Investing in our relationships

We pride ourselves on being relationship-oriented. How a bank responds to its clients during moments of uncertainty in the markets and economy define those relationships for years to come.

One of the first to offer cryptocurrency custody services

The price of Bitcoin was less than $200 when our Blockchain and Cryptocurrency Practice was established in 2015. As this market continues to evolve, we surveyed some of our largest clients to determine if they were interested in crypto – and it turned out that there was not only broad interest, but that fund managers also wanted the credibility of a bank like U.S. Bank to help reassure their clients. To meet this need, we became one of the first to offer cryptocurrency custody services, which are now available to Global Fund Services clients. The offering will help investment managers store private keys for Bitcoin with assistance from sub-custodian NYDIG.

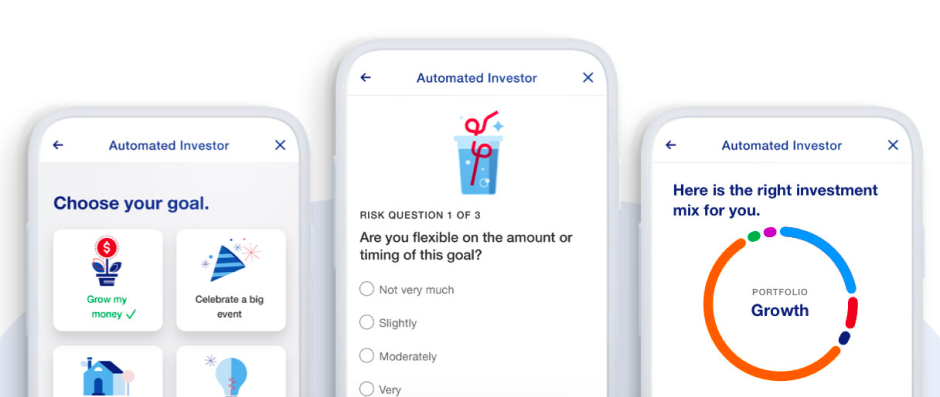

An easier-to-use digital investing tool

U.S. Bancorp Investments (USBI) revamped its Automated Investor to make it easier to use and more accessible to first-time investors. Based on extensive research and customer co-creation, the USBI team rebuilt the experience and is delivering many new features, including a new low minimum investment of $1,000 (previously $5,000); a new faster application with fewer steps; seven new customer-friendly goals, including a new home and a home remodel; and a new dashboard for accounts that shows projected value, whether a customer is on or off track toward goals.

New passive currency hedging service

We also announced a new passive currency hedging service powered by Lumint’s industry-leading technology. The new U.S. Bank Global Currency Management solution offers institutional investors a highly automated and scalable solution for portfolio and share class currency hedging and will allow them to enjoy full performance of their assets and protect their overall investment from currency exchange volatility.

More specialty coverage for large corporate clients

Our Corporate Banking team serves clients in more than a dozen industries across the country, from Healthcare to Insurance, delivering the credit, leasing and international payment services that have helped businesses grow, hire and innovate. In response to clear market needs, we added Aerospace & Defense and Hospitality & Leisure, enabling more companies to benefit from the team’s deep specialty expertise and broad geographic coverage as they continued to navigate the impacts of the pandemic.

Welcoming PFM Asset Management

The acquisition of PFM Asset Management by U.S. Bancorp Asset Management solidified our position as a leading provider of investment solutions. PFM Asset Management brings a wide array of client relationships and product offerings, including local government investment pools, outsourced chief investment officer services and separately-managed accounts in both fixed income and multi-asset class strategies. PFM Asset Management will continue to operate as a separately registered investment adviser.

Addressing Environmental, Social and Governance (ESG) through financing activities

In a survey, 71 percent of chief financial officers (CFOs)(opens new window) told us that their business’s focus on ESG has increased in the past year. While there are countless impactful ESG activities taking place across organizations, attention has increasingly turned to how CFOs can address ESG through their financing activities. The opportunities to structure financing to incentivize progress are vast. That’s part of the reason why we expanded sustainable financing capabilities as client demand surges, including the formal establishment of a full-service ESG practice within Fixed Income & Capital Markets.

We also joined Enterprise Community Partners to issue – and invest in – an innovative bond designed for targeted and measurable racial equity results. Issued by Enterprise Community Loan Fund, Enterprise’s Community Development Financial Institution (CDFI), the $30 million bond will help provide loans to housing developers who identify as Black, Indigenous or with other communities of color. This is the first CDFI-issued racial equity bond, and the designation of this social bond as a racial equity bond provides for targeted investments in underserved communities.