6

5

Barclays CEO Energy-Power Conference

Paal Kibsgaard

Now let’s turn to the financials. In terms of our market cap, today we are bigger than the

sum of our three main competitors by a wide margin.

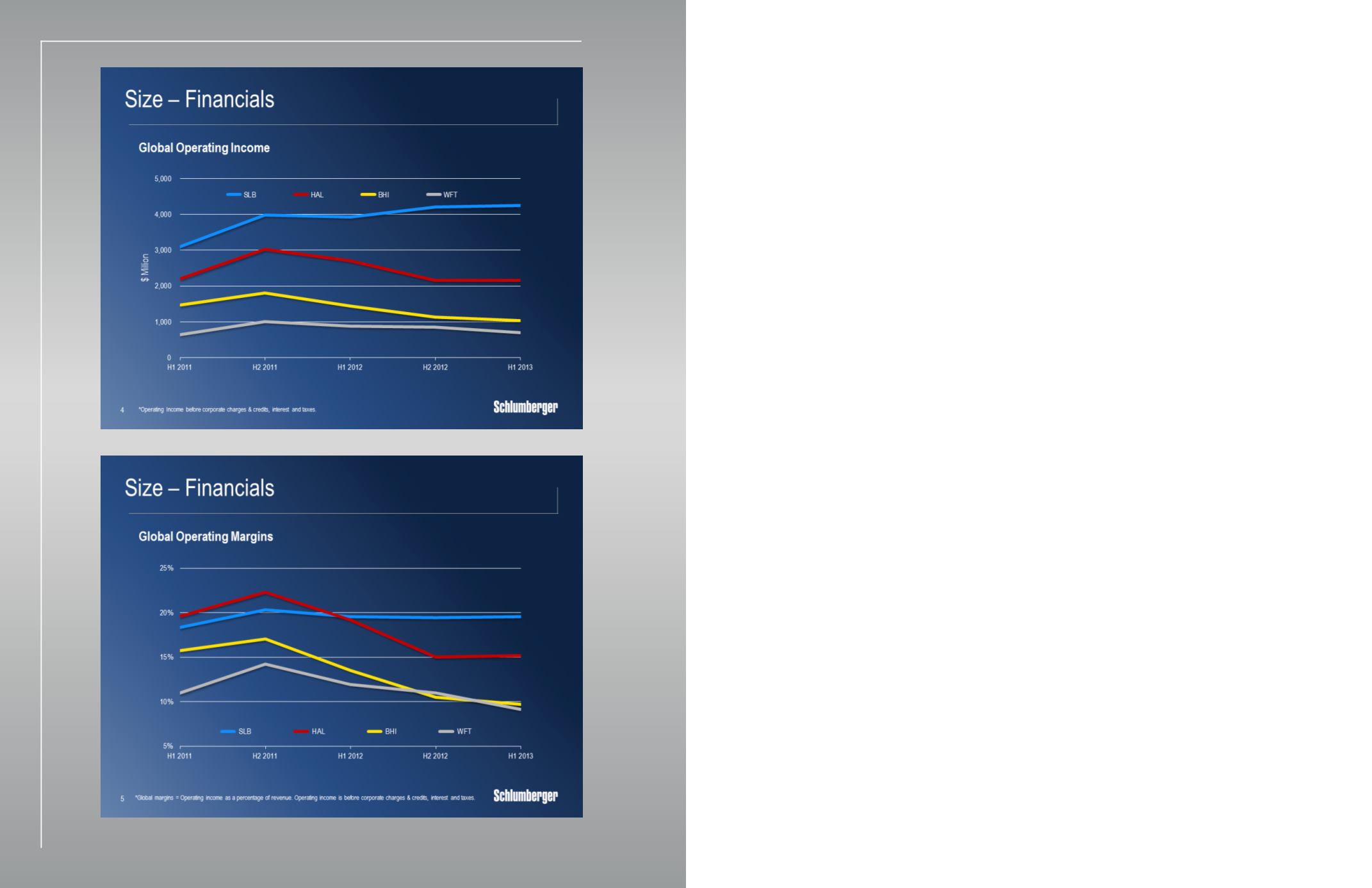

In terms of global operating income, we have progressed well over the past few years,

achieving 37% growth between H1 2011 and H1 2013. During the same period, operating

income for the other three global oilfield services companies combined has contracted.

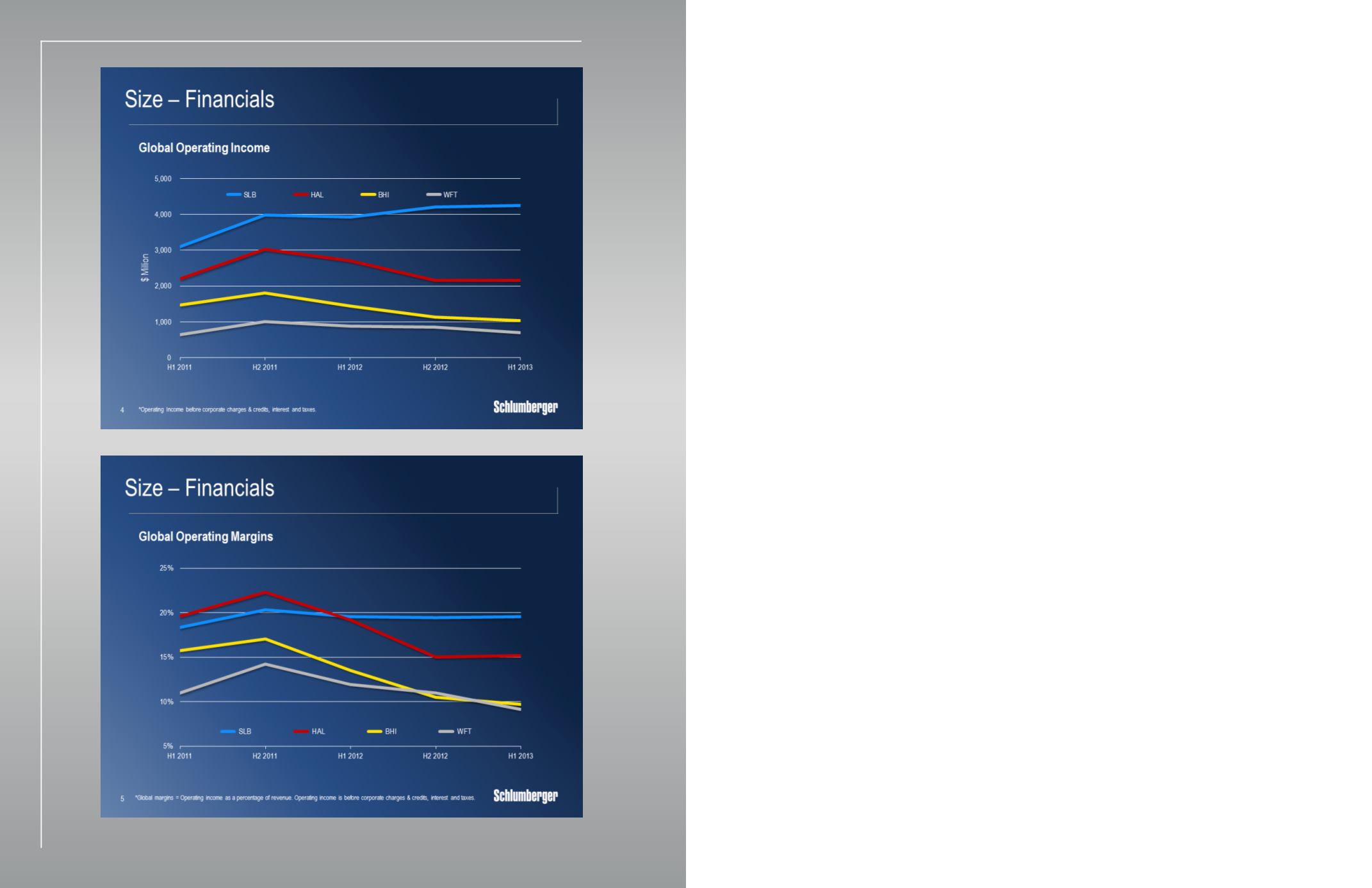

This outperformance is driven by the quality of our revenue streams and by the strength of

our operational execution. Profitability remains a core value for us and through technology

and strategic bidding we continue to command industry-leading operating margins.

In 2011 our global margin lead versus the average of our three main competitors was

270 basis points. Focused execution in a challenging environment has now enabled us to

extend our lead to more than 800 basis points.

This number is driven by the international market, where our margin lead is now around

10 percentage points, but also by our resilient margins in North America, where we have

also taken the lead during the past 12 months.