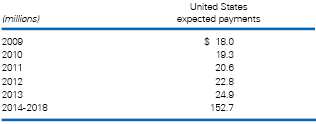

Pension benefit payments in our major plans are made from assets of the pension plans. It is anticipated that future benefit payments for the U.S. plans for the next 10 fiscal years will be as follows:

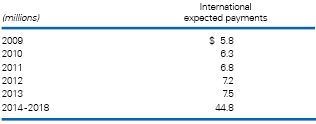

It is anticipated that future benefit payments for the international plans for the next 10 fiscal years will be as follows:

Following our September 30, 2008 measurement date, economic conditions have changed such that there has been a further decrease in the funded level of our retirement plans. In 2009, we expect to contribute approximately $40 million to $60 million to our U.S. pension plans and approximately $10 million to our international pension plans.

401(k) Retirement Plans

For the U.S. McCormick 401(k) Retirement Plan, we match 100% of a participant’s contribution up to the first 3% of the participant’s salary, and 50% of the next 2% of the participant’s salary. Certain of our U.S. subsidiaries sponsor separate 401(k) retirement plans. Our contributions charged

|