Payment Services —

growth and expansion for a global era

From world-wide credit and debit card processing to electronic check and gift card issuing... to corporate travel, purchasing and fleet and aviation fuel payment systems... to new healthcare payment solutions, our Payment Services division sets new standards in convenience, reliability and innovation. Customers know our services will grow with them, as we expand capabilities and service to meet current and future needs. Through acquisitions and continued investment in existing operations, our payments capabilities have grown substantially at home and abroad.

In Fall 2008, U.S. Bank, as the number one Visa Gift Card issuer in the United States, issued our 25 millionth Visa Gift Card.

Disciplined investment strategies

"Over the years, the professionals in Wealth Management have had a reputation for making prudent investment decisions on behalf of their clients, like me. Some people might have called that approach overly cautious, but I call it taking a long-term view and looking out for my best interests."

Wealth Management

An important client benefit of Wealth Management's expanded service model is having an entire team of dedicated Personal Trust Specialists available to address any needs or questions.

Knowledge and responsiveness

"My U.S. Bank commercial team knows me, knows my business, knows what I'm going through right now and is on my side every step of the way."

In 2008, U.S. Bank continued its commitment to invest in the Company for the future.

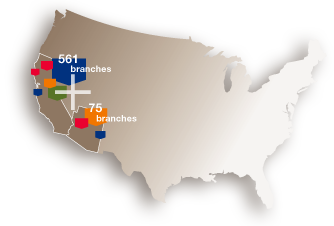

Three advantageous in-market acquisitions during the year expanded our presence in key markets of California. In June we completed the acquisition of Mellon 1st Business Bank, acquiring $3.4 billion in assets and expanding our middle market commercial lending capabilities in those markets. Then in November, we acquired the majority of the banking operations of Downey Savings and Loan and PFF Bank & Trust from the FDIC, with built-in conditions that limit credit losses. The transactions added 213 new banking locations, primarily in California, and we now have the fourth-largest branch network in the state of California.

With the acquisition of Mellon 1st Business Bank, Downey Savings and Loan, and PFF Bank & Trust, we continue to widen our distribution network and branch offices in the growing California and Arizona markets.

In-store branch network largest in nation

In another branch expansion initiative, in September we assumed the leases of 49 full-service in-store banking offices in Smith's Food and Drug Stores, a division of the Kroger Co., in Nevada and Utah, two targeted growth markets for us. When all are opened, by the end of March 2009, U.S. Bank will have the nation's largest network of in-store and on-site branches with over 700 of these offices, giving us access to more than 10 million prospects weekly. More locations are scheduled to open later in 2009.

Other expansions included the 2008 acquisition of Southern DataComm, a payments software and service provider, by our wholly owned Elavon (formerly NOVA Information Systems) payments subsidiary. The addition gives U.S. Bancorp true end-to-end payments capability in our international payments processing.

Other U.S. Bancorp lines of business expanded, too. In Wholesale Banking we expanded our penetration of Fortune 500 customers, and we saw continued growth in Treasury Management services with cutting edge product introductions, including further enhancements to our proprietary on-line management tool, SinglePoint. Wholesale rate of growth in Community Banking markets doubled in the fourth quarter as customers continued a "flight to quality," seeking stability and soundness in their banking partner. We also expanded our National Corporate Banking services in Chicago.

U.S. Bank SBA services expand to Mid-Atlantic

In February 2008, U.S. Bank opened its first office on the East Coast in Wilmington, Delaware, providing Small Business Administration (SBA) guaranteed loans in six Mid-Atlantic states, plus Washington, D.C. The new presence expands our sizable SBA business; U.S. Bank is the nation's third-largest SBA lender among banks by volume and operates 24 designated SBA business center offices nationwide. We provided a record $504 million in SBA loans in 2008.

In spite of turmoil in the housing markets, our Mortgage Banking business flourished in 2008, again reflecting the flight to quality. We remain among the largest mortgage lenders in the nation and among the largest mortgage servicers. In addition, our customer satisfaction survey scores showed that 98 percent would recommend U.S. Bank Home Mortgage to others.

The expansion of our signature PowerBanking branch service model continued in 2008 with new crucial "stronghold" markets designated PowerBank markets with service enhancements for branch customers. In 2008, the Twin Cities, Portland and Cincinnati joined the 2007 PowerBank markets of Denver and St. Louis. When we launch a PowerBank market, we refurbish offices, add branch staff, upgrade ATMs, increase marketing support, extend banking hours and install such amenities as coin counters and other customer conveniences. Early PowerBank markets have already seen market share increases and higher customer satisfaction survey scores.

Expanded marketing and advertising accompanies the conversion of a U.S. Bank market to a PowerBank market. TV commercials and newspaper advertisements communicate longer hours and other PowerBank benefits.

Wealth Management expands service delivery

During 2008, our Wealth Management line of business became a more integrated and coordinated group to fully capture the significant opportunities offered by the impending retirement of baby boomers and the growing number of high net worth families. Wealth Management expanded and enhanced its service model during 2008 to provide a unified team approach to meeting different clients' financial needs and to heighten the customer experience overall. Four key client segments were identified and customized service approaches created for each segment, based on the common needs and service preferences of each. Each segment model is designed to help serve clients better, capture more business through customer trust and satisfaction and capitalize on market opportunities. Response times have been shortened, service hours lengthened and new teams of experts formed. Further refinements to the new business model continue throughout 2009.