| |

In the fourth quarter, we slowed the pace of changes, and we focused on simple

outcomes. In addition, stores that had received only the cultural aspects of customer

centricity made major strides. Soon rising consumer confidence and expense cutting

enabled us to raise our earnings guidance. We finished the year with revenue growth

of 12 percent, to $30.8 billion; and growth in earnings from continuing operations

of 22 percent, to $1.1 billion. We returned $922 million to shareholders through stock

repurchases and dividends—nearly a three-fold increase over fiscal 2005. We also

contributed approximately $30 million to our store communities, including relief for

families and schools devastated by hurricanes Katrina, Wilma and Rita.

Success and earnings growth of this magnitude are exciting for any company, particu-

larly one our size. I strongly believe that our decision to accelerate customer centricity

contributed to our 22-percent increase in earnings from continuing operations this year.

Profitably Scaling Customer Centricity

We have an unshaken belief in the need to transform our company, and our trans-

formation has moved beyond the tipping point. We believe that the best way to boost

returns is to invest in our customers and employees. Accordingly, we have set six

priorities for fiscal 2007.

- One, we plan to implement a single, customer-centric operating model at all U.S.

Best Buy stores and the corporate campus by fiscal year end. Moving to a single

operating model will eliminate redundant work and put all of us on the same team.

Our intention is to combine the best of our original, highly disciplined operating

model with our more flexible, customer-centric model.

- Two, we plan to continue to grow organically. We expect to open approximately

90 new stores in North America. We also anticipate adding 200 more Magnolia

Home Theaters locations inside U.S. Best Buy stores, taking advantage of rising

consumer interest in flat-panel TVs.

- Three, we will build our small-business capabilities. This effort includes nearly

doubling our Best Buy For Business locations, to more than 200 stores, which will

train more than 900 Microsoft-certified professionals by fiscal year end.

- Four, we expect to grow our services business by driving productivity improvements

in computer services and home theater installation. We plan to drive the gains

through the implementation of new tools, the benefits of scale and a market-based

approach to home visits.

- Five, we plan to enhance our ability to provide complete solutions to customers.

We expect to do that by giving our stores better tools and capabilities for describ-

ing, demonstrating and selling solutions such as digital music subscriptions,

digital cable and voice-over-Internet telephony.

- Six, we plan to pursue an international growth strategy. We are beginning by

leveraging our supply chain and technology investments in Canada, where we

operate both Future Shop and Best Buy stores. We also are embarking on a

controlled growth strategy in China.

These priorities are aimed at profitably scaling the best ideas from last year, based

on what we have learned, as we build new, strategic capabilities supported by a

single operating model.

|

|

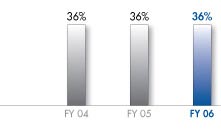

Customer Loyalty

We believe customer centricity helped us maintain

our customer loyalty (percentage of customers

rating us 5 on a 5-point scale). The highest loyalty

came from customers who used Geek Squad.

Source: Weekly online surveys

Source: Weekly online surveys

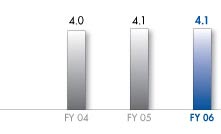

Employee Engagement

Best Buy’s growth strategy benefits from knowledgeable and engaged employees. We are

investing in employees in order to deliver better

customer service.

Source: Gallup survey, using a 5-point scale

Source: Gallup survey, using a 5-point scale

|

|