Leading in an increasingly digital world

Digital money movement is transforming how we interact with each other and the financial system. Whether transferring money from consumer to consumer, business to business or variations in-between, the events of the past two years accelerated the embrace of real-time and other digital payment types from the realm of early adopters into the mainstream. An insurance claim can now be paid digitally rather than writing a check, roommates can split household expenses through Zelle® and a restaurant can have access to the money it made in a day available by close rather than waiting for every credit card transaction to process or check to clear.

Unique competitive advantage

We have a unique competitive advantage with our technology and processes. It’s enabled us to create innovative products and services that harness real-time payments capabilities to help consumer, small business and commercial clients conduct their business with greater speed, efficiency and security. Nearly 20,000 of our business customers have started using Everyday Funding(opens new window) to receive merchant settlement transfers 365 days per year, including over the weekend and on holidays. This gives them continuous access to funds to pay bills and keep their businesses moving forward.

Award-winning solution

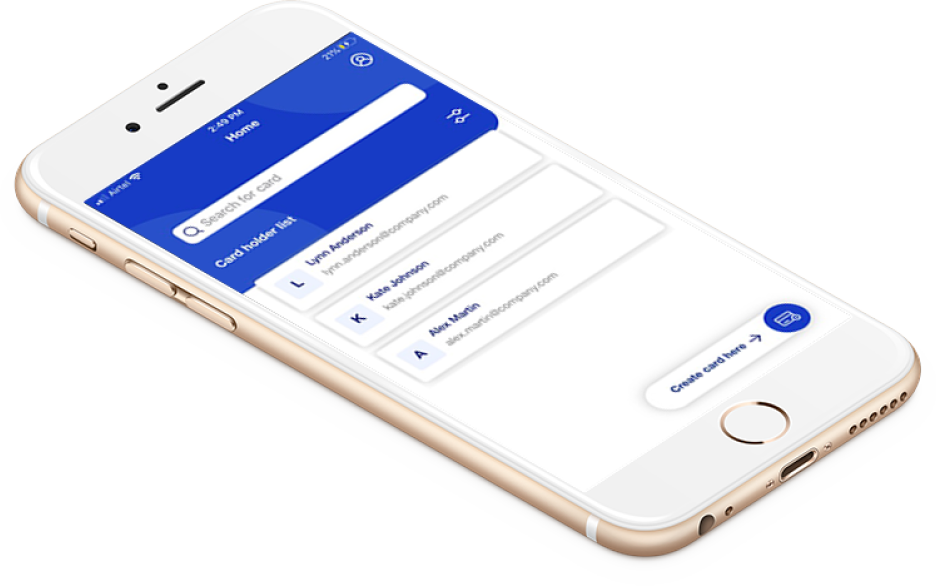

At the start of the pandemic, companies turned to us to provide their employees quick access to virtual corporate cards through the U.S. Bank Instant Card(opens new window) app so they could buy their own home office equipment or personal protection equipment (PPE) without using their personal credit cards. The solution proved to be so popular it has expanded into everything from distributing emergency funds for foster care parents to allowing job candidates to book their own travel. The card was honored with the 2021 Impact Innovation Award in Product Development by the Aite Group, a global research and advisory firm.

170 new features in 2021

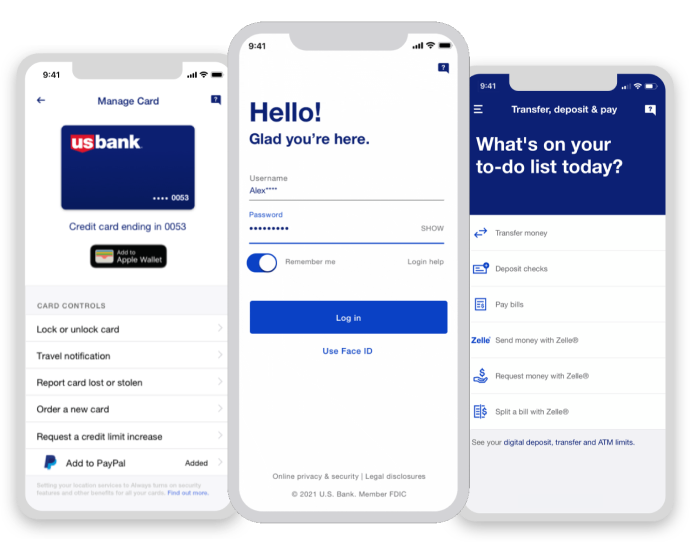

Our mobile app won accolades, including a No. 1 ranking among banking apps by industry benchmarking firm Keynova Group in its Q3 2021 Mobile Banker Scorecard and No. 1 rankings in both Alerts and Account Management categories from Insider Intelligence. We’ve delivered more than 170 new features across the mobile app and online and expanded the capabilities of existing features like Smart Assistant(opens new window). In early 2021, we launched new personalized digital tools that give high-touch customer service with a local banker, through both virtual appointments and cobrowsing with video(opens new window) – a first in the industry and available via both mobile app and online.

Helping business owners focus on

what matters most

We’ve also been making strategic acquisitions to help businesses simplify their money movement needs. In November, we announced the acquisition of TravelBank, a fintech company that provides an all-in-one, mobile-friendly solution for travel management. Our integration with TravelBank’s platform will provide the most comprehensive expense, travel and payment solution in the industry. We also bought Bento Technologies, better known as Bento for Business, a fintech company that provides payment and expense management services for small and midsize businesses. Adding Bento to our suite of services means we can help our business banking customers spend less time worrying about administrative tasks and more time and energy on bringing their vision to life.