Lynne Gordon, M.F.A., Cincinnati artist, is known for her sculptured fine jewelry in precious metals, drawings and paintings. She is also an architecture consultant, supporter of countless fine art and civic endeavors and has been a U.S. Bancorp client and shareholder for more than 40 years. "The management of U.S. Bancorp has always impressed me," says Ms. Gordon. "A long history of consistent earnings and conservative policies has increased the value of my investment in this quality company."

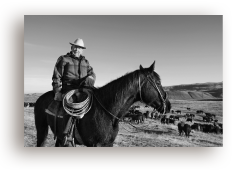

Harry Bettis, Idaho cattle rancher and generous philanthropist, knows the value of a long-term investment, and he's been a U.S. Bancorp shareholder for more than 50 years. "I appreciate the prudent way they run this bank," says Mr. Bettis. "Steady earnings and industry leadership over the years have been an important reason I've stayed with U.S. Bancorp stock. They manage the company for their shareholders, as well as for their customers."

Our business diversification, strong balance sheet and disciplined approach to credit and risk management proved beneficial in 2008, but could not completely shield our Company from unprecedented uncertainty in the financial markets and a weakening economy.

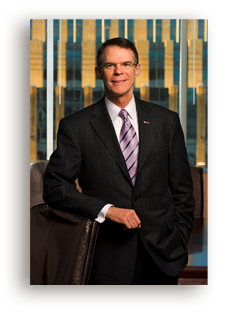

Fellow Shareholders:

2008 was an extremely challenging, and in many ways historic year for all companies in the financial services industry — here and around the world. While I am very disappointed that the value of our shareholders' investment in our Company declined during 2008, I am proud that our business model and disciplined risk management allowed U.S. Bancorp to fare better than many others in the industry. Our company continued to make a profit, to generate capital, to increase lending, and to accept and safeguard deposits throughout the year. We reported key financial results at or near the top of our peer group of banks, including industry-leading returns on average assets and average common equity. We built new and deeper customer relationships, expanded our franchise, and created innovative new products and services. In other words, we continued to create the catalysts for long-term growth in core operating earnings. In addition, we gave back to our communities in both money and time, engaged, honored and rewarded our employees and focused on environmental sustainability. In fact, our recent focus on employee engagement is proving to be perfectly timed, as their support and commitment are of utmost importance as we navigate this difficult environment. These are all reasons to be pleased and proud of our Company.

Flight to quality

The Company continued to benefit from the "flight to quality" as customers sought banks with strong capital and the ability to provide them with the financial products and services they need during this period of economic uncertainty.

Commercial and retail average loans increased; deposits increased; net interest income increased, and the net interest margin widened. Regulatory capital levels were strong, our capital generation rate was the highest among our peers, and we are serving a million more customers than a year ago. Our core business results in 2008 were solid.

And yet, we saw an overall decline in earnings, principally due to significantly higher credit costs and market-related write-downs as the economy deteriorated throughout 2008. Given the more conservative risk profile of U.S. Bancorp's loan portfolio, the Company's overall credit quality was relatively better than its peers. The cost of credit, however, still had a sizeable impact on 2008 results. The provision for credit losses was higher in 2008 than 2007 by $2,304 million. This unfavorable change refl ected both an increase in net-charge-offs year-over-year of $1,027 million, as well as a $1,277 million provision expense to build the allowance for credit losses. Nonperforming assets ended the year at $2,624 million, compared with $690 million at December 31, 2007. This increase refl ected the continuing stress in the residential real estate-related industries and portfolios and the impact of a weakening economy on other consumer and commercial sectors, as well as recent acquisitions. Given the current economic environment, we expect the upward trend in nonperforming assets and net charge-offs, along with additional market-related losses, will continue in 2009, which makes it imperative that we maintain the strength of our balance sheet by adequately providing for future loan losses — and be assured we will. Further, and more importantly, the higher cost of credit was, and will be, more than covered by the Company's strong core operating earnings.

Relative to the rest of the industry, U.S. Bancorp performed very well in 2008. Still, the impact of higher credit costs and market-related charges led to overall 2008 financial results that were disappointing to both me and our managing team.

Capital Purchase Program participation

In November 2008, we announced that U.S. Bancorp would participate in the U.S. Treasury Capital Purchase Program. Subsequently, we issued $6.6 billion of preferred stock and related warrants to the U.S. Treasury.

The decision to participate in the program was made after a thoughtful and detailed evaluation of the impact that the program would have on our Company's ability to serve our customers, support the communities in which we operate, create long-term value for our shareholders and, overall, assist the U.S. Treasury in its quest to stimulate the United States economy. Although participation in the program was not necessary from a capital adequacy perspective, as our capital position was strong, it was determined to be financially beneficial and provided U.S. Bancorp with the on-going capacity for additional loan growth and for funding growth initiatives. The financial benefits, including solidifying the Company's already strong capital position and the ability to compete more effectively with other banks that had already announced their participation in the program, were compelling.

Strengthening western markets

On November 21, 2008, we announced that our Company's lead bank, U.S. Bank National Association, acquired the banking operations of two separate California financial institutions from the Federal Deposit Insurance Corporation; Downey Savings & Loan Association, F.A., and PFF Bank & Trust. These transactions followed the Company's acquisition of Mellon 1st Business Bank in Los Angeles and Orange County, which was announced in March 2008. These three acquisitions strengthened our geographic footprint in the attractive Western region of our franchise. We believe that acquisitions like Downey Savings & Loan, PFF Bank & Trust and Mellon 1st Business Bank are an effi cient means of leveraging our strong capital base and investing in our Company. While adding over 200 new branch locations in total, these three acquisitions served to elevate us to the position of the 4th largest banking system in California.

As part of the Downey Savings & Loan and PFF Bank & Trust acquisitions, the Company agreed to modify the terms of certain residential mortgage loans in accordance with the FDIC Mortgage Loan Modification Program. This program will allow us to work closely with approximately 35,000 homeowners in an effort to provide solutions for these potentially troubled borrowers to stay in their homes. We have had a similar loan modifi cation program in place at U.S. Bancorp since 2007 and have been very satisfi ed with the results. We believe that helping to keep borrowers in their homes is one of the key elements necessary to the eventual stabilization of housing prices and economic recovery.

Baker joins board of directors

In February 2008, Douglas M. Baker, Jr. was appointed to its board of directors. Mr. Baker, 49, is the chairman, president and chief executive offi cer of Ecolab Inc. Based in St. Paul, Minnesota, Ecolab is a provider of cleaning, sanitizing, food safety and infection control products and services. Doug brings extensive experience and insight to the board and his leadership abilities provide a valuable contribution.

Looking ahead

The disruption and uncertainty in the financial markets continues. And all indications are that the challenges will remain for most of 2009. The size, scope and pace of change, government intervention and other activities in the financial sector refl ect the very historic nature of this time.

I believe that now, more than ever, the conservative policies, essential values and integrity of this Company will benefit our shareholders, customers, communities and employees. I am extremely proud of our employees. They have not been distracted by industry turmoil; they have worked hard, achieved goals, generated revenue, served customers and ensured that U.S. Bancorp is always "open for business."

Throughout this report, you can read more about their efforts and how U.S. Bancorp continues to invest in the future of this Company, connect with customers, engage our employees and grow our business.

We are managing through these critical times, but are also operating with a clear view of the long-term future of this Company and our fundamental goal to deliver earnings and returns on your investment that are consistent, predictable and repeatable. I am more confi dent than ever that our future is bright and the special qualities that make U.S. Bancorp distinctive among its peers will become more evident in the coming year.

Sincerely,

Richard K. Davis

Chairman, President and

Chief Executive Officer

March 2, 2009