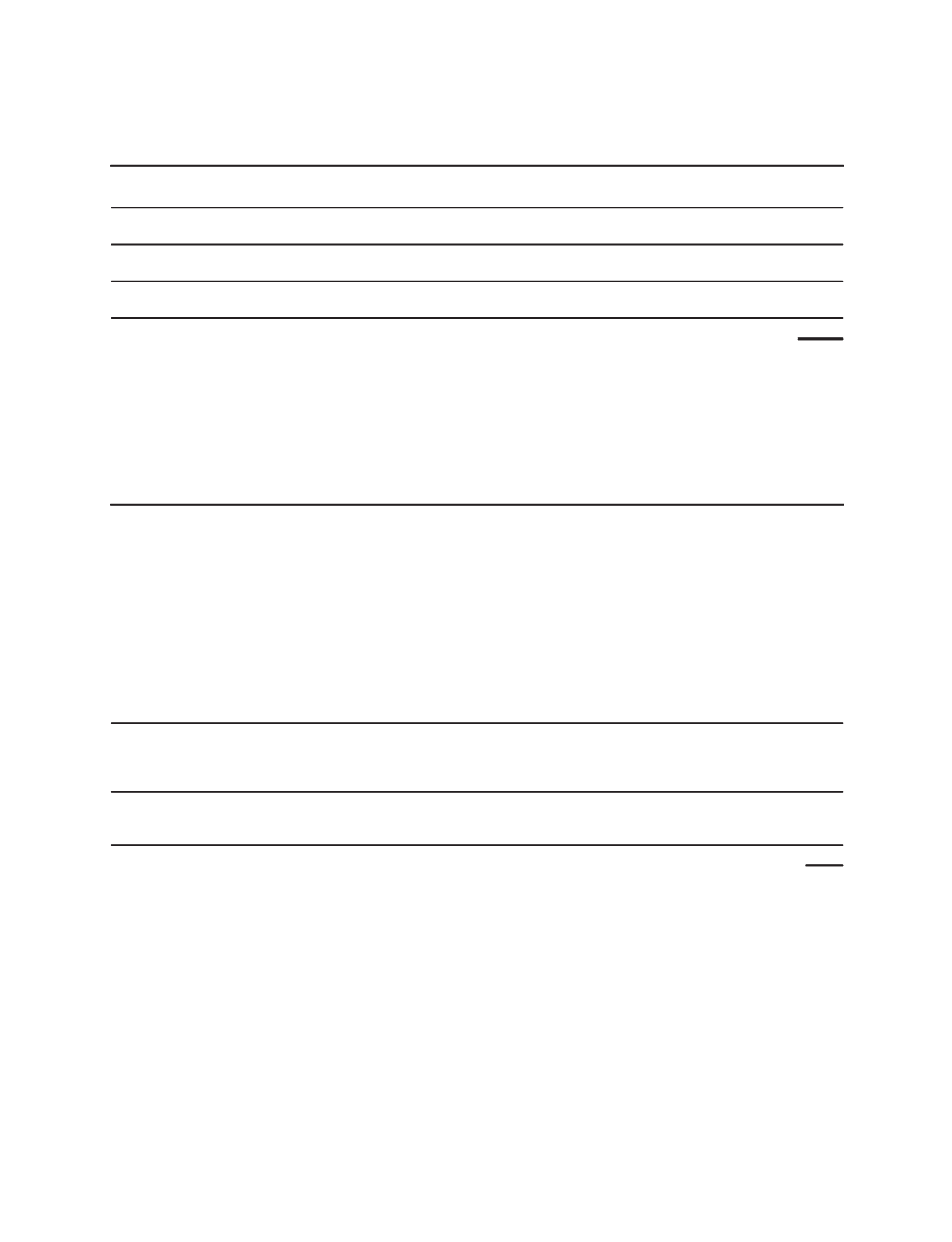

(Stated in millions, except exchange ratio and per share amounts)

Number of shares of Smith common stock outstanding as of the acquisition date

248

Number of Smith unvested restricted stock units outstanding as of the acquisition date

4

252

Multiplied by the exchange ratio

0.6966

Equivalent Schlumberger shares of common stock issued

176

Schlumberger closing stock price on August 27, 2010

$ 55.76

Common stock equity consideration

$ 9,812

Fair value of Schlumberger equivalent stock options issued

$ 16

Total fair value of the consideration transferred

$ 9,828

Certain amounts reflect rounding adjustments

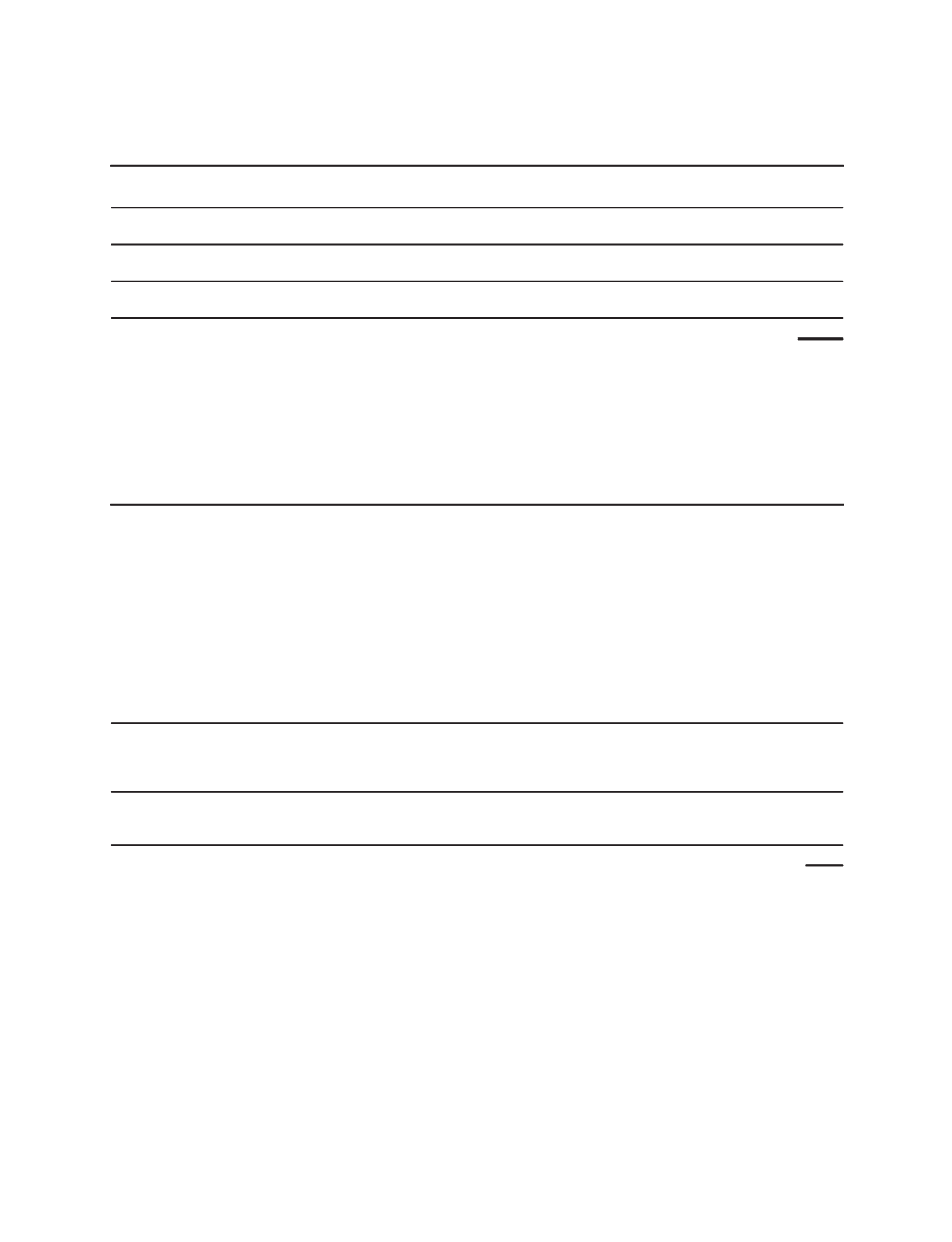

Preliminary Allocation of Consideration Transferred to Net Assets Acquired

The following amounts represent the preliminary estimates of the fair value of identifiable assets acquired and

liabilities assumed in the merger. The final determination of fair value for certain assets and liabilities will be completed

as soon as the information necessary to complete the analysis is obtained. These amounts will be finalized as soon as

possible, but no later than one year from the acquisition date.

(Stated in millions)

Cash

$ 399

Accounts receivable

1,831

Inventory

(1)

2,013

Fixed assets

2,017

Intangible assets:

Tradenames (weighted-average life of 25 years)

1,560

Technology (weighted-average life of 16 years)

1,170

Customer relationships (weighted average life of 23 years)

1,360

Other assets

429

Accounts payable and accrued liabilities

(1,460)

Long-term debt

(2)

(2,141)

Deferred taxes

(3)

(1,936)

Other liabilities

(528)

sub-total

$ 4,714

Less:

Investment in M-I SWACO

(4)

(1,429)

Noncontrolling interests

(111)

Total identifiable net assets

$ 3,174

Gain on investment in M-I SWACO

(4)

(1,238)

Goodwill

(5)

7,892

Total consideration transferred

$ 9,828

(1) Schlumberger recorded an adjustment of approximately $155 million to write-up the acquired inventory to its estimated fair value. Schlumberger’s

cost of revenue reflected this increased valuation as this inventory was sold. Accordingly, Schlumberger’s margins were temporarily reduced in the

initial periods subsequent to the merger.

(2) In connection with the merger, Schlumberger assumed all of the debt obligations of Smith including its long-term fixed rate notes consisting of the

following: $220 million 6.75% Senior Notes due 2011, $300 million 8.625% Senior Notes due 2014, $275 million 6.00% Senior Notes due 2016 and

$700 million 9.75% Senior Notes due 2019. Schlumberger recorded a $417 million adjustment to increase the carrying amount of these notes to

their estimated fair value. This adjustment will be amortized as a reduction of interest expense over the remaining term of the respective

obligations.

(3) In connection with the acquisition accounting, Schlumberger provided deferred taxes related to, among other items, the estimated fair value

adjustments for acquired inventory, intangible assets and assumed debt obligations. Included in the provisions for deferred taxes are amounts

relating to the outside basis difference associated with shares in certain Smith non-US subsidiaries for which no taxes have previously been

provided. Schlumberger expects to reverse the outside basis difference primarily through the reorganization of those subsidiaries as well as

through repatriating earnings in lieu of permanently reinvesting them. In this regard, Schlumberger is in the process of assessing certain factors

that impact the ultimate amount of deferred taxes to be recorded. The amount of deferred taxes recorded will likely be revised after this

assessment is completed. Any revision to the amount of deferred taxes recorded will impact the amount of goodwill recorded.

49

Part II, Item 8