With much of the developed world still grappling with high unemployment levels, heavy debt burdens and high budget deficits, we nevertheless posted a solid financial performance in 2010.

Our organic volume performance was adversely affected by unprecedented excise tax hikes in numerous countries which, coupled with continued economic uncertainty, spurred further adult consumer downtrading, heightened price competition and fueled a surge in illicit trade. However, we surpassed our earnings per share (EPS) and cash flow targets by a comfortable margin.

I am delighted to share with you some of Philip Morris International Inc.’s (PMI) key highlights of 2010 in this letter, following which you will read more about how our profitable growth is driven by the success of our broad brand portfolio in markets across all geographies, led by Marlboro, the world’s only truly global cigarette brand.

2010 Results

Total cigarette volume of 899.9 billion units exceeded 2009 by 35.8 billion, or 4.1%. On an organic basis, which excludes the favorable impact of acquisitions, including the highly successful business combination with Fortune Tobacco Corporation in the Philippines, volume was down by 21.6 billion units, or 2.5%.

Total cigarette volume of 899.9 billion units exceeded 2009 by 35.8 billion, or 4.1%. On an organic basis, which excludes the favorable impact of acquisitions, including the highly successful business combination with Fortune Tobacco Corporation in the Philippines, volume was down by 21.6 billion units, or 2.5%.

We grew our aggregate share in both OECD and non-OECD markets, gained aggregate share in our top 30 operating companies income (OCI) markets, and grew Marlboro’s global share.

We grew our aggregate share in both OECD and non-OECD markets, gained aggregate share in our top 30 operating companies income (OCI) markets, and grew Marlboro’s global share.

Net revenues, excluding excise taxes, reached $27.2 billion, up by $2.2 billion, or 8.7%, and up by $848 million, or 3.4%, on an organic basis, which excludes acquisitions and currency. This was slightly below our mid- to long-term constant currency target growth rate of between 4% and 6%, excluding acquisitions.

Net revenues, excluding excise taxes, reached $27.2 billion, up by $2.2 billion, or 8.7%, and up by $848 million, or 3.4%, on an organic basis, which excludes acquisitions and currency. This was slightly below our mid- to long-term constant currency target growth rate of between 4% and 6%, excluding acquisitions.

Strong pricing, up by $1.7 billion versus 2009, outpaced unfavorable volume/mix by a factor of more than two.

Strong pricing, up by $1.7 billion versus 2009, outpaced unfavorable volume/mix by a factor of more than two.

Reported operating companies income grew by $1.2 billion, or 11.6%, to $11.5 billion and by $740 million, or 7.2%, on an organic basis, in line with our mid- to long-term, adjusted constant currency target growth rate of between 6% and 8% for the third year in a row.

Reported operating companies income grew by $1.2 billion, or 11.6%, to $11.5 billion and by $740 million, or 7.2%, on an organic basis, in line with our mid- to long-term, adjusted constant currency target growth rate of between 6% and 8% for the third year in a row.

The three-year productivity target we set at the time of the spin-off from Altria Group, Inc. in March 2008 of $1.5 billion in gross cumulative savings was achieved in 2010, due in large measure to numerous initiatives pursued in both procurement and manufacturing.

The three-year productivity target we set at the time of the spin-off from Altria Group, Inc. in March 2008 of $1.5 billion in gross cumulative savings was achieved in 2010, due in large measure to numerous initiatives pursued in both procurement and manufacturing.

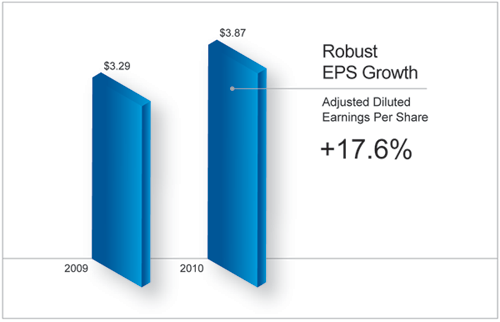

Adjusted diluted EPS of $3.87 were up by 17.6%, and by 14.0% on a constant currency basis, versus 2009.

Adjusted diluted EPS of $3.87 were up by 17.6%, and by 14.0% on a constant currency basis, versus 2009.

Discretionary cash flow, defined as operating cash flow less capital expenditures, of $8.7 billion in 2010 was up by $1.6 billion, or 21.7%, versus 2009, partly reflecting the strict management of our working capital by further optimizing our supply chain, particularly leaf and finished goods inventories. This performance represented a record level of 32.1% when expressed as a percentage of net revenues, excluding excise taxes, well ahead of each of our competitors and every company in our peer group.

Discretionary cash flow, defined as operating cash flow less capital expenditures, of $8.7 billion in 2010 was up by $1.6 billion, or 21.7%, versus 2009, partly reflecting the strict management of our working capital by further optimizing our supply chain, particularly leaf and finished goods inventories. This performance represented a record level of 32.1% when expressed as a percentage of net revenues, excluding excise taxes, well ahead of each of our competitors and every company in our peer group.

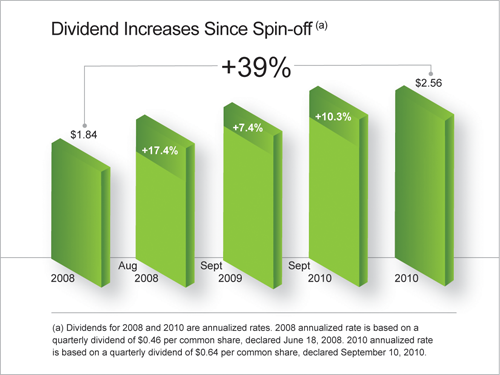

Our strong cash flow performance enabled us to continue to reward shareholders in a generous manner.

Our strong cash flow performance enabled us to continue to reward shareholders in a generous manner.

We increased our quarterly dividend in September 2010 by 10.3% to an annualized level of $2.56 per common share. In April 2010, we completed our 2008–2010 share repurchase program of $13 billion and, in May 2010, initiated a new, three-year share repurchase program of $12 billion. Our share repurchases in 2010 totaled $5.0 billion, or 97.1 million shares. The combination of dividends paid to shareholders and the share repurchase programs means we have returned $26.7 billion to our shareholders since the spin-off in 2008 through 2010, more than 25% of our market capitalization at year-end 2010.

As of December 31, 2010, our total shareholder return (TSR) for the year was a strong 27.2%, well ahead of our peer group (up by 8.7%) and the S&P 500 (up by 15.0%). Of note is that we achieved the fifth-highest performance in the top 25 S&P 500 companies in 2010. Since the spin-off, our TSR was 30.4%, an excellent performance relative to our peer group (up by 7.9%), our tobacco peer group (up by 7.9%) and the S&P 500 (up by 1.8%). Indeed, compared to the top 25 S&P 500 companies, we were fourth overall, outpaced only by technology companies.

As of December 31, 2010, our total shareholder return (TSR) for the year was a strong 27.2%, well ahead of our peer group (up by 8.7%) and the S&P 500 (up by 15.0%). Of note is that we achieved the fifth-highest performance in the top 25 S&P 500 companies in 2010. Since the spin-off, our TSR was 30.4%, an excellent performance relative to our peer group (up by 7.9%), our tobacco peer group (up by 7.9%) and the S&P 500 (up by 1.8%). Indeed, compared to the top 25 S&P 500 companies, we were fourth overall, outpaced only by technology companies.

Brand Performance

Marlboro’s share momentum improved as the year unfolded, despite the challenging economic environment. This is testament to the success and disciplined deployment of the brand’s new architecture. In virtually all instances, we are witnessing improvements in the brand’s key image attributes and demographic profile. Marlboro’s performance in Asia was singularly robust in 2010, notably thanks to several entries focused on the Fresh pillar, such as Black Menthol and Ice Blast.

Elsewhere in this Report, you will find examples of the continued progress being made by our other international brands, including L&M, our second-largest and fastest-growing cigarette brand in our European Union Region, as well as our other regional and domestic brands.

Business Development, Environmental Health and Safety, and R&D

The strategic highlight of the year was the highly successful transaction in the Philippines, announced in February, which combined the businesses of our local affiliate with Fortune Tobacco Corporation (FTC) to create a new company called PMFTC. The Philippines is one of the largest global cigarette markets and, prior to the combination, FTC was one of the five largest privately owned cigarette companies in the world.

In June, we announced that our Brazilian affiliate had entered into an integration agreement with two local leaf suppliers that will provide 10% of PMI’s global leaf requirements. This initiative will further ensure the stability of our leaf supply in the country, improve cost efficiencies and enable us to better align leaf supply and demand.

Our dedicated efforts to improve our environmental, health and safety performance are bearing fruit. We were ranked fourth among all consumer products companies in the 2010 S&P 500 Carbon Disclosure Leadership Index and seventh in the larger global index. Of note is that we led all other tobacco companies. While there remains much to be accomplished, we are clearly off to a good start.

We continue to advance our ambition to launch reduced-risk products in the mid-term. The integration of our initiatives on product development, risk assessment and the optimal regulatory pathway is complex, but progressing in a steadfast manner.

The Regulatory and Fiscal Environment

We support comprehensive tobacco regulation and related fiscal policies that are evidence based and that contribute to the goal of harm reduction. We do not support regulations that would deprive us of our ability to compete fairly with other manufacturers or that would deprive adult consumers of the ability to select, buy and use the tobacco products they prefer.

On the regulatory front, plain packaging, product display bans and ingredient restrictions or outright bans remain the key threats to the legitimate tobacco industry. These threats are likely to persist for years to come, and we will continue to actively challenge such proposals. Our efforts are bearing early fruit, with a few countries already rejecting the notion of plain packaging, for example, on both constitutional and intellectual property grounds.

On the fiscal front, the most significant challenge we faced in 2010 was the unprecedented number of countries that turned to tobacco to generate additional revenues by raising excise taxes to levels that went beyond any reasonable expectation. We take minor consolation from the fact that in many of the markets where these excise tax increases were abnormal, these same governments are seriously reconsidering their rash actions because the threat of illicit trade, so often ignored when tax policies are established, has now materialized. Fortunately, in the European Union, a new Tax Directive has been agreed upon, which sets out a roadmap through 2018, constitutes a significant improvement over prior regulation and whose beneficial impact is already being felt.

The Organization

Morale remains high, and the organization is as motivated and engaged as ever. Speed to market has improved markedly, and our entrepreneurial spirit continues to grow, as evidenced by the countless innovative initiatives that have been implemented across all functions and geographies.

In my opinion, the Board and management continue to work together in an exemplary, transparent and candid manner. The quality and timeliness of the information flow and access to management continues to be a key strength. The addition of Jennifer Li to the Board in 2010 was praised both internally and externally. Jennifer’s strong financial expertise, experience in a fast-growing, high-technology business, and Asian background have further strengthened the Board’s depth and global perspective.

The Year Ahead

Against a challenging global economic landscape we delivered solid results in 2010. The year 2011 is likely to be another difficult year as we continue to confront the same volatile operating environment. Nevertheless, I am confident that we have the appropriate strategies in place, a successful and exciting pipeline of innovative products, clear momentum and, above all, an exceptional pool of talent and the necessary resources to meet our ambitions. We remain steadfast in our commitment to enhance long-term shareholder value and to reward our shareholders appropriately. It only remains for me to applaud, with deep gratitude, the hard work, dedication and professionalism of our superb employees with whom it is my immense pleasure to serve and, as Chairman and Chief Executive Officer, my tremendous honor to represent.

Louis C. Camilleri

Chairman of the Board and Chief Executive Officer

March 11, 2011