To Our Fellow Shareholders:

We enter 2011 with one of the strongest portfolios of food brands and products in Canada, a clear and compelling plan for future success, and seven consecutive quarters of improving results behind us. This plan will see us significantly improve profitability and competitiveness by eliminating costs and investing in scale and technology. It is achievable, measureable and affordable. It includes cost reduction initiatives that are well within our control and ability to execute, and is already showing results.

Our entire Management team is committed to executing on this plan and delivering on the promise of creating value for Maple Leaf Foods and its shareholders. Specifically, we expect the plan to deliver 75% margin growth by 2015.

Across our organization, we are continuing to set global standards of excellence in food safety. We have been recognized as one of Canada’s leading corporate cultures. We are investing in product innovation and marketing to grow market share and build on our brand leadership. And we hold fast to our Maple Leaf Leadership Values as the touchstone for everything we do.

2010 Financial Highlights

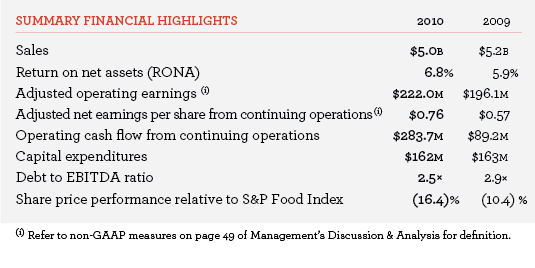

Adjusted Earnings Per Share increased 33% in 2010 compared to 2009 due to continued better performance in the Meat Products Group. We benefited from robust poultry and pork markets and improved manufacturing efficiencies. While margins increased in the prepared meats business due to the success of many initiatives to reduce costs and increase net pricing, earnings were affected by lower volumes as consumers adjusted to higher price levels. In the Bakery Products Group, stronger results in the fresh bakery business were more than offset by lower earnings in the frozen and U.K. bakery operations. A number of initiatives are underway in both these businesses to increase earnings and are expected to contribute positively in 2011.

We completed several debt refinancings, on competitive rates and terms, including a US$355 million private placement refinancing, a $170 million committed three-year accounts receivable securitization, and a Canadian private debt financing for $90 million, all of which increased the average maturity of the Company’s debt to 4.2 years. Maple Leaf’s ability to finance on favourable terms is a reflection of the investment community’s confidence in our business and Maple Leaf’s value creation plan. With the existing revolving credit facility maturing on May 31, 2011, the Company is currently negotiating a longer-term replacement facility.