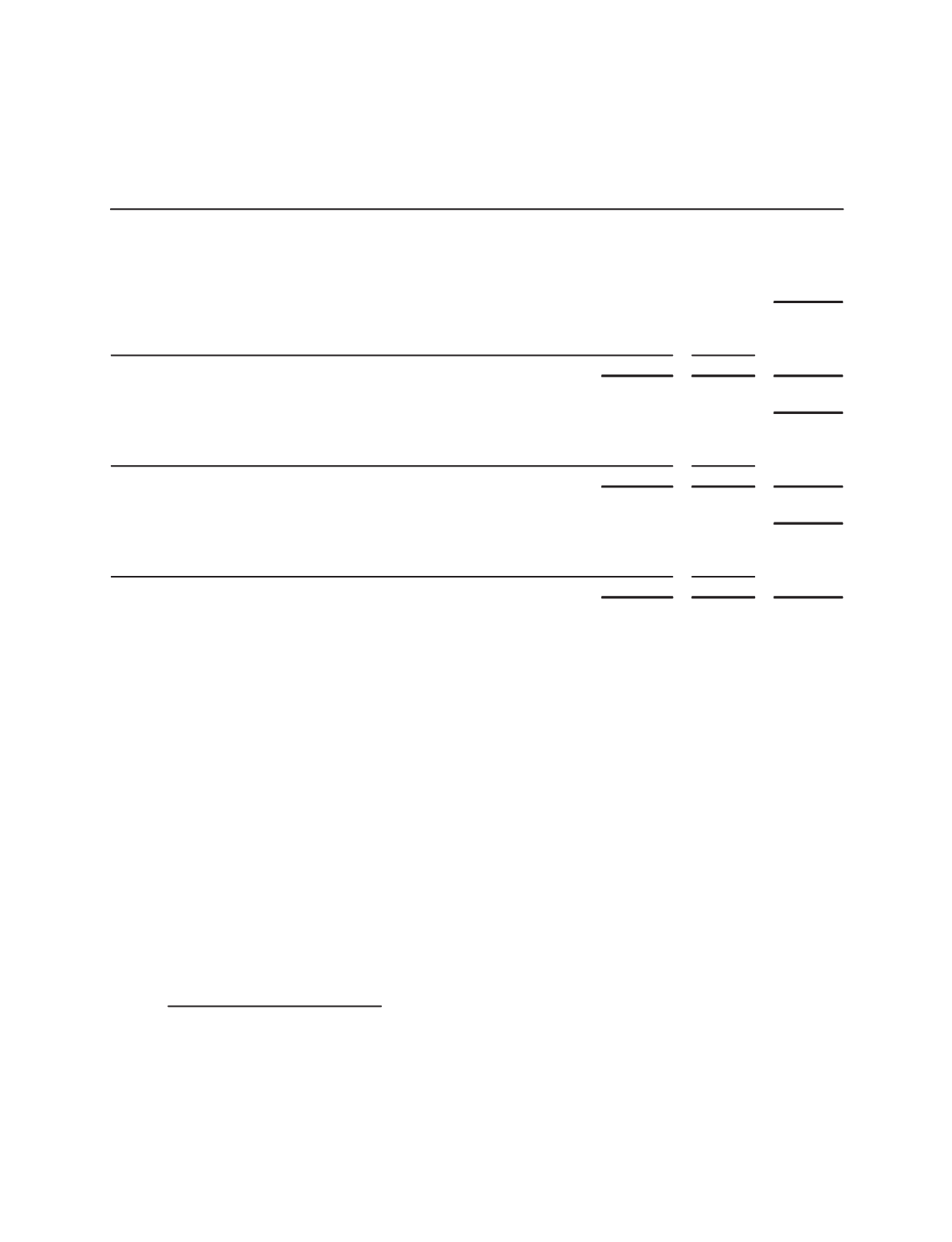

The following is a reconciliation from basic to diluted earnings per share from continuing operations for each of the

last three years:

Schlumberger

Income from

Continuing

Operations

Weighted

Average

Shares

Outstanding

Earnings Per

Share from

Continuing

Operations

(Stated in million except per share amounts)

2010:

Basic

$4,267

1,250

$3.41

Assumed conversion of debentures

3

2

Assumed exercise of stock options

–

9

Unvested restricted stock

–

2

Diluted

$4,270

1,263

$3.38

2009:

Basic

$ 3,156

1,198

$ 2.63

Assumed conversion of debentures

8

8

Assumed exercise of stock options

–

7

Unvested restricted stock

–

1

Diluted

$ 3,164

1,214

$ 2.61

2008:

Basic

$ 5,397

1,196

$ 4.51

Assumed conversion of debentures

12

13

Assumed exercise of stock options

–

13

Unvested restricted stock

–

2

Diluted

$ 5,409

1,224

$ 4.42

Employee stock options to purchase approximately 12.5 million, 17.1 million and 5.8 million shares of common stock

at December 31, 2010, 2009 and 2008, respectively, were outstanding but were not included in the computation of diluted

earnings per share because the option exercise price was greater than the average market price of the common stock,

and therefore, the effect on diluted earnings per share would have been anti-dilutive.

3. Charges and Credits

Schlumberger recorded the following Charges and Credits in continuing operations during 2010, 2009 and 2008:

2010

Fourth quarter of 2010:

k

In connection with Schlumberger’s merger with Smith International, Inc. (“Smith”) (see Note 4 –

Acqui-

sitions

), Schlumberger recorded the following pretax charges: $115 million ($73 million after-tax) relating to

the amortization of purchase accounting adjustments associated with the write-up of acquired inventory to its

estimated fair value, $17 million ($16 million after-tax) of professional and other fees and $16 million

($12 million after-tax) relating to employee benefits.

k

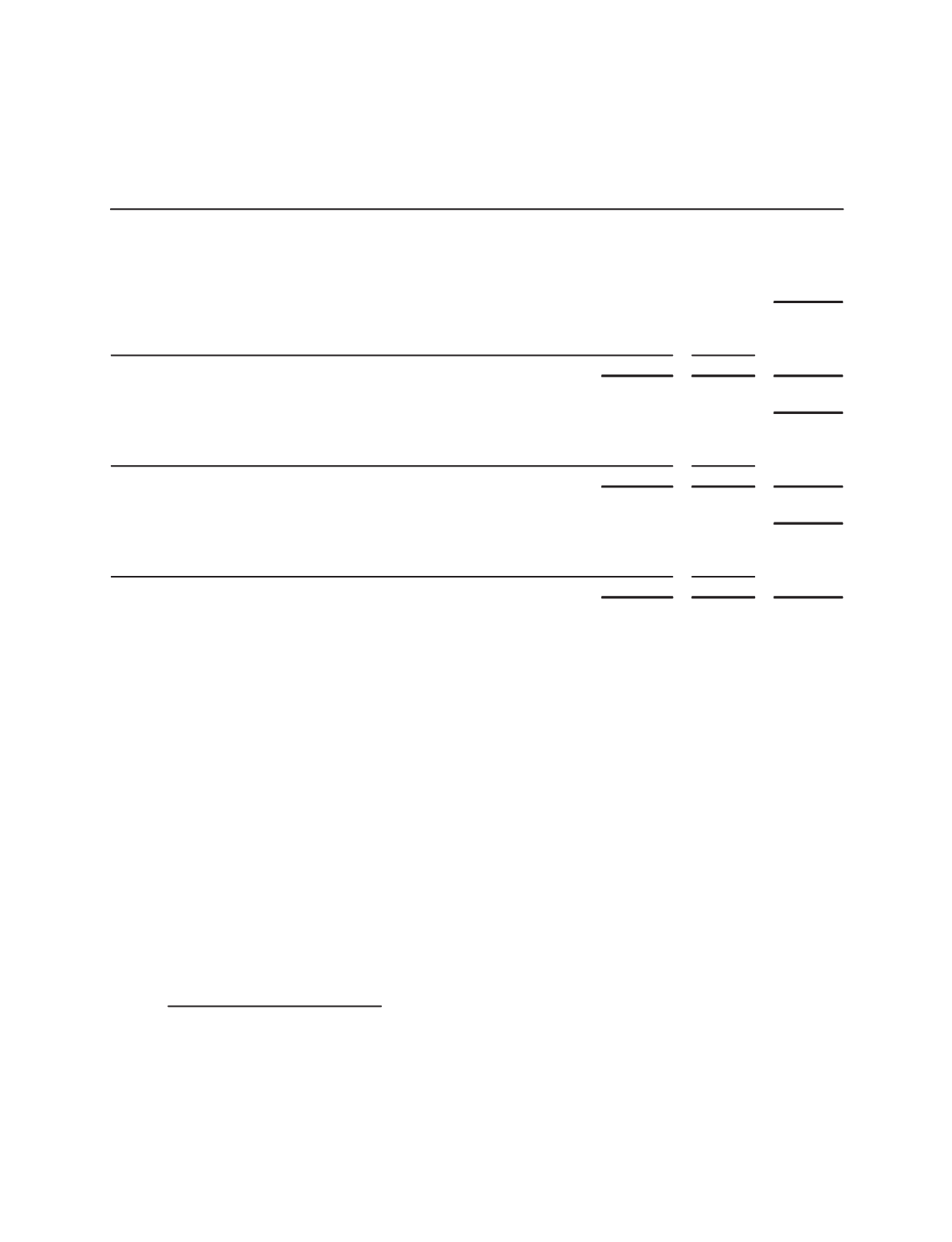

Schlumberger repurchased the following debt:

Carrying

Value

(Stated in millions)

6.50% Notes due 2012

$297

6.75% Senior Notes due 2011

$123

9.75% Senior Notes due 2019

$212

6.00% Senior Notes due 2016

$102

8.625% Senior Notes due 2014

$ 88

45

Part II, Item 8