Delivering breakthrough financial performance

Our success in the marketplace has been matched by our disciplined financial management, resulting in record profits, cash generation, and a solid balance sheet in 2009.

Throughout the year, we took a number of steps to control our expenses and leverage our existing organization to enable us to continue our strong momentum, build our business, and deliver profitable growth for our shareholders. For example, SG&A expenses were reduced from 55% of revenues in 2008 to 50% in 2009. We saw significant improvement in U.S. sales force productivity in 2009 as we benefited from additional clinical case support provided by our new plaque excision specialists and additional sales training. We also believe we are positioned to effectively compete in a more challenging future healthcare market with peripheral vascular and neurovascular procedures that are less vulnerable to the macro-economic environment.

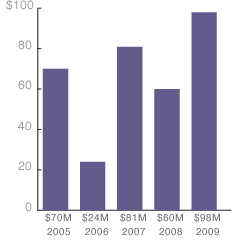

We generated approximately $70 million of cash flow from operations during 2009 and exited the year with $98 million of cash and cash equivalents. This strong cash generation was critical to our ability to pursue activities such as the acquisition of Chestnut, and it will provide us flexibility in achieving our strategic goals.

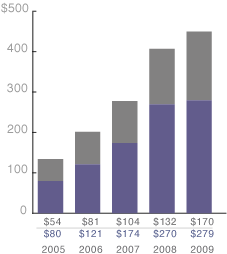

(in millions)

= Peripheral Vascular

= Neurovascular

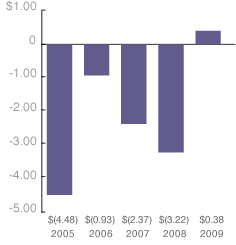

per Diluted Share/Unit

(in millions)