Awards Granted Prior to November 30, 2005 –

Awards were calculated at their fair value at the date of original grant. Compensation expense for the unvested portion of these options at December 1, 2005 is recorded in the income statement ratably over the remaining vesting period without regard to the employee’s retirement eligibility. Upon retirement, any unrecorded compensation expense will be recorded immediately.

For all grants, the amount of compensation expense to be recorded is adjusted for an estimated forfeiture rate which is based on historical data.

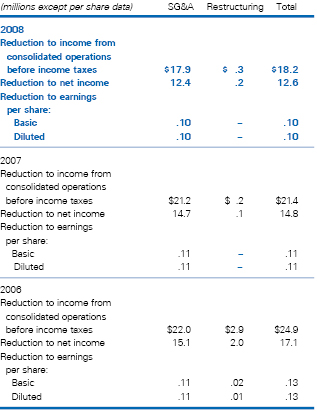

The table below presents the impact of stock-based compensation expense for 2008, 2007 and 2006.

The stock-based compensation expense recorded in restructuring charges was for the acceleration of vesting in accordance with the provisions of the award for employees who were part of our severance charges (see note 3).

Total unrecognized stock-based compensation expense at November 30, 2008, 2007 and 2006 was $9.1 million, $11.6 million and $19.5 million, respectively, and the

|

|

weighted-average period over which these will be recognized are 1.1 years, 1.1 years and 1.3 years, respectively.

We have two types of stock-based compensation awards: restricted stock units (RSUs) and stock options, including grants under an employee stock purchase plan (ESPP). Below, we have summarized the key terms and methods of valuation for our stock-based compensation awards:

RSUs

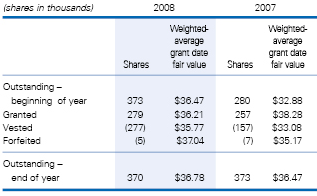

RSUs are valued at the market price of the underlying stock on the date of grant. Substantially all of the RSUs vest over a two-year term and are expensed ratably over that period, subject to the retirement eligibility rules discussed above.

A summary of our RSU activity for the years ended November 30, 2008 and 2007 follows:

Stock Options

ESPP – We have an ESPP which enables employees to purchase McCormick Common Stock Non-Voting at the lower of the stock price at the grant date or purchase date. Our current plan, which was offered in May 2007, has a two-year term and is expensed ratably over the life of the grant. Historically, we have adopted a new ESPP upon the expiration of an existing plan.

We value our ESPP using the Black-Scholes option pricing model which uses the assumptions shown in the table below. We use the Black-Scholes model as opposed to a lattice pricing model since employee exercise patterns, which are considered in a lattice model, are not relevant to this plan. The risk-free interest rate is based on the U.S. Treasury two-year rate in effect at the time of grant.

Other Option Plans – Stock options are granted with an exercise price equal to the market price of the stock at the date of grant. Substantially all of the options granted vest ratably over a four-year period and are exercisable over a

ten-year period.

|