F-17

Goodwill

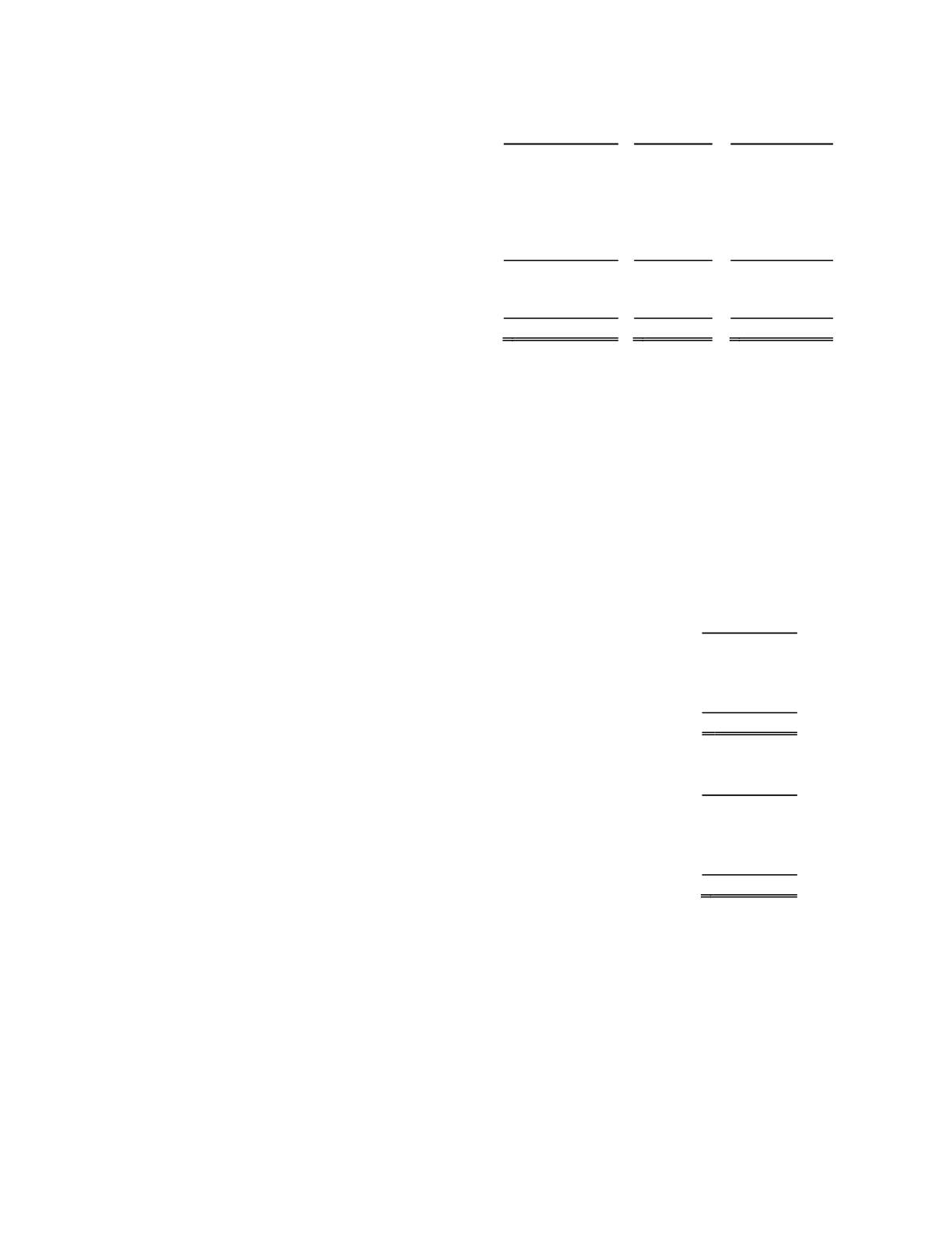

The balances and changes in amount of goodwill are as follows:

Commercial

Segment

Government

Segment

Total

Balance as of December 31, 2011 ......................................... $

122,454 $

54,023 $

176,477

Adjustments to the purchase price allocation for the

acquisition of Trident ..............................................

—

273

273

Goodwill from acquisition of microDATA..................

22,032

—

22,032

Impairment charge related to the adjusted fair value

of the Navigation reporting unit ..............................

(86,332)

—

(86,332)

Balance as of December 31, 2012 .........................................

58,154

54,296

112,450

Impairment charge related to the adjusted fair value

of the Platforms and Applications reporting unit ....

(8,209)

—

(8,209)

Balance as of December 31, 2013 ......................................... $

49,945 $

54,296 $

104,241

We assess goodwill for impairment in the fourth quarter of each year, or sooner should there be an indicator of impairment. We

periodically analyze whether any such indicators of impairment exist. Such indicators include a sustained, significant decline in the

Company’s stock price and market capitalization, a decline in the Company’s expected future cash flows, a significant adverse change

in legal factors or in the business climate, unanticipated competition, and/or slower expected growth, among others. For goodwill

impairment testing, we have four reporting units. In 2013, we reorganized the Commercial Segment in order to better conform and

integrate the product lines and create efficiencies, so that one management team is now responsible for all Commercial

Platforms &

Applications

other than the 9-1-1

Safety and Security

part of the Commercial Segment. Previously, our Commercial Segment was

comprised of

Navigation

and

Other Commercial

reporting units. Our two Government Segment reporting units, the

Government

Solutions Group

(“GSG”) unit and the

Cyber Intelligence

unit, remain the same.

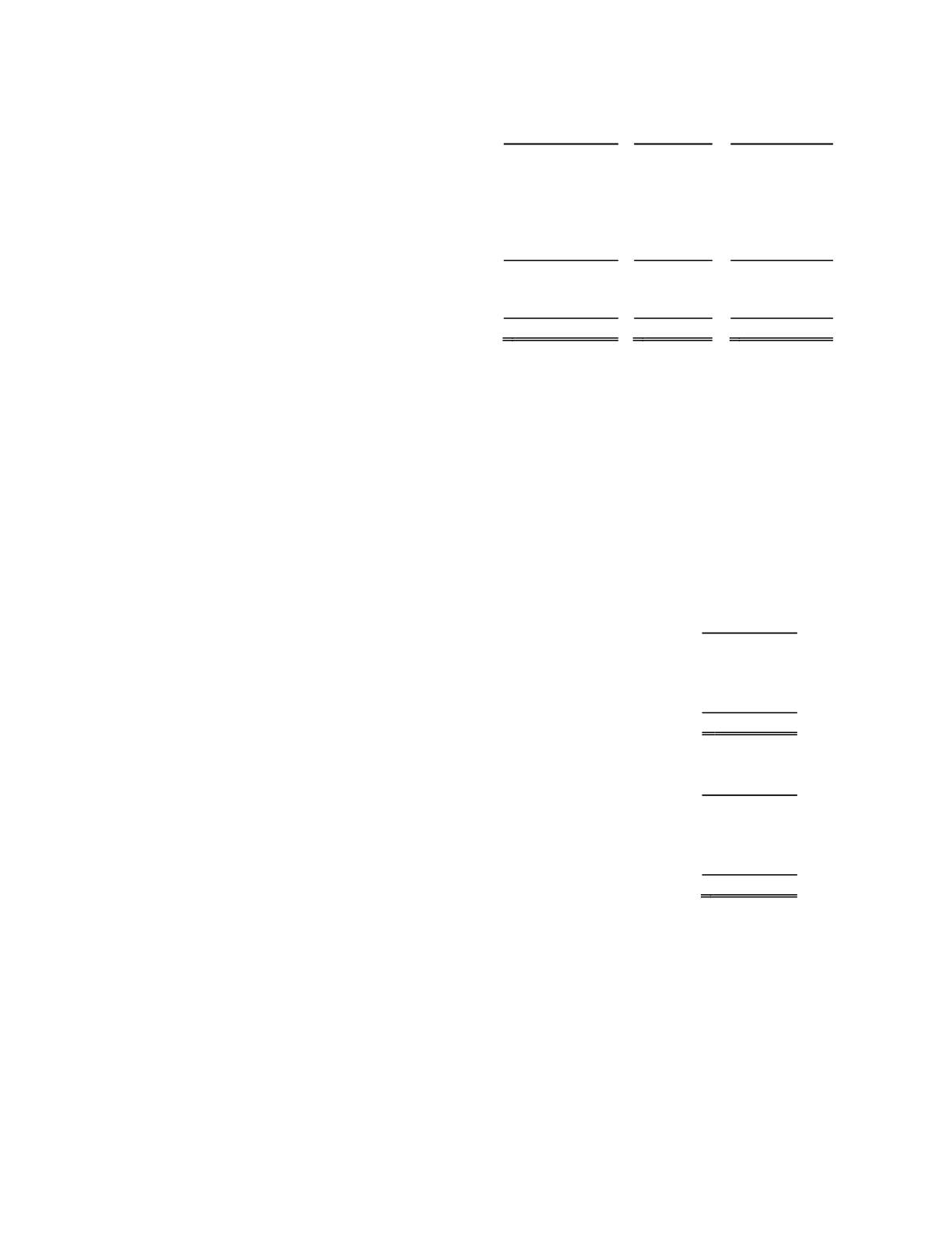

Goodwill balances by reporting unit:

December 31,

2013

Platforms and Applications .......................................................................................... $

27,912

Safety and Security Group ...........................................................................................

22,033

Government Solutions Group.......................................................................................

26,141

Cyber Intelligence ........................................................................................................

28,155

Total goodwill..................................................................................................... $

104,241

December 31,

2012

Navigation .................................................................................................................... $

22,102

Other Commercial ........................................................................................................

36,052

Government Solutions Group.......................................................................................

26,141

Cyber Intelligence ........................................................................................................

28,155

Total goodwill..................................................................................................... $

112,450

Our fourth quarter 2013 impairment testing resulted in the write-down of our Platforms and Applications reporting unit’s

goodwill from a carrying value of $36,121 to the estimated fair value of $27,912 at December 31, 2013, resulting in an impairment

charge of $8,209. We used a discounted cash flow method to determine to determine the fair value of the goodwill of the Platforms

and Applications Reporting Unit.

In performing our 2013 testing for our Safety and Security and Cyber Intelligence reporting units, we used a discounted cash

flow method as well as a market approach based on observable public comparable company multiples of revenue and earnings before

interest taxes depreciation and amortization (“EBITDA”) and weighted the results from the two methods to estimate the reporting

units’ fair values. For our Government Solutions Group we used only a discounted cash flow method. Determining fair value requires

the exercise of significant judgment, including judgment about appropriate discount rates, the amount and timing of expected future

cash flows, as well as relevant comparable company multiples for the market comparable approach and the relevant weighting of the

methods utilized.