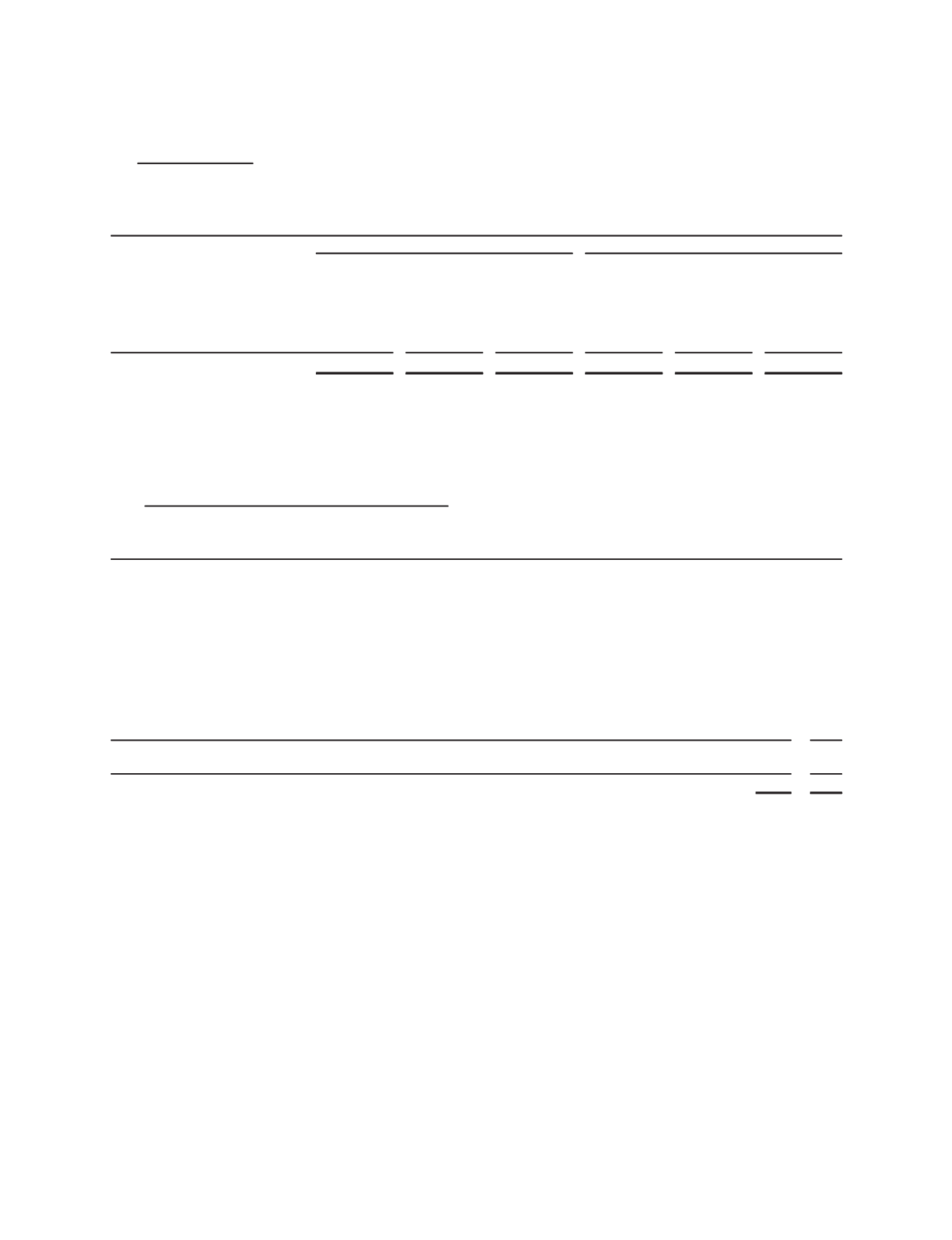

9. Intangible Assets

Intangible assets principally comprise technology/technical know-how, tradenames and customer relationships. At

December 31, the gross book value and accumulated amortization of intangible assets were as follows:

Gross

Book Value

Accumulated

Amortization

Net Book

Value

Gross

Book Value

Accumulated

Amortization

Net Book

Value

2010

2009

(Stated in millions )

Technology/Technical Know-How

$1,846

$215

$1,631

$527

$163

$364

Tradenames

1,678

61

1,617

84

32

52

Customer Relationships

1,963

129

1,834

355

80

275

Other

378

298

80

376

281

95

$5,865

$703

$5,162

$1,342

$556

$786

Amortization expense was $190 million in 2010, $114 million in 2009 and $124 million in 2008.

The weighted average amortization period for all intangible assets is approximately 21 years.

Amortization expense for the subsequent five years is estimated to be as follows: 2011 – $323 million, 2012 –

$316 million, 2013 – $298 million, 2014 – $292 million and 2015 – $277 million.

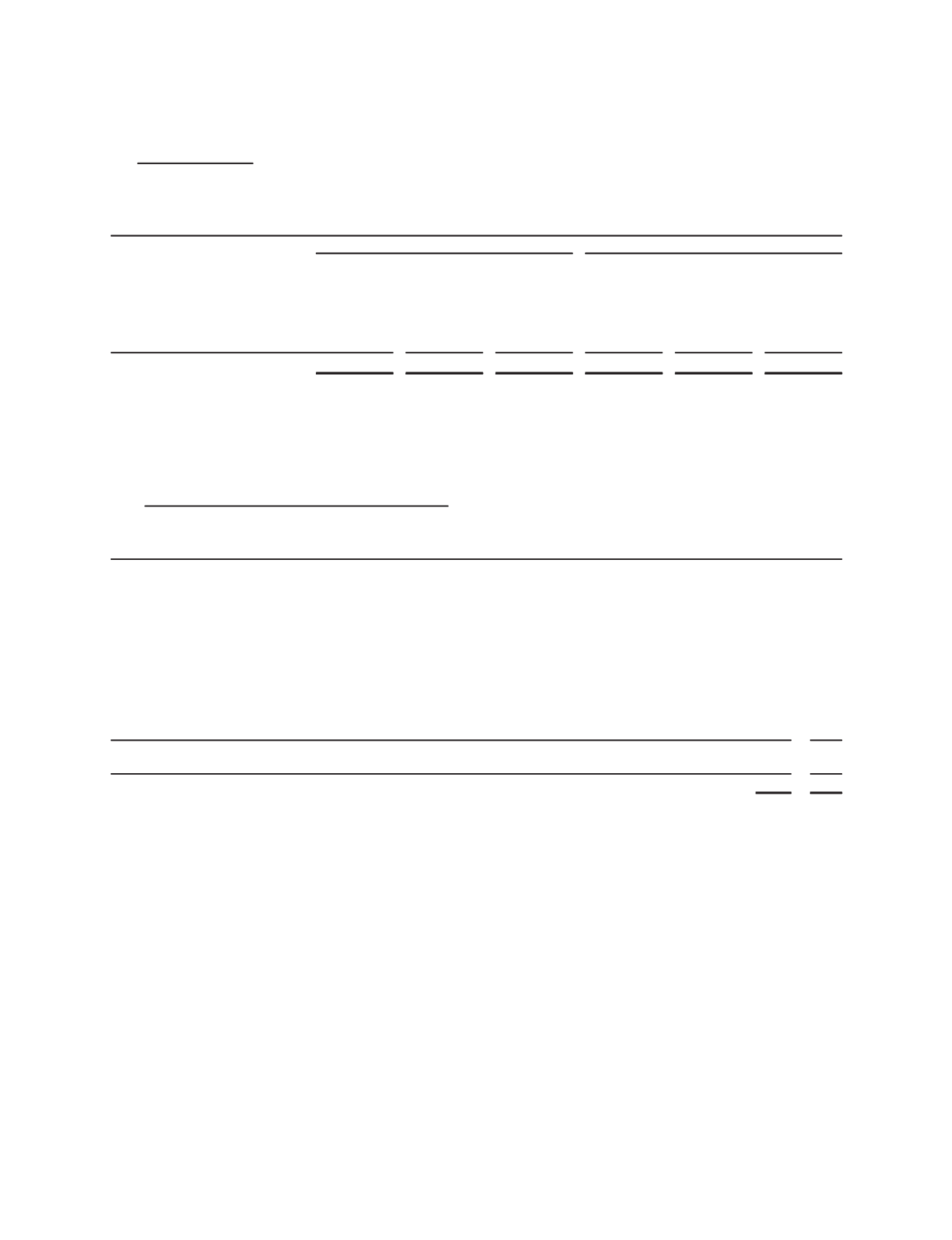

10. Long-term Debt and Debt Facility Agreements

Long-term Debt

consists of the following:

As at December 31,

2010 2009

(Stated in millions)

4.50% Guaranteed Notes due 2014

$1,319

$1,449

2.75% Guranteed Notes due 2015

1,310

–

5.25% Guaranteed Notes due 2013

659

727

9.75% Senior Notes due 2019

(1)

776

–

3.00% Guaranteed Notes due 2013

450

449

8.625% Senior Notes due 2014

(1)

272

–

6.00% Senior Notes due 2016

(1)

218

–

6.5% Notes due 2012

–

649

5.875% Guaranteed Bonds due 2011

–

362

Commercial paper borrowings

367

358

Other variable rate debt

133

360

5,504

4,354

Fair value adjustment – hedging

13

1

$5,517

$4,355

(1) Represents long-term fixed rate debt obligations assumed in connection with the merger of Smith, net of amounts repurchased subsequent to the

closing of the transaction.

The fair value adjustment presented above represents changes in the fair value of the portion of Schlumberger’s fixed

rate debt that is hedged through the use of interest rate swaps.

During the third and fourth quarters of 2010, Schlumberger repurchased all of its $650 million 6.50% Notes due 2012.

During the first quarter of 2009, Schlumberger entered into a

A

3.0 billion Euro Medium Term Note program. This

program provides for the issuance of various types of debt instruments such as fixed or floating rate notes in euro, US

dollar or other currencies.

Schlumberger issued

A

1.0 billion 2.75% Guaranteed Notes due 2015 in the fourth quarter of 2010 under this program.

Schlumberger entered into agreements to swap these euro notes for US dollars on the date of issue until maturity,

effectively making this a US dollar denominated debt on which Schlumberger will pay interest in US dollars at a rate of

2.56%. Schlumberger also issued

A

1.0 billion 4.50% Guaranteed Notes due 2014 in the first quarter of 2009 under this

program. Schlumberger entered into agreements to swap these euro notes for US dollars on the date of issue until

maturity, effectively making this a US dollar denominated debt on which Schlumberger will pay interest in US dollars at a

rate of 4.95%.

During the third quarter of 2009, Schlumberger issued $450 million of 3.00% Guaranteed Notes due 2013.

53

Part II, Item 8