More important from our perspective is the recognition that extreme events will happen, and we must both price for them and respond to them in ways that balance great service and competitive pricing. We will never perfectly match pricing with extreme monthly events but we strive to carry sufficient contingency in our pricing such that, over any reasonable time frame, we will produce our targeted outcomes. The last six months has been a case study of exactly that practice. From April through September, we had an aggregate combined ratio of 94.3, a very acceptable outcome. However, the range of the combined ratios for those six months was 6.2 points.

Consistent with the second quarter, our handling of the catastrophe losses remains a point of pride within the organization, and customer feedback is extremely gratifying. In fact we examined the propensity for policy renewal of those customers who experienced our catastrophe response, and noted incremental gains compared to a control group. Auto claims resulting from extreme weather, while far from easy to handle, do not present many of the issues more closely associated with other property lines. We have been able to get reasonably rapid closure, and capacity for repairs in general seems up to the demand. Reserving challenges exist, but the short tail on the time to resolution tends to mitigate any longer-term concerns about our true understanding of the exposure and pricing assumptions.

Quarterly premium growth of 4% was less exciting than I would prefer. A closer diagnostic would suggest this too has high variability across contributing states. Florida, our largest volume state, and New Jersey, a top ten contributor, have been the focus of my commentary over the last several reports, with most recent commentary considerably more optimistic about returning to growth. Both states remain very much on track, and each posted very good numbers for growth and profitability for the quarter. Needless to say, dipping down with subsequent recovery is not a preferred means of operating.

Two other notable states, New York and Michigan, had improvement in the quarter. Michigan is still on the watch list and New York is eager for increasing growth at the now attained margins. Rounding out state commentary, it is of note to suggest our comfort with pricing for writing new business in Massachusetts is now much higher, and, while considerably longer than planned, we are moving from new entry status to early maturity in the state.

There are many states where we would like to see growth be considerably stronger and amplify the overall results. We have no other significant concerns with any states or products, and are positioned for, and working hard to gain, additional traction.

Our Commercial Auto product has endured a long period of premium decline, in many ways a mirror to the economy at large. In last quarter’s letter, I suggested our first positive growth quarter in some considerable time felt like a “step in the right direction”. The feeling was substantiated, in part through appropriate prior pricing actions earning through the book, and in part from selected pockets of increased demand. Our Commercial Auto business posted double digit written premium growth for the quarter (10%) at slightly less than targeted margins. While margin attainment appropriately has our attention, it is good to see the game plan we had hoped for start to play out. Our growth for the year has now turned positive at 3% with a combined ratio of 91.4.

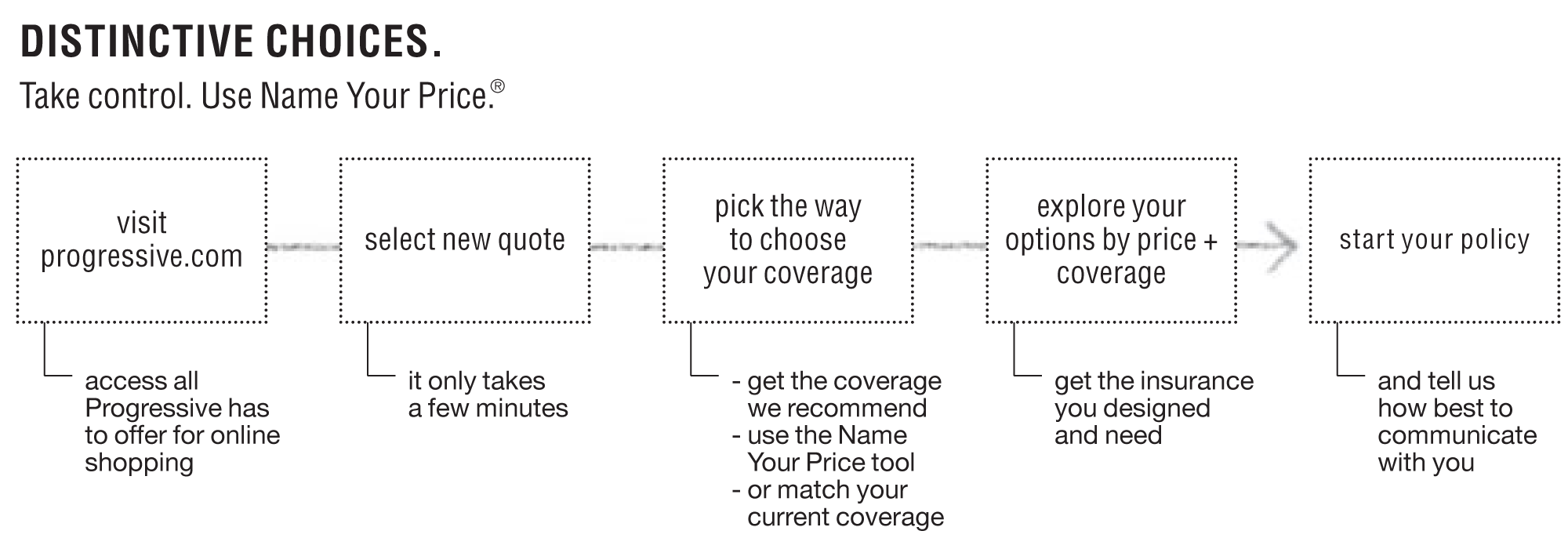

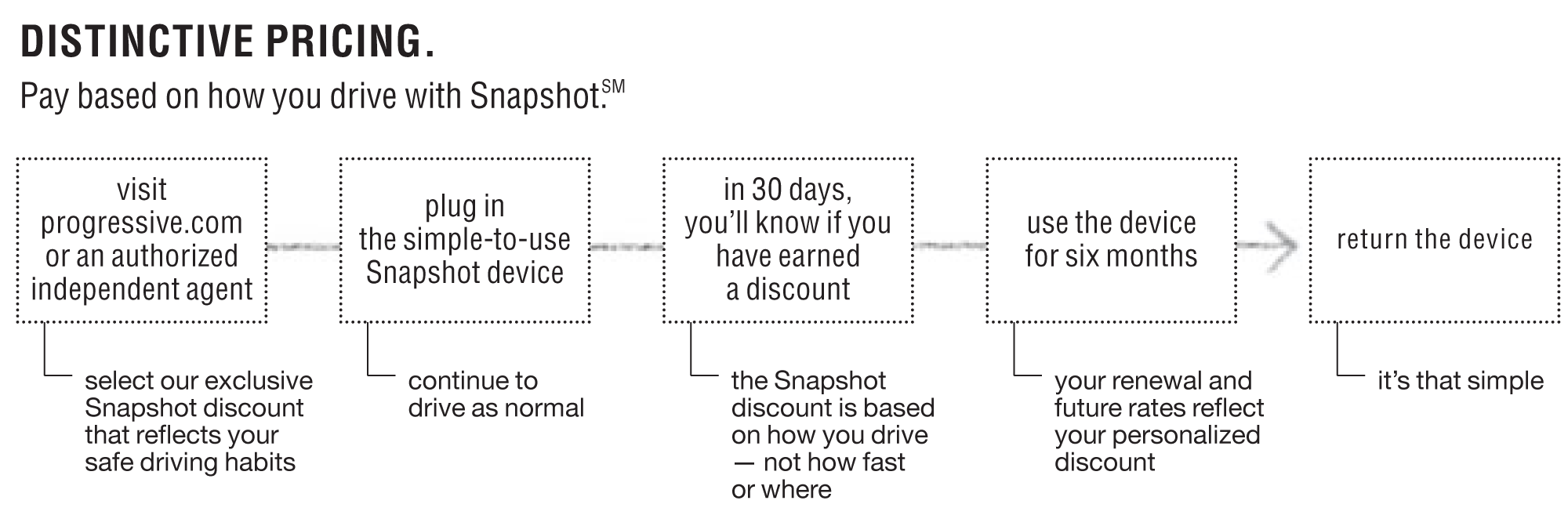

Initiatives such as Name your Price®, Snapshot®, and mobile functionality all continued as expected through the quarter. We are actively preparing for and executing more ways to communicate these distinctive features that, when received by consumers, are highly appreciated. We have developed a considerable inventory of new commercials within our Superstore/Flo campaign that we have high expectations of delivering the communication we are seeking.

Our comfort with natural storms is considerably higher than with those of the economic variety. I’ll leave the commentary of the global investment markets in the third quarter to others, but suggest the daily variance around any major equity index makes my prior commentary on our monthly combined ratios look extremely tame. Needless to say, our investment returns at this time are far less than we might desire in our plan for return on equity for our investors. With that clear recognition, and the appreciation that managing our portfolio to a very short duration for some time has left opportunity on the table, I continue to feel strongly, given the climate and uncertainty, that we have taken a port in the storm that will not inhibit our ability to underwrite all the business we can while maintaining an appropriately aggressive premiums-to-surplus ratio. The total return for the portfolio for the quarter was (2.2)%. Our unrealized pretax gain position of $871 million at the end of this quarter was $434 million less than at the end of the second quarter, and, while an understandable position on a relative basis, far from desirable. Common and preferred equities contributed disproportionately to this variability and, as such, we remain happy with our portfolio limit of 25% to what we call Group I assets, which is largely those two classes of assets, with common equities at about 10%.

Our capital position during the quarter remained extremely strong and presented no concerns; in fact, we saw some opportunities. We took advantage of the current conditions to issue $500 million in senior debt. We were delighted by the market response and had no trouble placing the offering at a coupon interest rate of 3.75%. Our debt-to-total capital ratio will decrease early next year when we will pay down $350 million of maturing debt, but at quarter end we remained just inside our 30% guideline.

With a strong capital position, solid operations, and what appeared to us to be depressed equity valuations including ours, we repurchased our stock during the quarter at accelerated rates. We repurchased 22.2 million shares during the quarter, consistent with our long-standing guidance that we will repurchase shares when our capital balances, view of the future, and the company’s stock price make it attractive to do so. We intend to remain conservative in our asset allocation and duration, believing current yields further out the yield curve often do not compensate sufficiently to endure the price risk in the current investing climate.

Certainly this was a different quarter, with results perhaps needing a little more clarification than at other times. All in all, I would assess this as an acceptable quarter and a touch better than that given the weather and economic conditions. I’m pleased we put ourselves in a position to take advantage of those same economic conditions to adjust our capital structure by adding debt and reducing equity, all while having no concerns regarding capital adequacy for any of our plans and opportunities in the operating business.

Operationally, we look forward to the fourth quarter and would welcome portfolio valuation improvements, but are not dependent on them to execute our underwriting plans.

Glenn M. Renwick

President and Chief Executive Officer