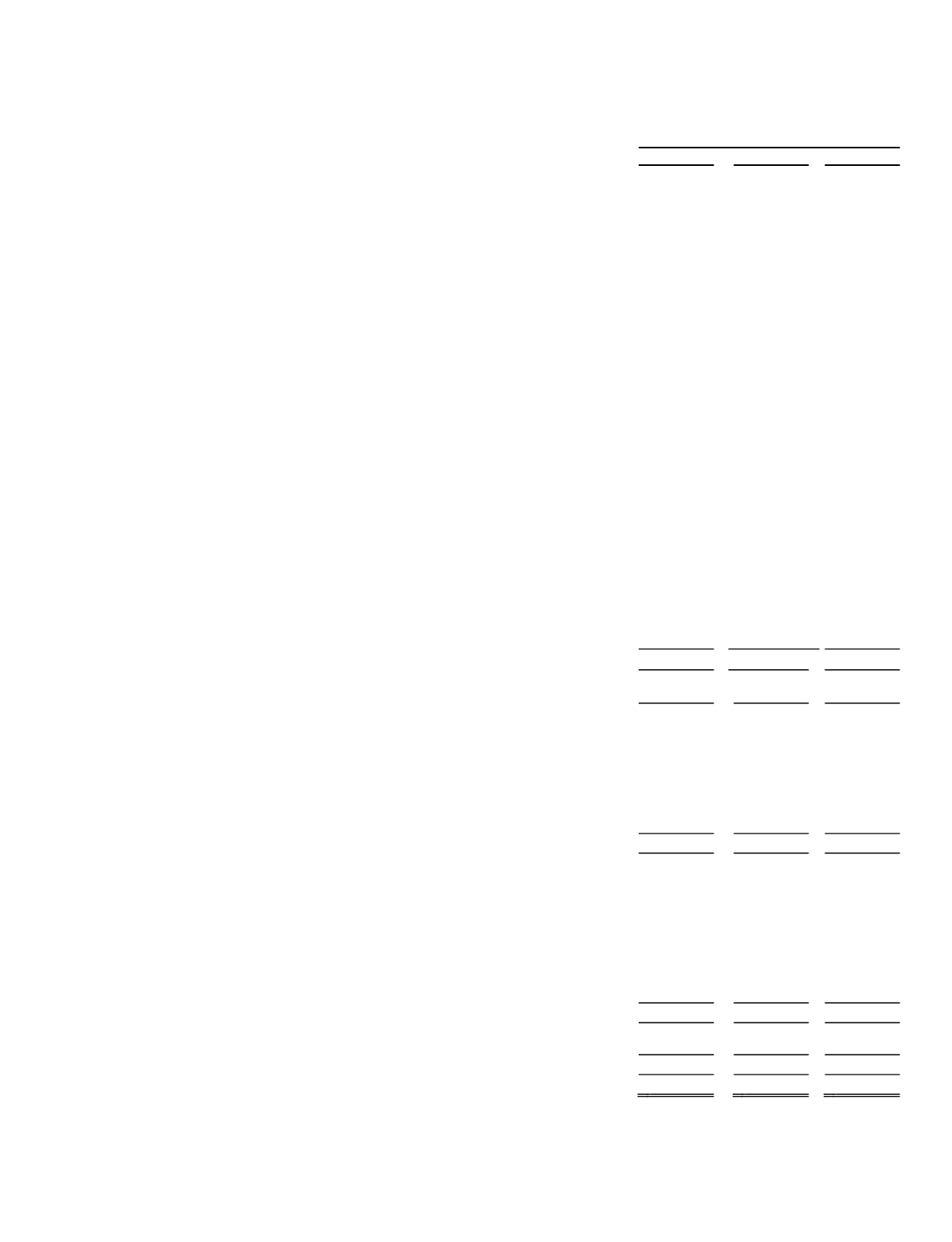

F-7

TeleCommunication Systems, Inc.

Consolidated Statements of Cash Flows

(amounts in thousands)

Year ended December 31,

2013

2012

2011

Operating activities:

Net income (loss) ................................................................................................................... $ (58,597) $ (97,988) $

7,004

Adjustments to reconcile net income/(loss) to net cash provided by operating activities:

Impairment of goodwill and long-lived assets..............................................................

31,977 125,703

—

Depreciation and amortization of property and equipment ..........................................

14,853

14,245

12,135

Amortization of software development costs ...............................................................

7,466

7,660

10,771

Stock-based compensation expense..............................................................................

7,036

9,021

9,672

Amortization of acquired intangible assets...................................................................

4,570

4,374

5,535

Deferred tax provision (benefit) ...................................................................................

16,046 (15,691)

4,428

Excess tax deficit (benefit) from share-based payment arrangements..........................

—

1,510

(4,746)

Amortization of investment premiums and accretion of discounts, net........................

246

425

931

Loss (gain) on early retirement of debt.........................................................................

178

(431)

—

Amortization of deferred financing fees.......................................................................

3,403

757

798

Other non-cash adjustment ...........................................................................................

(1,339)

968

1,539

Changes in operating assets and liabilities:

Accounts receivable, net .....................................................................................

37,202 (16,062) (10,258)

Unbilled receivables............................................................................................

7,086

8,768

1,111

Inventory.............................................................................................................

1,194

(3,941)

(1,703)

Deferred project costs and other current assets ...................................................

108

1,376

(2,251)

Other assets .........................................................................................................

(2,772)

1,316

3,882

Accounts payable and accrued expenses............................................................. (13,464) (10,441)

779

Accrued payroll and related liabilities ................................................................

(4,028)

1,063

2,804

Deferred revenue.................................................................................................

(1,718)

5,184

(5,893)

Other liabilities....................................................................................................

(1,254)

108

(4,890)

Subtotal – Changes in operating assets and liabilities............................................................

22,354 (12,629) (16,419)

Net cash provided by operating activities ..............................................................................

48,193

37,924

31,648

Investing activities:

Acquisitions, net of cash acquired .........................................................................................

— (20,786) (16,066)

Purchases of property and equipment .................................................................................... (10,736) (17,761) (21,090)

Purchases of marketable securities......................................................................................... (12,697)

(6,630) (24,104)

Proceeds from sale and maturity of marketable securities .....................................................

7,316

10,587

40,250

Capitalized software development costs ................................................................................

(1,954)

(1,881)

(2,478)

Net cash used in investing activities ...................................................................................... (18,071) (36,471) (23,488)

Financing activities:

Payments on bank borrowings, notes payable, and capital lease obligations......................... (91,066) (55,664) (25,024)

Proceeds from bank and other borrowings.............................................................................

66,500

54,500

9,500

Excess tax (deficit) benefit from share-based payment arrangements ...................................

—

(1,510)

4,746

Earn-out payment related to 2009 acquisition........................................................................

—

(3,863)

(3,213)

Payments of tax withholdings on restricted stock ..................................................................

(457)

—

—

Proceeds from exercise of employee stock options and sale of stock ....................................

182

809

1,509

Net cash used in financing activities ...................................................................................... (24,841)

(5,728) (12,482)

Net increase (decrease) in cash

............................................................................................

5,281

(4,275)

(4,322)

Cash and cash equivalents at the beginning of the year .........................................................

36,623

40,898

45,220

Cash and cash equivalents at the end of the year

.............................................................. $ 41,904 $ 36,623 $ 40,898

See accompanying Notes to Consolidated Financial Statements.