CORPORATE GOVERNANCEThe Board of Directors is committed to being a leader in corporate governance. The Board believes that good governance enhances shareholder value and goes beyond simply complying with legal requirements. It means taking an integrated and collaborative approach to governance that promotes integrity, accountability, transparency, and the highest ethical standards. To that end, the Board has adopted a number of policies and practices to ensure effective governance, including our Governance Principles, which provide a framework for oversight of Raytheon’s governance. See “Governance Documents” on page 22 below for information on obtaining copies of the Governance Principles and related materials. BOARD LEADERSHIP STRUCTUREThe Board believes the most effective leadership structure for Raytheon at this time is one with a combined Chairman and CEO, coupled with an independent Lead Director. Having a combined Chairman and CEO promotes a cohesive vision and strategy for Raytheon and enhances our ability to execute effectively. We have found that this structure is particularly advantageous for our international business because many of our foreign government customers value unified leadership and a single ultimate executive decision-maker. The Board created the Lead Director role as an integral part of a leadership structure that promotes strong, independent oversight of Raytheon’s management and affairs. The Lead Director, who must be independent, has the following primary responsibilities:

Working with the Chairman

to develop and approve

Board agendas and

meeting schedules;

Advising the Chairman as to

the quality, quantity and

timeliness of the information

sent to the Board;

Developing agendas for and

chairing executive sessions of

the Board (in which the

independent directors meet

without management); and

Acting as a liaison between

the independent directors and

the Chairman and CEO.

Vernon E. Clark has served as the Lead Director since May 2013. The Board annually reviews the role and function of the Lead Director. In March 2016, upon the recommendation of the Governance and Nominating Committee, the Board determined that the Lead Director should serve an initial two-year term, and may serve up to three additional one-year terms as determined by the Board. The Board believes restricting the Lead Director’s time in that role promotes leadership refreshment. BOARD ROLEOur Board is responsible for overseeing the management of the business and affairs of Raytheon. Among the Board’s most significant responsibilities is the oversight of Raytheon’s long-term strategy and management of risk, and the selection of the CEO and planning for the CEO’s succession. THE BOARD’S ROLE IN STRATEGY The Board recognizes the importance of ensuring that our overall business strategy is designed to create long-term value for Raytheon shareholders. As a result, the Board maintains an active oversight role in formulating, planning and implementing Raytheon’s strategy. We have a robust annual strategic planning process during which elements of our business, financial, and investor plans and strategies and near- and long-term initiatives are developed and reviewed. This annual process culminates with a full-day Board session to review Raytheon’s overall strategy with our Senior Leadership Team and other executives. In addition to our business strategy, the Board reviews Raytheon’s 5-year financial plan, which serves as the basis for the Annual Operating Plan for the upcoming year. The Board regularly considers the progress of and challenges to Raytheon’s strategy and related risks throughout the year. At each regularly-scheduled Board meeting, the Chairman and CEO has an executive session with the Board to discuss strategic and other significant business developments since the last meeting. THE BOARD’S ROLE IN RISK MANAGEMENT The Board oversees Raytheon’s risk-management program and allocates certain oversight responsibilities to its committees. Our risk-management program covers the full range of material risks to Raytheon, including strategic, operational, financial, and compliance and reputational risks. Management carries out the daily processes, controls and practices of our riskmanagement program, many of which are embedded in our operations. In addition, as part of our enterprise riskmanagement process (ERM), management identifies, assesses, prioritizes and develops mitigation plans for Raytheon’s top risks. These plans are reviewed annually with the full Board. The Board and the committees also regularly review and discuss significant risks with management, including through annual strategic discussions and reviews of annual operating plans, financial performance, merger and acquisition opportunities, market environment updates, international business activities, and presentations on specific risks. Each committee regularly reports to the Board on risk matters under its purview. The Board periodically reviews our risk-management (including ERM) policies, processes and controls, and the Audit Committee from time to time separately reviews the Board’s approach to risk oversight. BOARD OF DIRECTORS

oversees strategic and significant operational risks, such as operating and financial plan

risks; legal and regulatory compliance risks, including those related to litigation, government

investigations and enforcement actions, disputes, risk exposures and governance issues; and

risks related to prospective mergers and acquisitions.

Audit Committee

oversees risks related

to financial reporting,

internal controls,

internal audit, auditor

independence, and

related areas of law

and regulation.

Governance and

Nominating

Committee

oversees risks related

to governance issues.

Management

Development and

Compensation

Committee

oversees risks related

to compensation

policies and practices

and talent acquisition,

retention and

development.

Public Affairs

Committee

oversees various

aspects of U.S. and

international

regulatory compliance,

social responsibility,

environmental matters,

export/import controls

and crisis management.

Special Activities

Committee

oversees cybersecurity

risks and risks related

to our classified

business.

THE BOARD’S ROLE IN MANAGEMENT SUCCESSION PLANNING The Board’s Management Development and Compensation Committee (MDCC) and the full Board periodically review succession planning for the Chairman and CEO and other senior leadership positions. These reviews include consideration and assessment of key leadership talent throughout Raytheon, and roles for which it may be necessary to consider external candidates. The Board also reviews Raytheon’s talent strategy for critical roles, and has regular opportunities to observe key leadership and high potential talent through presentations, meetings and other events. The Board’s carefully considered planning is evident in the process by which Thomas Kennedy was ultimately elected as Chairman and CEO. Mr. Kennedy, who has had a 33-year career with Raytheon, previously served in a series of positions of increasing responsibility, including President of Raytheon’s Integrated Defense Systems business, Executive Vice President and Chief Operating Officer, and CEO. DIRECTOR CANDIDATE CONSIDERATION AND BOARD REFRESHMENTThe Board and its Governance and Nominating Committee seek to have an engaged and independent Board that upholds the highest ethical standards. Each Raytheon director is expected to:

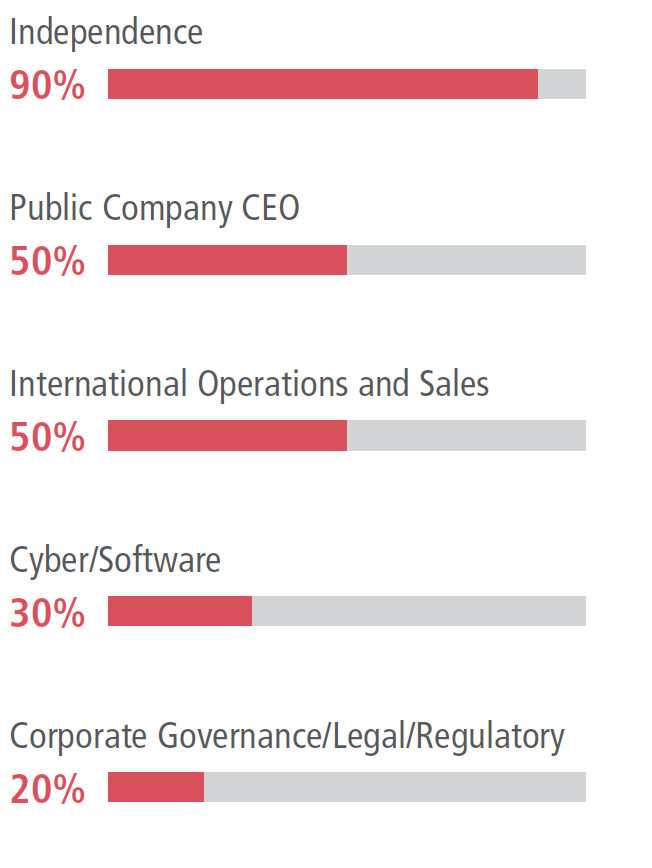

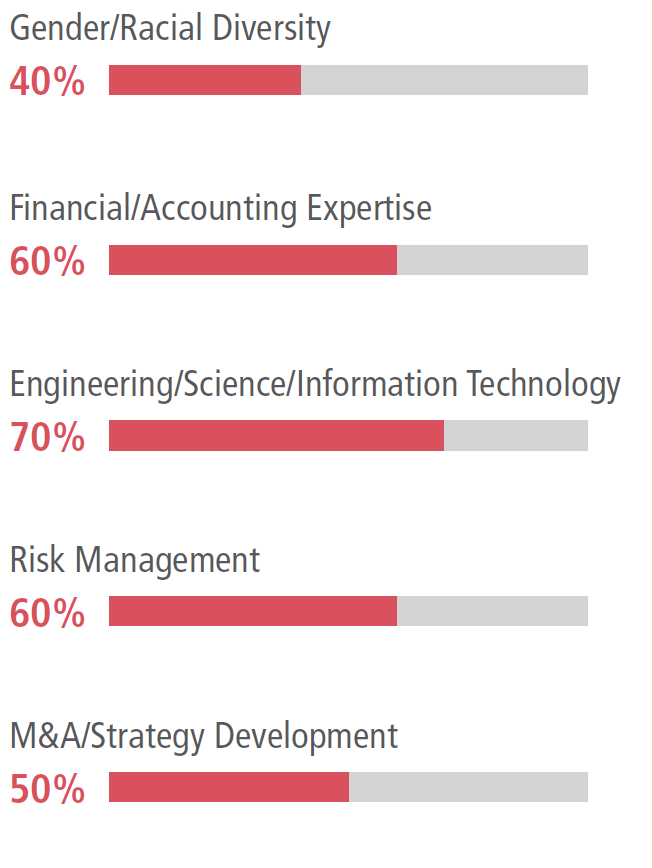

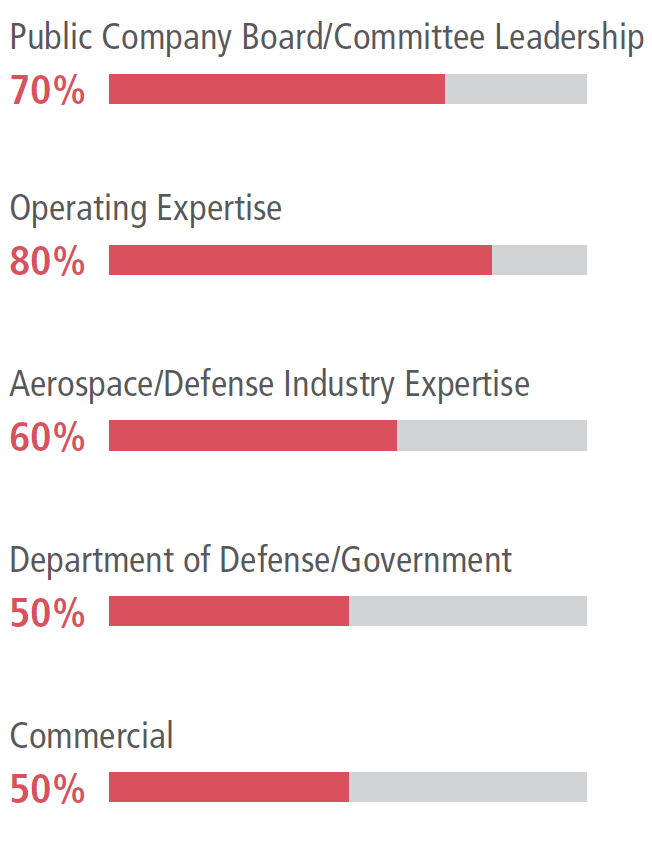

EVALUATING BOARD CAPABILITIES AND DETERMINING NEEDS When evaluating each director nominee and the potential needs and composition of the Board as a whole, the Governance and Nominating Committee looks for nominees with the potential to make significant contributions to the Board that will enable the Board to continue to serve the long-term interests of Raytheon and its shareholders. To that end, the Governance and Nominating Committee has identified critical experiences, qualifications, attributes and skills, and created a matrix to ensure each is adequately represented among our directors. The Committee regularly reviews the director skills matrix to confirm that it appropriately reflects the attributes most needed to support Raytheon’s long-term growth strategy. From time to time, the Committee may engage a third party for a fee to assist it in identifying potential director candidates. In light of Raytheon’s current emphasis on international growth, emerging customer needs, technological innovation, and cybersecurity, as well as our complex and evolving business and operations generally, including a national security focus and classified and other regulatory requirements, the Governance and Nominating Committee believes the following experiences, qualifications, attributes and skills must be adequately represented on the Board:

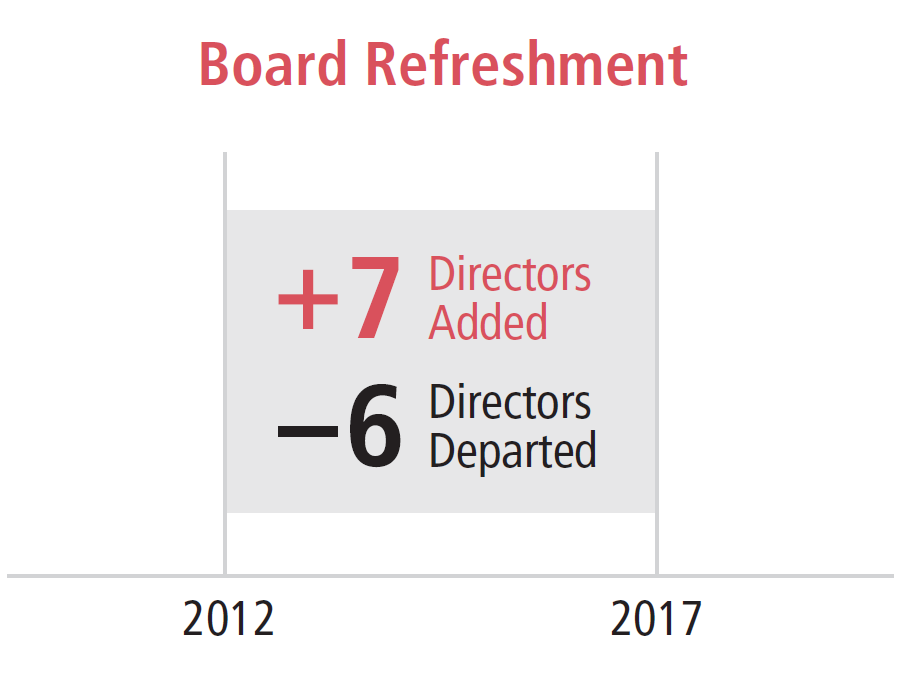

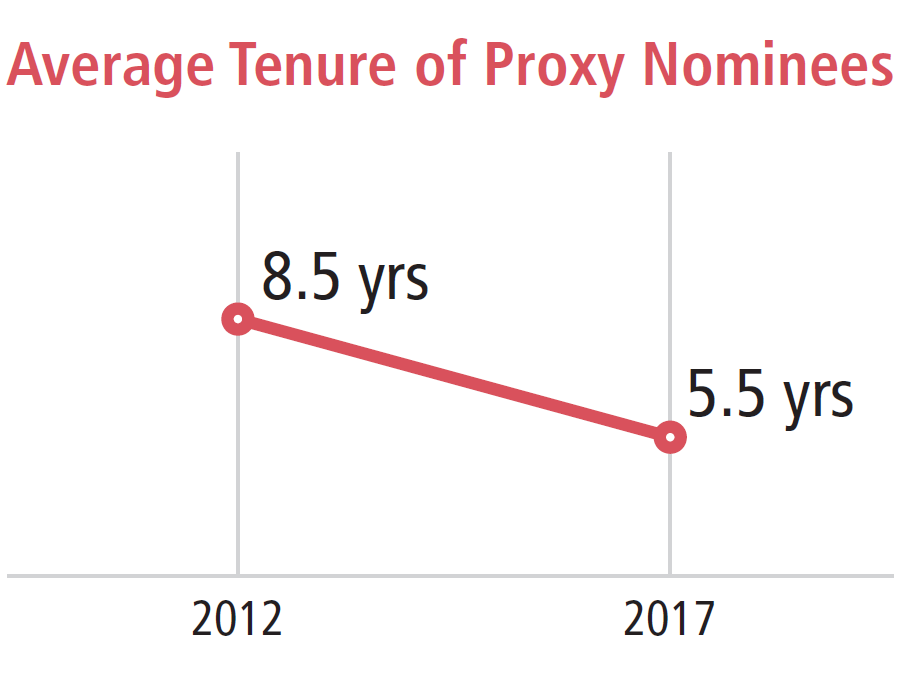

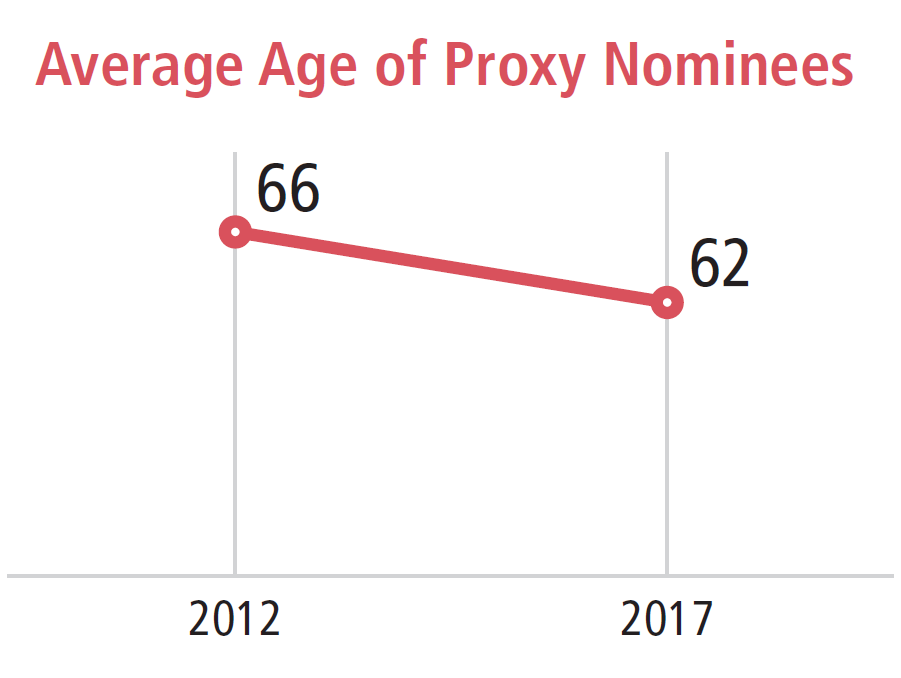

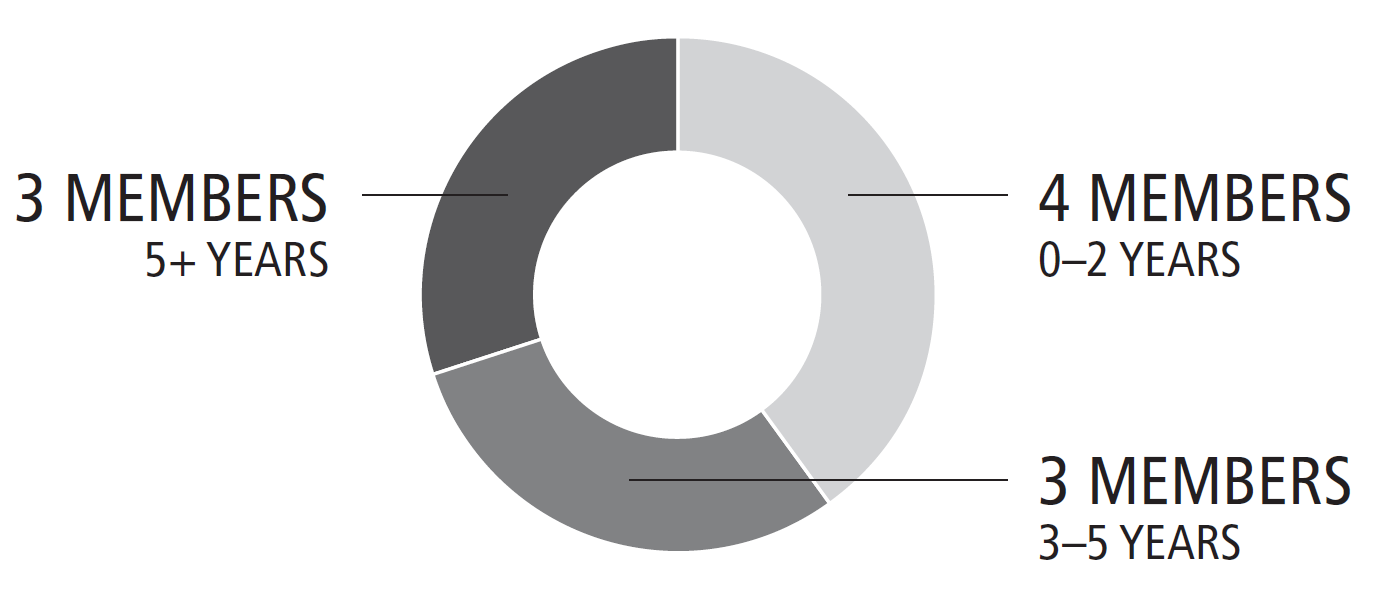

BOARD REFRESHMENT AND CURRENT COMPOSITION In addition to ensuring the Board reflects an appropriate mix of experiences, qualifications, attributes and skills, the Governance and Nominating Committee also focuses on director succession and tenure. Over the last five years, the Board has undergone significant refreshment, resulting in lower average tenure, younger average age, and broadened diversity of background. BOARD REFRESHMENT — LAST FIVE YEARS (2012-2017)

Through this refreshment, a number of directors joined the Board with key experiences and attributes, such as public company CEOs and individuals with experience in international sales and operations, commercial, information technology, and cyber/software. CURRENT DIRECTORS — KEY ATTRIBUTES (10 DIRECTOR NOMINEES)

The Board also has achieved a balance of directors who have served for a number of years and have a deep knowledge of Raytheon’s business and operations and newer directors who may lend fresh perspectives.

This graph also appears on page 3.

In addition to refreshing the Board’s composition generally, the Board regularly refreshes its committee chairs and committee membership to promote strong committee leadership and independence as well as director development and succession planning. In 2016, Tracy A. Atkinson became the Chair of the Audit Committee, Stephen J. Hadley became the Chair of the Governance and Nominating Committee, and Letitia A. Long became the Chair of the Public Affairs Committee. DIRECTOR INDEPENDENCEThe Board has adopted specific director independence criteria, consistent with the New York Stock Exchange (NYSE) listing standards, to assist it in making determinations regarding the independence of its members. These criteria, which are detailed in our Governance Principles, are available as described below under “Governance Documents.” To be considered independent, the Board must determine that a director does not have a material relationship, directly or indirectly, with Raytheon. The Board considers the independence of its members at least annually, in part by reviewing Raytheon’s relationships with organizations with which our directors are affiliated. The Board has determined that no director other than Mr. Kennedy, the Chairman and CEO, has, directly or indirectly, a material relationship with Raytheon, nor does any other director have a direct or indirect material interest in any transaction involving Raytheon. Every director other than Mr. Kennedy, including Mr. Ruettgers, who is retiring from the Board, satisfies our independence criteria. In connection with its review and determination of director independence, the Board considered certain non-material relationships and transactions involving certain directors, including:

In all cases, the transactions were provided in the ordinary course of business; none of the directors had any direct or indirect material interest in, or received any special compensation in connection with, the transactions or relationships; and the amounts paid in those transactions were well below thresholds prescribed under the NYSE standards and the Governance Principles. BOARD AND COMMITTEE EVALUATION PROCESSThe Governance and Nominating Committee leads an annual performance evaluation of the Board and each Board committee as described below. SEPTEMBER - OCTOBER

Each director completes a Board self-evaluation questionnaire and a separate questionnaire for each committee on which the director serves. The Boardrequests ratings and solicits specific questionnaire The committee-specific detailed suggestions for improving Board and committee governance processes and effectiveness. questionnaires are tailored to the respective committees’ roles and responsibilities and any applicable legal or regulatory obligations. OCTOBER - NOVEMBER

Self-evaluation questionnaire results are compiled and summarized by the Office of the Corporate Secretary. The summaries include all specific director comments, without attribution. Each director receives the Board self-evaluation summary and the self-evaluation summary for each committee on which the director serves. The Lead Director and the Chairman receive all of the selfevaluation summaries. NOVEMBER

Committee self-evaluation results are discussed by each committee, and Board self-evaluation results are discussed by the full Board, in each case in executive session. Each committee and the Board identify areas for further consideration and opportunities for improvement, and implement plans to address those matters. JULY

Each committee and the full Board convene in executive session to review progress with respect to any identified areas for further consideration. ONGOING

Directors may

discuss concerns,

including those

related to individual

performance,

separately with

the Lead Director.

The Board views self-evaluation of Board and committee performance as an integral part of its commitment to continuous improvement. This process has prompted a number of changes to the Governance Principles, committee charters, and Board governance practices generally. By way of example, the self-evaluation exercise has led to enhancements to processes related to director candidate identification and recruitment, executive succession planning, and director education. The Governance and Nominating Committee periodically reviews the evaluation process and considers ways to enhance it. SHAREHOLDER ENGAGEMENTUnder the Board’s purview, we make a concerted effort to engage with shareholders to ensure we consider their views and address their interests. In addition to meeting with investors to discuss our performance, strategy and operations, we also regularly engage with our shareholders to solicit their views on governance and executive compensation matters, as discussed in more detail below. KEY ELEMENTS OF GOVERNANCE AND COMPENSATION OUTREACH We recognize the value of engaging with our shareholders on governance and compensation matters so we can better understand their views and interests and share our perspective on these important subjects. The hallmarks of our shareholder engagement program are described below.

GOVERNANCE INITIATIVES Over the past several years, shareholder input solicited during our outreach efforts has contributed greatly to shaping a number of our governance initiatives. For example, as part of our fall 2015 outreach, we communicated extensively with our shareholders regarding their views on shareholder proxy access, including key terms such as the minimum shareholder ownership percentage, the maximum number of shareholders, and the number of board nominees. As a result, in March 2016, the Board proactively adopted a proxy access by-law amendment. Other key governance initiatives on which we solicited input from our shareholders include:

COMPENSATION PROGRAM In regular outreach discussions, we also request shareholder input on Raytheon’s executive compensation program, including design elements and metrics, to ensure that the program reflects shareholders’ interests and objectives. We believe the results of Raytheon’s annual say-on-pay vote, which has averaged 95.0% support in the last six years, confirm the value of this endeavor. GOVERNANCE POLICIES AND PRACTICESMAJORITY VOTING FOR DIRECTORS Our by-laws contain a “majority of votes cast” standard for uncontested elections of directors, meaning that a director nominee is elected if the number of votes cast for the nominee exceeds the number of votes cast against the nominee. In contested elections (that is, those in which the number of nominees exceeds the number of directors to be elected), the voting standard is a plurality of votes cast. Our Governance Principles provide that any incumbent director in an uncontested election who fails to receive the requisite majority of votes cast “for” his or her election must tender a resignation to the Governance and Nominating Committee. The Committee will make a recommendation to the Board as to whether to accept or reject that resignation. The Board will act on the resignation and publicly disclose its decision and the rationale behind it within 90 days from the date results are certified. The director whose resignation is under consideration will abstain from participating in both the Governance and Nominating Committee’s recommendation and the Board’s ultimate decision. If a resignation is not accepted by the Board, the director may continue to serve. SERVICE ON OTHER BOARDS Our Governance Principles limit the number of for-profit company boards on which a director may serve to four (including Raytheon), or two in the case of a director who currently serves as CEO of a company (not counting the board of the company where the director is employed). This latter limitation applies to our CEO. A director who is considering joining the board of another for-profit company must notify the Chairman of the Board and the Chair of the Governance and Nominating Committee regarding the proposed board service, and may not accept the position until advised that service on the other board would not conflict with a Raytheon policy or service on the Raytheon Board. Additionally, we have established a policy requiring all officers and employees to obtain written approval before joining the board of another business entity to ensure that such service is not contrary to the interests of Raytheon. CODE OF CONDUCT AND CONFLICT OF INTEREST POLICY We have adopted Code of Conduct and Conflict of Interest policies that serve as the foundation of our ethics and compliance program and cover a wide range of areas. The Code of Conduct provides guidance on conflicts of interest, insider trading, discrimination and harassment, confidentiality, and compliance with laws and regulations applicable to the conduct of our business. All officers, directors, employees and representatives are required to comply with the Code of Conduct and are subject to disciplinary action, including termination, for failure to do so. We provide ethics education for directors, officers and employees. Any amendments to the Code of Conduct or the grant of a waiver from a provision of the Code of Conduct requiring disclosure under applicable Securities and Exchange Commission (SEC) rules will be disclosed on our website. Under our Conflict of Interest Policy, directors, officers and employees are expected to bring to the attention of the Vice President, General Counsel and Secretary or the Vice President - Ethics and Business Conduct any actual or potential conflict of interest. Anyone may report matters of concern to Raytheon’s Ethics Office through our anonymous, confidential toll-free EthicsLine at 1-800-423-0210, by writing to the Ethics Office, Raytheon Company, 870 Winter Street, Waltham, Massachusetts 02451, or by submitting comments on our website at www.raytheon.com in the section entitled, “Contact the Ethics Office,” under the heading “Investor Relations/Corporate Governance/Contact the Company.” TRANSACTIONS WITH RELATED PERSONS Our Board has adopted a written Related Party Transactions Policy. Related party transactions include all transactions and relationships involving amounts in excess of $120,000 between Raytheon (including subsidiaries) and any director, executive officer, 5% shareholder, or an immediate family member of any of the foregoing (“interested person”) and certain entities in which an interested person has a significant interest. Under the policy, the Governance and Nominating Committee reviews the material facts of all related party transactions identified by the Vice President, General Counsel and Secretary and determines whether to approve, disapprove or ratify the transaction or relationship involved. Certain transactions and relationships have been pre-approved for purposes of the policy, including (a) executive officer compensation approved by the Board, (b) director compensation, (c) certain relatively small transactions between Raytheon and other companies and (d) certain charitable contributions made by Raytheon. Ms. Atkinson and Messrs. Hadley, Oliver, Paliwal, Winnefeld, Kennedy, Jimenez, Wajsgras and Yuse served as members of boards of, or were otherwise affiliated with, charitable or other non-profit organizations to which Raytheon made contributions in 2016 (other than through a trade association membership or our matching gift and charitable awards program). These contributions were consistent with all company policies, and no organization received, in the aggregate, more than $200,000. In a Schedule 13G filing made with the SEC, BlackRock, Inc., including its subsidiaries, reported beneficial ownership of 7.60% of our outstanding common stock as of December 31, 2016. Under a previously established business relationship, BlackRock has provided investment management services for the benefit of the Raytheon Master Benefit Pension Trust. For providing such investment management services, BlackRock received fees of $4.4 million in 2016. The Governance and Nominating Committee has reviewed this relationship and approved it on the basis that BlackRock's ownership of Raytheon stock plays no role in the business relationship between the two companies and the engagement of BlackRock has been on terms no more favorable to it than terms that would be available to unaffiliated third parties under the same or similar circumstances. POLICY ON SHAREHOLDER RIGHTS PLANS We do not have a shareholder rights plan. The Board will obtain shareholder approval prior to adopting a shareholder rights plan unless the Board, in the exercise of its fiduciary duties, determines that, under the circumstances then existing, it would be in the best interests of Raytheon and our shareholders to adopt a rights plan without prior shareholder approval. If a rights plan is adopted by the Board without prior shareholder approval, the plan must provide that it will expire within one year of adoption unless ratified by shareholders. RESTATEMENT CLAWBACK POLICY Our Governance Principles contain a Restatement Clawback Policy that gives the Board the right to recover Results-Based Incentive Plan payments, Long-Term Performance Plan awards, and restricted stock awards made on or after January 1, 2009, to any elected officer, to the extent that such payments or awards were inflated due to erroneous financial statements substantially caused by the executive’s knowing or intentionally fraudulent or illegal conduct. The policy is designed to increase the likelihood that Raytheon will be successful if it seeks to recover the portion of an executive’s incentive compensation attributable to inflated financial results caused by the executive’s malfeasance. DIRECTOR NOMINATIONS BY SHAREHOLDERSNominations for director may be made only by the Board or a Board committee, or by a shareholder or shareholders entitled to vote who comply with the relevant provisions in Raytheon’s by-laws. SHAREHOLDER NOMINATIONS VIA PROXY ACCESS BY-LAW (SECTION 2.11) The proxy access by-law sets forth conditions under which shareholders may include nominees in Raytheon’s Annual Meeting proxy materials. The proxy access by-law provides that:

SHAREHOLDER NOMINATIONS OTHER THAN VIA PROXY ACCESS BY-LAW (SECTION 2.7) Shareholders also may nominate people for election to the Board at an annual or special meeting of shareholders in accordance with the standard advance notice by-law provisions. For our 2018 Annual Meeting of Shareholders, we must receive this notice between January 25, 2018, and February 24, 2018. We are not obligated to include any such nomination in our proxy materials. Shareholders wishing to propose a director candidate for consideration by the Governance and Nominating Committee may do so by sending the candidate’s name, biographical information, and qualifications to the Committee Chair, in care of the Corporate Secretary, Raytheon Company, 870 Winter Street, Waltham, Massachusetts 02451. The Committee reviews each candidate’s qualifications in accordance with the director qualification criteria contained in our Governance Principles and determines whether the candidate should be nominated for election to the Board. DIRECTOR DEVELOPMENT AND EDUCATIONOur director education program consists of visits to Raytheon facilities and education regarding our Code of Conduct and other policies and practices relevant to our business and operations. Periodically, we provide updates on topics of interest to the Board. We also encourage directors to attend external director education programs at Raytheon’s expense. We make available to the Board, on an ongoing basis, descriptions of a variety of upcoming director education programs that may be of interest, and provide program assessments from directors who have participated in such programs. COMMUNICATION WITH THE BOARDInterested parties may communicate with our Board through our Lead Director in writing, care of the Corporate Secretary, Raytheon Company, 870 Winter Street, Waltham, Massachusetts 02451, or by submitting comments on our website at www.raytheon.com in the section entitled “Contact the Board” under the heading “Investor Relations/Corporate Governance/Contact the Company.” Communications are referred to the Lead Director and tracked by the Office of the General Counsel. Anyone who has a concern regarding our accounting, internal controls over financial reporting, or auditing matters may communicate that concern to the Audit Committee. You may contact the Raytheon Audit Committee by writing to the address above, or by submitting comments on our website at www.raytheon.com in the section entitled “Contact the Audit Committee Regarding Accounting, Internal Controls or Auditing Matters” under the heading “Investor Relations/Corporate Governance/Contact the Company.” Communications are referred to the Audit Committee and tracked and investigated in the ordinary course by our Ethics Office with the assistance of the Office of the General Counsel unless otherwise instructed by the Audit Committee. POLITICAL CONTRIBUTIONS AND LOBBYING EXPENDITURES DISCLOSURERaytheon has for a number of years voluntarily included disclosure on its website relating to political contributions and lobbying expenditures. In March 2016, we significantly expanded this website disclosure to include the following:

This disclosure is available on our website at www.raytheon.com under the heading “Investor Relations/Corporate Governance/Political Contributions and Lobbying Expenditures.” GOVERNANCE DOCUMENTSOur key governance documents are available on our website at www.raytheon.com under the heading “Investor Relations/Corporate Governance.” These include:

These documents are also available in print to any shareholder who requests them by writing to Raytheon Company, Investor Relations (Corporate Secretary for the by-laws), 870 Winter Street, Waltham, Massachusetts 02451 or by emailing invest@raytheon.com. |