2009 was a remarkable year — a year that distinguished U.S. Bancorp as a very special company.

U.S. Bancorp's financial performance continued to be industry-leading in 2009. During this unprecedented year of economic uncertainty and financial recession, we remained focused on our role as a strong and trusted guide for our customers and an active participant in our communities. Further, we accepted the challenge to serve as a leader within the financial services industry to promote a "new dialogue" and instill confidence in the key role of banks in the economic recovery.

Quality, Strength, Leadership

The theme of this year's Annual Report to Shareholders is Quality, Strength, Leadership. These attributes reflect the manner in which U.S. Bancorp has endeavored to manage through this time of unparalleled turmoil on behalf of our shareholders, customers, employees and the communities we serve.

Long before the recent economic events occurred, U.S. Bancorp was known as a prudent, conservative and high quality banking company. During the years leading into the recession, we were often considered too prudent or too cautious. Our banking model was simple, transparent and predictable. And while we are pleased that this conservative operating philosophy has served us very well during this downturn — we are equally pleased with our growing momentum and the recent investments we have made in our franchise, our people and our communities.

Flight to quality

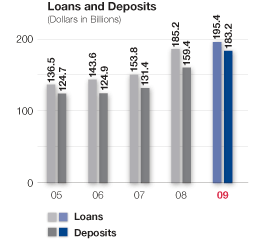

U.S. Bancorp's stability and soundness created a manifest flight to quality that began two years ago and continues today, as customers seek a solid financial partner that they can trust. This strong operating position was best reflected in the substantial growth of our balance sheet and further evidenced by the deeper customer relationships that we have established in the past year.

While many of our peers are downsizing, restructuring, or exiting businesses — we are expanding. Additionally, during 2009, U.S. Bancorp's business model remained intact; our simple business strategies proved themselves, and they continue to be our blueprint for the future.

This stability allowed us to continue our focus on growing our businesses, adding to our franchise, increasing market share, further developing our employee talent and taking advantage of opportunities for acquisitions that will strengthen U.S. Bancorp in the future. While last year may have been a time for many to retrench and focus on the present — we were investing in our company and focusing on the future.

Continuing strength

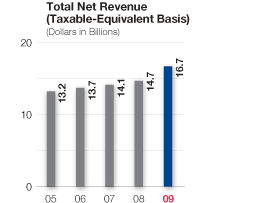

U.S. Bancorp's fourth quarter and full year 2009 earnings fully reflected the strength and quality of our company. We achieved record total net revenue for both the quarter and the year; a record $4.4 billion for the fourth quarter and a record $16.7 billion for the full year 2009. The strong growth in net revenue, the result of our expanding balance sheet and fee-based businesses, as well as recent investments in our branch network and various growth initiatives, was the primary driver behind the increase in fourth quarter earnings compared with the same period of 2008.

Perhaps the most important variables during this economic recession are asset quality and credit costs. In fact, the provision for credit losses for 2009 was $2.5 billion higher than 2008. For the fourth quarter, credit costs, including the cost of building the allowance for credit losses, were higher than the same quarter of 2008, but lower than the previous quarter. This moderation on a linked quarter basis is an indication that slower-paced credit deterioration is forthcoming. While a slower rise in net charge-offs and non-performing assets is a very positive trend, both are still increasing, and accordingly, we continued to increase the allowance for credit losses. When we are confident that there is a sustained and predictable decrease in net charge-offs and non-performing assets, rather than merely a slower pace, we will declare that we have finally "turned the corner." As I have stated previously, I expect U.S. Bancorp entered this recession later and will exit this recession earlier than most of our peers.

Throughout this report, you will find details about our financial results and recent activities. This year, more strongly than ever before, I encourage you to read it thoroughly for a complete view of our operating results. I believe you will find it heartening that U.S. Bancorp remained consistently profitable in 2009, while helping our customers manage through these unprecedented times.

We are aligned to make the most of an economic recovery and we have positioned the bank to emerge as an even stronger competitor. This annual report will also allow you to see the importance that we place on our engaged and loyal employees and their personal contributions in creating a world-class financial institution. Our employees, our most important asset, fulfill the promise of banking through the trust, honesty and transparency they bring to everything they do for our customers.

Our capital position remains strong. With our positive earnings stream, business line momentum and moderating credit costs, we expect to continue to generate significant capital going forward and build upon this already solid base.

Dividend actions

Increasing the dividend remains one of our most important priorities. While we are confident that our earnings can support a higher dividend, the permanence and sustainability of an economic recovery, as well as the impact of potential regulatory and legislative actions, remain uncertain and will influence the level of capital that will be required going forward. We will continue to assess and evaluate the effect of these factors on our company, and we will await evidence of a sustainable economic recovery and clear capital guidelines before we take a definitive action on our dividend.

Accordingly, the quarterly dividend rate of $.05 per common share was thoughtfully considered last December and was maintained. We greatly appreciate the impact that this lower dividend rate has on our shareholders, and we are grateful for your support of our prudent approach to capital preservation at this critical time.

U.S. Bancorp Managing Committee (left to right)

Jennie P. Carlson, Executive Vice President, Human Resources -

Pamela A. Joseph, Vice Chairman, Payment Services -

P.W. (Bill) Parker, Executive Vice President and Chief Credit Officer -

Richard J. Hidy, Executive Vice President and Chief Risk Officer -

Joseph C. Hoesley, Vice Chairman, Commercial Real Estate -

Howell (Mac) McCullough, III, Executive Vice President, Chief Strategy Officer -

Richard K. Davis, Chairman, President and Chief Executive Officer -

Lee R. Mitau, Executive Vice President and General Counsel -

William L. Chenevich, Vice Chairman, Technology and Operations Services -

Richard C. Hartnack, Vice Chairman, Consumer Banking -

Joseph M. Otting, Vice Chairman, Commercial Banking -

Andrew Cecere, Vice Chairman and Chief Financial Officer -

Richard B. Payne, Jr., Vice Chairman, Corporate Banking -

Diane L. Thormodsgard, Vice Chairman, Wealth Management & Securities Services

Leadership

New rules governing the operations of financial institutions should be expected in the near future in an effort by regulators and legislators to prevent a repeat of the issues that precipitated the current economic recession. We intend to be involved in the discussions and decision-making that will craft the next generation of banking policy.

We fully support financial regulatory reform and strong consumer protection. We recognize the need for oversight of systemically important institutions, and we welcome a new model of regulation that would also oversee non-bank financial services providers. America deserves a strong financial system that operates in a more transparent and prudent manner — and we seek a key role as a partner in the development of this new system.

Finally, while we fully support steps to bring stability back to the financial services industry, we will continue to protect and differentiate U.S. Bancorp, helping to ensure that any new rules and policies do not impair our ability to best serve our customers and shareholders.

Looking forward

I am confident that U.S. Bancorp's momentum will only accelerate in a recovering economy. We have the depth, determination and strength to withstand continuing challenges and we are positioned for growth and prosperity in the future. We will continue to manage U.S. Bancorp for the benefit of our shareholders, our customers, our employees — and the economic well-being of our country and its economy.

Your trust is well placed and we are grateful for your support and engagement. We are "dream makers" and look forward to our emerging role as one of America's best banks!

Sincerely,

Richard K. Davis

Chairman, President and Chief Executive Officer

February 26, 2010