to expense under all 401(k) retirement plans were $5.7 million, $5.7 million and $5.6 million in 2008, 2007 and 2006, respectively.

At the participant’s election, 401(k) retirement plans held 2.9 million shares of McCormick stock, with a fair value of $86.5 million, at November 30, 2008. Dividends paid on these shares in 2008 were $2.6 million.

Postretirement Benefits

Other Than Pensions

We currently provide postretirement medical and life insurance benefits to certain U.S. employees who were covered under the active employees’ plan and retire after age 55 with at least 5 years of service. Employees hired after December 31, 2008 will not be eligible for a company subsidy. They will be eligible for coverage on an access only basis. The subsidy provided under these plans is based primarily on age at date of retirement. These benefits are not pre-funded but paid as incurred.

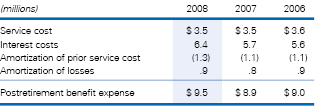

Our other postretirement benefit expense follows:

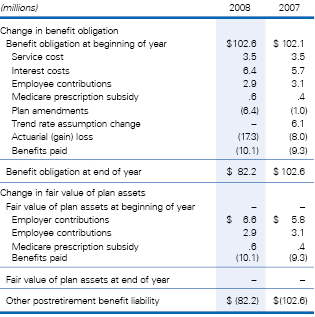

Rollforwards of the benefit obligation, fair value of plan assets and a reconciliation of the plans’ funded status at November 30, the measurement date, follow:

|

|

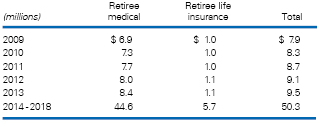

Estimated future benefit payments (net of employee contributions) for the next 10 fiscal years are as follows:

The assumed discount rate was 8.6% and 6.3% for 2008 and 2007, respectively.

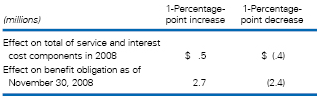

For 2009, the assumed annual rate of increase in the cost of covered health care benefits is 9.0% (9.8% last year). It is assumed to decrease gradually to 5.0% in the year 2014 (5.0% by 2014 last year) and remain at that level thereafter. Changing the assumed health care cost trend would have the following effect:

11. STOCK-BASED COMPENSATION

In 2006, we adopted SFAS No. 123(R), “Share-Based Payment.” This statement requires us to expense the fair value of grants of various stock-based compensation programs over the vesting period of the awards. We used the “Modified Prospective Application” transition method whereby we did not restate prior year financial statements. Compensation expense is calculated and recorded beginning in 2006 as follows:

Awards Granted After November 30, 2005 – Awards are calculated at their fair value at date of grant. The resulting compensation expense is recorded in the income statement ratably over the shorter of the period until vesting or the employee’s retirement eligibility date. For employees eligible for retirement on the date of grant, compensation expense is recorded immediately.

|