"With a solid 2013 behind us, we approach 2014

aware of the challenges but eager to embrace

the remarkable opportunities presented by the

new programs."

Jay M. Gellert

President and Chief Executive Officer

TO OUR STOCKHOLDERS:We are pleased to report to you on a successful 2013 for your company. In 2013, we achieved the goals we laid out to you at the beginning of the year. We:

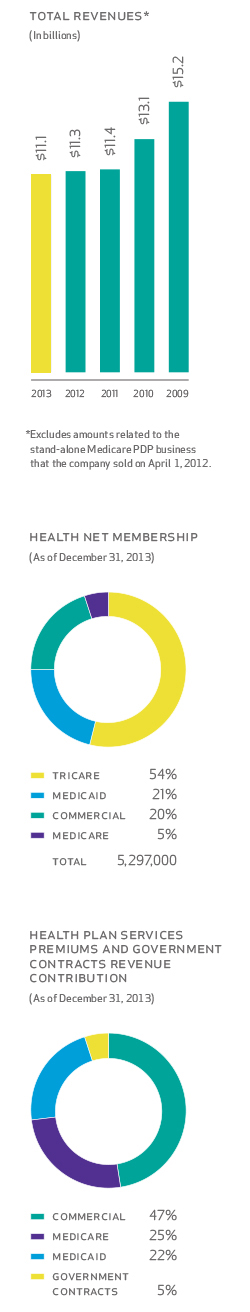

In addition to these key accomplishments, we had to address the profound changes sweeping across the entire health care industry due to health care reform and persistent economic pressures. These changes meant that we had to spend considerable time, effort and resources in 2013 preparing for the new programs going into effect in 2014 and the future. Therefore, this letter is as much about the future as it is about 2013. In fact, much of our effort in 2013 addressed the opportunities and challenges presented by health care reform. It has the potential to significantly reshape Health Net in the years ahead, especially in our government-sponsored health care businesses. FINANCIAL HIGHLIGHTSIn 2013, Health Net achieved GAAP earnings per diluted share of $2.12, an increase of 44.2 percent compared with 2012. For the combined Western Region Operations and Government Contracts segments, earnings per diluted share were $2.21, more than double the comparable amount in 2012. Revenues declined by less than 1 percent in 2013 compared with 2012, primarily due to lower enrollment in our commercial health plans. In 2013, we focused on improving our commercial book of business. As part of this strategy, we had to incur membership losses, primarily in our large group business. These were necessary in order to achieve our margin goals. As evidence of our success, the commercial medical care ratio (MCR) improved from 2012 to 2013 by 320 basis points and the gross margin per member per month (PMPM) increased 32.4 percent over the same period. These achievements also were the result of our tailored network product strategy and disciplined pricing across all lines of our commercial business. The Medicaid MCR in 2013 also improved substantially compared with 2012. Most of this improvement was the result of a number of favorable rate actions, the reinstatement of California Medicaid premium taxes and our innovative state settlement agreement we signed in late 2012 with California’s Department of Health Care Services. It is clear from these developments that the state settlement agreement is working as intended, strengthening our state health programs business. In 2013, we met key financial performance goals with no recurrence of adverse prior year reserve development. Cash flows from operations was $95.8 million, less than our goal of operating cash flow equal to net income plus depreciation and amortization. This shortfall was primarily due to timing related to certain Medicare and Medicaid payments. Overall, our cash position is sound. Consistent with our expectations, we ended 2013 with approximately $209 million in cash and investments at the parent and a low 23.5 percent debt-to-total capital ratio. Thanks to our strong cash position, we purchased 2.7 million shares of our common stock in 2013 for approximately $70 million. We continue to believe that purchasing Health Net stock represents a prudent use of our excess capital. Our general and administrative expenses were higher in 2013 than in 2012, as expected, driven primarily by investments we made to prepare for the new opportunities presented as a result of health care reform. We devoted these resources to prepare for the new individual insurance exchanges, Medicaid expansion and the dual eligibles demonstration pilots in California. HEALTH CARE REFORMIndividual ExchangesThe first of the three key areas of health care reform affecting Health Net is the individual health insurance exchanges. These insurance exchanges allow individuals to purchase health insurance online. We have actively embraced the concept. We believe it is an opportunity for us to more deeply penetrate the individual market, an area that historically has not been one of our strengths. Under the terms of the Affordable Care Act (ACA), each state has the option of running its own exchange, having the federal government run the exchange or having a joint federal/state-run exchange. In California, the state decided to run its own exchange. Known as Covered California, it is, in our view, already a leader among state-run exchanges. Much of our effort in 2013 addressed the opportunities and challenges presented by health care reform. It has the potential to significantly reshape Health Net in the years ahead, especially in our government-sponsored health care businesses.We also participate in the federally-run Arizona exchange and the state-run exchange in Oregon. We are focusing our efforts—particularly in California—around our expertise in tailored network HMO products. We built our individual exchange products with our small group, tailored network HMO products as a guide. In so doing, we are able to offer individual exchange customers more affordable products that allow access to providers dedicated to quality, access and cost efficiency. Each exchange has four metal tiers of products—Platinum, Gold, Silver and Bronze. Our exchange strategy has focused on the Silver products that offer comprehensive coverage to the exchange population eligible for subsidies. We believe these products provide the best route to affordability through the use of our tailored network HMO strategy. We expect these products will generate a significant concentration of market share for Health Net. As of March 31, 2014, we enrolled approximately 247,000 new members through the individual exchanges. These members enrolled primarily in the Silver tailored networks, in accordance with our strategy. Medicaid ExpansionMedicaid is the federal/state health care program for those with low incomes. We have been active in Medi-Cal, California’s Medicaid program, for many years. A notable development in 2013 was our entry into the Arizona Medicaid managed care program. Beginning October 1, 2013, we began enrolling Medicaid members in Maricopa County, the county that includes Phoenix. Prior to the ACA, to be eligible for Medicaid, a person’s income had to be at or below 100 percent of the Federal Poverty Level (FPL). Under the ACA, eligibility has been expanded to those whose income is below 133 percent of the FPL. As of February 28, 2014, we had enrolled approximately 160,000 new members in the expansion programs in California and Arizona, collectively. The Coordinated Care InitiativeImplementation of California’s Coordinated Care Initiative, or CCI, began in 2014. This initiative includes the dual eligibles demonstrations in Los Angeles and San Diego counties, among others, and the enrollment of Medi-Cal beneficiaries (including dual eligibles) into managed care for Medi-Cal benefits, including Long-Term Services and Supports (LTSS), such as skilled nursing and home- and community-based services. Dual eligibles are those Medicare beneficiaries who, because of their financial status, also qualify for Medicaid. Many of these beneficiaries have chronic health conditions and have not benefited from modern managed care techniques. Because of this, many states and the federal government believe there are opportunities to improve care coordination and lower cost growth by moving these beneficiaries into managed care plans. We spent approximately $14 million in 2013 preparing for the duals demonstrations. These are complex programs combining Medicare, Medi-Cal, traditional medical services, in-home services and long-term care. After much work, we finalized our duals contract in January 2014. We began enrolling members in April 2014, and the enrollment process is scheduled to last well into 2015. Beneficiaries who decide to opt out of the Medicare portion of the demonstration will still be enrolled in managed care for all Medi-Cal benefits, including LTSS. These beneficiaries will be reported as part of our Medicaid membership. Los Angeles County is of special importance to the demonstrations. There are approximately 370,000 dual eligibles in the county, representing approximately 8 percent of the total dual eligibles in the United States. For the purpose of the demonstration, the Centers for Medicare & Medicaid Services has set an enrollment cap of 200,000 for Los Angeles County. We are excited by the opportunity to help improve health care for the neediest populations and meet the needs of the state of California and the federal government. It is important to note that the financial results of our participation in Medicaid expansion and the duals demonstrations are covered by our state settlement agreement. medicare advantage and government contractsOur Medicare Advantage plans did well in 2013. Our Medicare Advantage enrollment increased by 4.3 percent in 2013 compared with 2012. Because of persistent rate pressure, the MCR, as expected, rose by 130 basis points in 2013 compared with 2012. We are focusing our efforts on southern California counties where we believe we have our best competitive positioning and our strongest provider relationships. Our Government Contracts segment, which includes our TRICARE North region and Military and Family Life Counseling contracts with the Department of Defense, performed as expected in 2013. This segment has produced stable and predictable results, and we believe this will continue in the future. conclusionWith a solid 2013 behind us, we approach 2014 aware of the challenges but eager to embrace the remarkable opportunities presented by the new programs. We believe that our participation in these new programs will help reshape Health Net into an even more diversified company with greater revenue and earnings balance among our health plan businesses. We see the opportunities arising from the exchanges as validation of our tailored network strategy and the way for us to sustain and grow our overall commercial franchise in the future. We look forward to meeting these new challenges and, in the process, improving the health and wellness of our current and expected new members. Thank you. April 30, 2014 |

FINANCIAL HIGHLIGHTS

|

|