Letter to Shareholders

Schlumberger revenue of $35.5 billion in 2015 represented a drop of 27% from 2014 due to customer spending falling as commodity prices weakened during the year. Revenue in North America decreased 39%, driven by a land rig count that ended the year 68% lower than the peak seen in 2014, as well as by pricing pressure that intensified during the year. North American offshore revenue fell more modestly as rigs in the US Gulf of Mexico shifted from exploration to development work, although the overall market in North America was the weakest for oilfield services since 1986. Internationally, revenue declined 21% as customers cut budgets and pressured service pricing, with these effects often exacerbated by activity disruptions, project delays, and cancellations.

In the oil markets, the negative sentiments that had dominated the year accelerated during the fourth quarter after some optimism earlier in the summer. The impact of OPEC lifting production targets to produce at maximum rates, combined with production in North America from unconventional resources declining slower than expected following the April peak, has led to supply continuing to exceed increasing demand. As a result, commodity prices fell dramatically, with oil dropping to a 12-year low by the end of the year. These weaker fundamentals drove industry exploration and production (E&P) capital investment significantly lower.

In the natural gas markets, US production grew to a record of 75 Bcf/d as new fields in the US Gulf of Mexico were brought into production and supplies from unconventional shale gas and tight oil reservoirs continued to grow. This trend is expected to continue with newly completed pipeline capacity in the northeast United States bringing new supplies. A relatively mild start to the winter together with North American gas storage levels well above the five-year average is keeping natural gas prices low. Internationally, European gas demand growth returned to positive territory. Despite this increased demand, storage levels are at record highs due to ample supply from the North Sea and Russia, as well as from liquefied natural gas (LNG). Demand rebounded in Asia but remained in a downward trend overall. As LNG exports from Australia grow, the region is likely to remain oversupplied with low natural gas prices persisting.

Our financial performance in 2015 was significantly impacted by the large decrease in land activity, particularly in the US, where the year-end land rig count numbered less than 700 rigs. This created massive overcapacity in the land market that impacted pricing levels across a broad range of oilfield services. Internationally, revenue in the Europe, CIS & Africa Area fell by 26% as a result of the weakening Russian ruble, and due to a drop in exploration activities in the North Sea and Sub-Saharan Africa. In Latin America, revenue declined 22% due to decreased activity in Mexico, Brazil, and Colombia as a result of sustained budget cuts that led to rig count reductions. Middle East & Asia Area revenue decreased 17% on lower activity in the Asia Pacific region, particularly in Australia, although this was partially offset by robust activity in the Gulf Cooperation Council countries, particularly Saudi Arabia, Kuwait, and Oman.

Among the Groups, Reservoir Characterization performance was impacted by sustained cuts in exploration spending, currency weaknesses, and operational disruptions from exhausted customer budgets that affected Wireline activities. For the Drilling Group, the drop in drilling activity coupled with persistent pricing pressure, currency weaknesses, and operational disruptions lowered Drilling & Measurements and M-I SWACO revenues across all geographies, but most significantly in the Europe, CIS & Africa Area. Production Group performance was mainly affected by the fall in North American land activity as exhausted customer budgets led to a continued decline in rig count and increased pricing pressure.

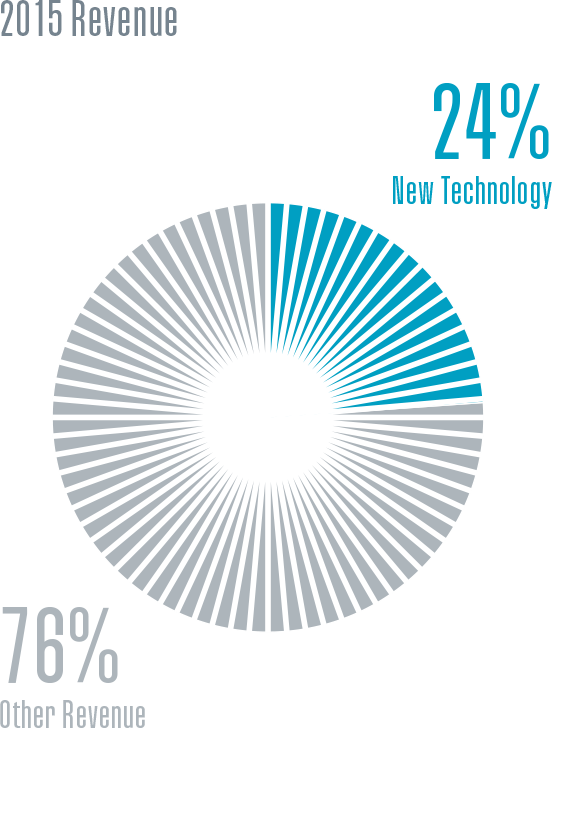

In spite of falling activity, new technology sales remained robust across all Groups during the year, representing 24% of total sales and proving the value that innovative technology can bring when delivered with increased efficiency and higher reliability. The third quarter saw the pressure pumping stage count for BroadBand* unconventional reservoir completion services reach almost 12,000 and pass the milestone of generating more than $1 billion in cumulative revenue since its introduction in late 2013. This performance is more than three times the success of the earlier HiWAY* flow-channel fracturing technique, which already represented a step change in new product introduction.

In terms of health and safety, our performance improved further in 2015. Our continued focus on driving and journey management led to a decrease in our auto accident rate of more than 8% compared with 2014. One of the major contributing factors to this improvement has been our investment in the Schlumberger Global Journey Management Center network that continues to monitor trips made in countries that we consider to exhibit medium and high driving risk. In environmental matters, we have shown that many of our technologies are playing increasing roles in lowering environmental impact while optimizing the production and recovery of nonrenewable resources efficiently and reliably. These are documented in our first Global Stewardship Report, which illustrates that our approach to sustainability is rooted in our global culture.

Despite today’s weak market for oilfield services, we delivered strong corporate financial results in 2015. At the beginning of 2015, the Board of Directors approved an increase in the quarterly dividend to $0.50 cents per share. This confidence has been justified by our generation of $5 billion in free cash flow during the year, after taking into account capital expenditures of $2.4 billion and investment in future revenue streams of $1.4 billion. We have returned $4.6 billion in cash to our shareholders through a combination of dividend payments and stock buy-backs. In addition, we have spent about $500 million on technology acquisitions that broadened our portfolio in a number of key products and services. Yet we increased our net debt by only $160 million due to our ability to generate cash, which is unmatched in the oilfield services industry. This has given us an unrivalled ability to capitalize on a variety of significant business opportunities.

Among these opportunities was the August announcement of our agreement to acquire Cameron International Corporation, the company with which we formed the OneSubseaTM joint venture in June 2013. The rationale for this acquisition lies in our belief that the industry’s next technical breakthrough will be achieved through the integration of Schlumberger downhole reservoir and well technologies with Cameron surface drilling, processing, and flow control technologies. Further development of instrumentation, software, and automation abilities will enable us to launch a new era of complete drilling and production system performance. On November 17, we received unconditional clearance from the US Department of Justice. We expect to close the transaction in the first quarter of 2016, which remains subject to other regulatory approvals and conditions in our merger agreement with Cameron.

In this uncertain environment, we continue to focus on what we can control. Throughout the year we took a number of actions to navigate through the current market downturn, including a reduction in our workforce. There is no easy way to let go of employees and everyone at Schlumberger has been affected by this difficult process. We will be better prepared when activity rebounds due to arranging a temporary leave of absence for more than 1,800 employees.

The industry’s next technical breakthrough will be achieved through the integration of Schlumberger downhole reservoir and well technologies with Cameron surface drilling, processing, and flow control technologies.

In spite of this, we remain constructive in our view of the market outlook in the medium term and continue to believe that the underlying balance of supply and demand will tighten. This will be driven by growth in demand, weakening supply as the massive E&P investment cuts take effect, and the size of the annual supply replacement challenge. In continuing to accelerate the benefits of our transformation program across both our Technologies and GeoMarket regions in 2016, we believe that we will emerge as a stronger company once the price of oil and the market conditions in our industry improve.

On behalf of all the Schlumberger people around the world, I want to thank our customers for their confidence and support. I would also like to personally thank our employees for their commitment and focus during what has been a very difficult year in the oil and gas E&P industry.