| |

In essence, our goal is to deploy customer centricity in a cost-effective manner at all

U.S. Best Buy stores. This year is an opportune time for further change, as we are

expecting to benefit from the current product cycle. We anticipate comparable store

sales gains from flat-panel televisions, MP3 players and accessories, notebook com-

puters, video gaming consoles, Geek Squad services and appliances. Partially offset-

ting these gains will be declines from analog TVs, phones, computer printers and CDs

Delivering On Growth

At the time this report was printed, based on our plans and current economic

expectations, we were expecting revenue of $34 billion to $35 billion for fiscal 2007,

an increase of10 percent to13 percent. We expected revenue growth from the new

store openings and a comparable store sales gain of 3 percent to 5 percent. We

also were anticipating earnings growth of approximately 20 percent. While we

believe this guidance range is achievable, we also recognize that the consumer elec-

tronics industry is very competitive, and our results could be affected by consumer

preferences, how well we execute our strategies and employee retention, among

other factors.

Longer term, we continue to pursue our goal of a 7-percent operating income rate.

Our earnings guidance for fiscal 2007 provides for an improvement of 40 basis

points. We expect the gain to come from improved capabilities in our supply chain

and information technology systems; leverage of our investments in Canada; and

organic growth fueled by new store openings, customer centricity work and the

expansion of our services business.

Leading Our People

Assisting me in working toward these goals are Brian Dunn, who was promoted

to president and COO, effective at the start of the fiscal year; Bob Willett, who was

named CEO of Best Buy International, effective the same date; and Darren Jackson

and Shari Ballard, who remain CFO and executive vice president of human capital,

respectively. I am honored to work alongside such a strong team of leaders.

Thanking Our Partners

Best Buy has a 40-year track record as a growth company. As we enter our fifth decade,

I would like to thank all of our partners who have contributed to our success. We are

indebted to our vendors, our communities and our shareholders for their support in

the past, today and in the future. Most of all, I would like to recognize our employees,

who make a difference for our customers every day. As I have said before, I believe

that we have only scratched the surface in realizing the opportunities associated with

our customer centricity strategy. I feel very optimistic about the coming year and the

heights to which our strategy will take us in the years ahead.

Bradbury H. Anderson

Vice Chairman and CEO

|

|

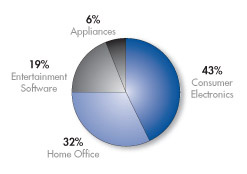

Product Revenue Mix

Consumer electronics increased to 43 percent of

our product revenue mix in fiscal 2006, up from

39 percent in fiscal 2005. This strength was pri-

marily driven by customer interest in flat-panel TVs

and MP3 players and accessories.

Earnings per Diluted Share

Earnings per diluted share from continuing

operations increased 22 percent in fiscal 2006

driven by strong revenue growth, an improved

gross profit rate, higher net interest income and

a lower tax rate.

5 of 5

5 of 5 |

|

|