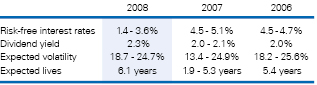

The fair value of the options are estimated using a lattice option pricing model which also uses the assumptions in the table below. We believe the lattice model provides a better estimated fair value of our options as it uses a range of possible outcomes over an option term and can be adjusted for changes in certain assumptions over time. Expected volatilities are based on the historical performance of our stock. We also use historical data to estimate the timing and amount of option exercises and forfeitures within the valuation model. The expected term of the options is an output of the option pricing model and estimates the period of time that options are expected to remain unexercised. The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant.

The per share weighted-average fair value for all options granted was $7.20, $6.83 and $7.47 in 2008, 2007 and 2006, respectively. These fair values were computed using the following range of assumptions for our various stock compensation plans for the years ended November 30:

Under our stock option plans, we may issue shares on a net basis at the request of the option holder. This occurs by netting the option cost in shares from the shares exercised.

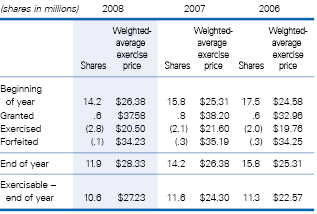

A summary of our stock option activity for the years ended November 30 follows:

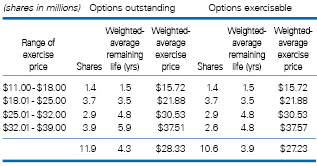

As of November 30, 2008, the intrinsic value (the difference between the exercise price and the market price) for both the options outstanding and for options exercisable was $49.6 million. The total intrinsic value of all options

|

|

exercised during the years ended November 30, 2008 and 2007 was $53.3 million and $33.2 million, respectively. A summary of our stock options outstanding and exercisable at November 30, 2008 follows:

12. INCOME TAXES

On December 1, 2007, we adopted FASB Interpretation (“FIN48”), “Accounting for Uncertainty in Income Taxes.” Upon adoption, we recorded the cumulative effects of this change in accounting principle of $12.8 million as a reduction to the opening balance of retained earnings.

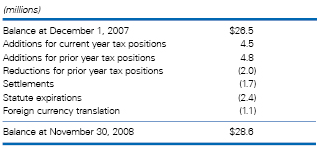

The total amount of unrecognized tax benefits as of December 1, 2007 and November 30, 2008 were $26.5 million and $28.6 million, respectively. This includes $24.8 million and $28.4 million, respectively, of tax benefits that, if recognized, would affect the effective tax rate.

We have historically classified unrecognized tax benefits in other accrued liabilities. As a result of the adoption of FIN 48, unrecognized tax benefits were classified to other longterm liabilities, unless expected to be paid within one year.

The following table summarizes the activity related to our gross unrecognized tax benefits from December 1, 2007 to November 30, 2008:

We record interest and penalties related to our federal, state, and non-U.S. income taxes in income tax expense. We recognized interest expense of $1.3 million for the year ended November 30, 2008. As of November 30, 2008, we had accrued $3.1 million of interest and penalties related to unrecognized tax benefits.

|