| |

How did we accelerate customer centricity last year? In true Best Buy fashion, we

decided to explore the limits of our capacity for change. For example, we converted

a record number of stores to the customer-centric operating model. We finished the

year with 300 stores, or 40 percent of U.S. Best Buy stores, operating under this

model. We expanded the number of Geek Squad agents by 5,000, and brought our

home theater installation services in-house to provide a better and more consistent

experience for our customers. We grew memberships in Reward Zone, our customer

loyalty program, to 7.2 million, and learned more about customer purchase patterns.

In addition, because customer centricity relies on employees engaging with customers

in new ways, we also focused on increasing employee retention. We changed how

we manage our people. We made more extensive use of strengths-based tools and

did a better job of listening to our employees. We also created an incentive system in

which all store employees could share. This work yielded results as well—employee

retention improved by 15 percent.

To support our strategy, we have embarked on a four-year program to transform our

supply chain and information technology systems. Our transformation goal is a simple

infrastructure that is built on “vanilla” applications and processes tried and tested

from the food industry. To date, the results are both material and promising: our

customer-facing POS systems are faster, cost less and have the flexibility to adjust as

we transform our multi-channel experience for customers.

Naturally, along with the benefits of our transformation came new challenges. For

example, our current product-centric organization could not effectively support the new

business model. In the interest of speed, we created parallel groups to support customer

centricity in store management, finance, training, legal and marketing. Supporting

two operating models was costly; yet our plan was to focus on efficiency after we had

implemented customer centricity in all markets. We believed that speed to market was

more important.

Testing Our Capacity Limits

In retrospect, we moved too quickly in some areas. In the fiscal third quarter, the volume

of changes peaked, leading to a dispersion of results. Specifically, the performance

of customer centricity stores converted in our fiscal third quarter was modestly below

our expectations. We stopped conversions for 90 days, and our analysis indicated

that we had overestimated our capacity for change. We had asked stores to implement

customer centricity, hire more services personnel, introduce Image Labs, reset their enter-

tainment software space and implement a new approach to appliance sales. Most

stores had executed well on one or more of these dimensions. Yet no store was able

to demonstrate the same level of success with all of these dimensions. These results

indicated to me that the overall strategy was intact, but we simply had asked too much

of our people within the third quarter.

|

|

Fiscal 2007 Goals

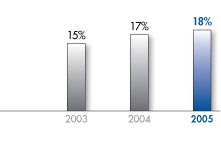

Best Buy U.S. Market Share

(calendar year data)

We believe that our market-share gains stem from

our heightened customer focus, differentiated

store experience and knowledgeable employees,

combined with our ability to offer total solutions.

Source: Company internal estimates and

NPD Group point-of-sale data

Source: Company internal estimates and

NPD Group point-of-sale data

|

|