F-15

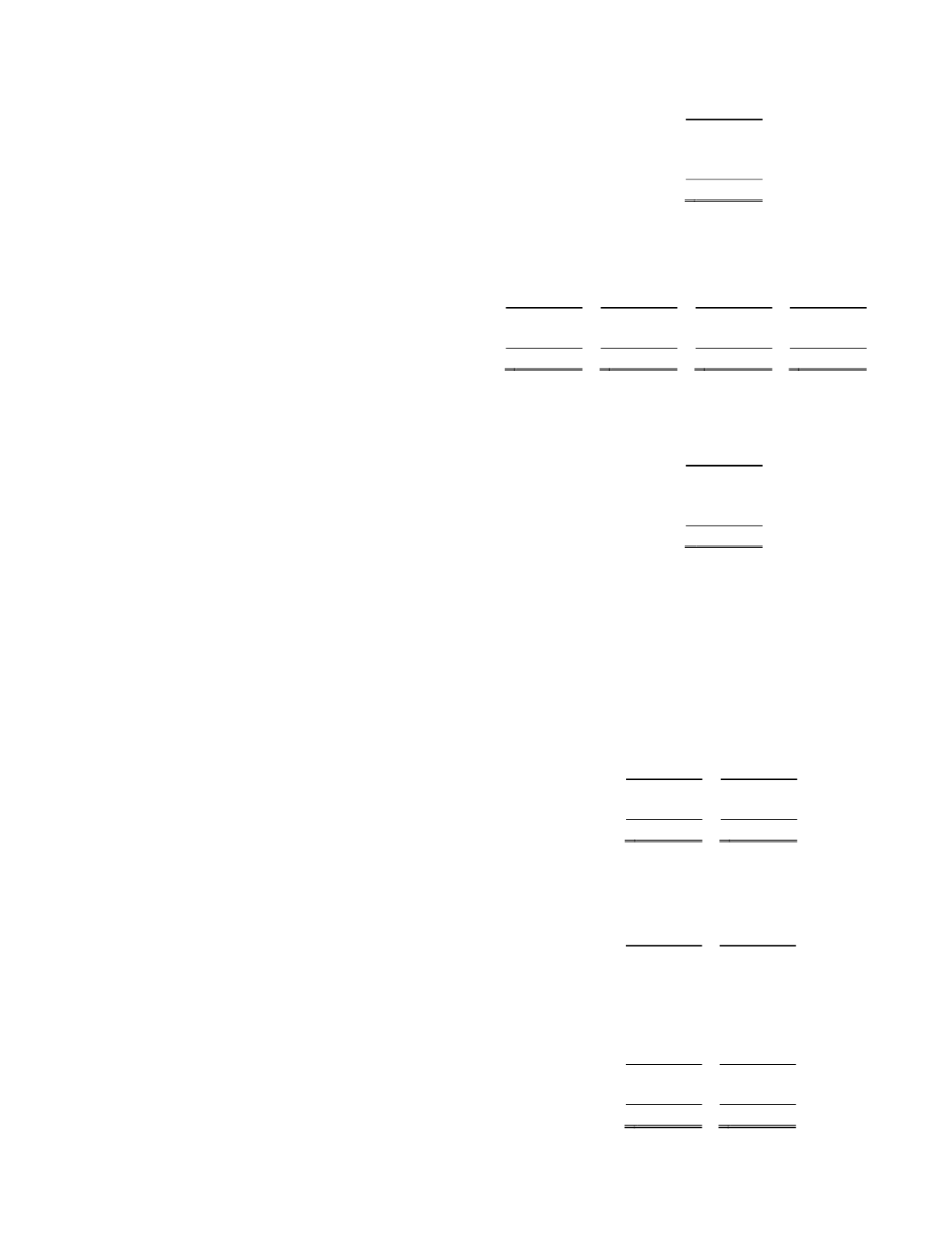

The following table summarizes the estimated fair value of available-for-sale marketable securities by contractual maturity at

December 31, 2013:

Fair Value

Due within 1 year or less ............................................................................... $

6,248

Due within 1-2 years......................................................................................

9,538

Due within 2-3 years......................................................................................

4,218

$ 20,004

The following is a summary of available-for-sale marketable securities at December 31, 2012:

Amortized

Cost Basis

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

Corporate bonds ......................................................................... $ 13,102 $

42 $

(3) $ 13,141

Mortgage-backed and asset-backed securities............................

1,732

3

(1)

1,734

Total marketable securities ............................................... $ 14,834 $

45 $

(4) $ 14,875

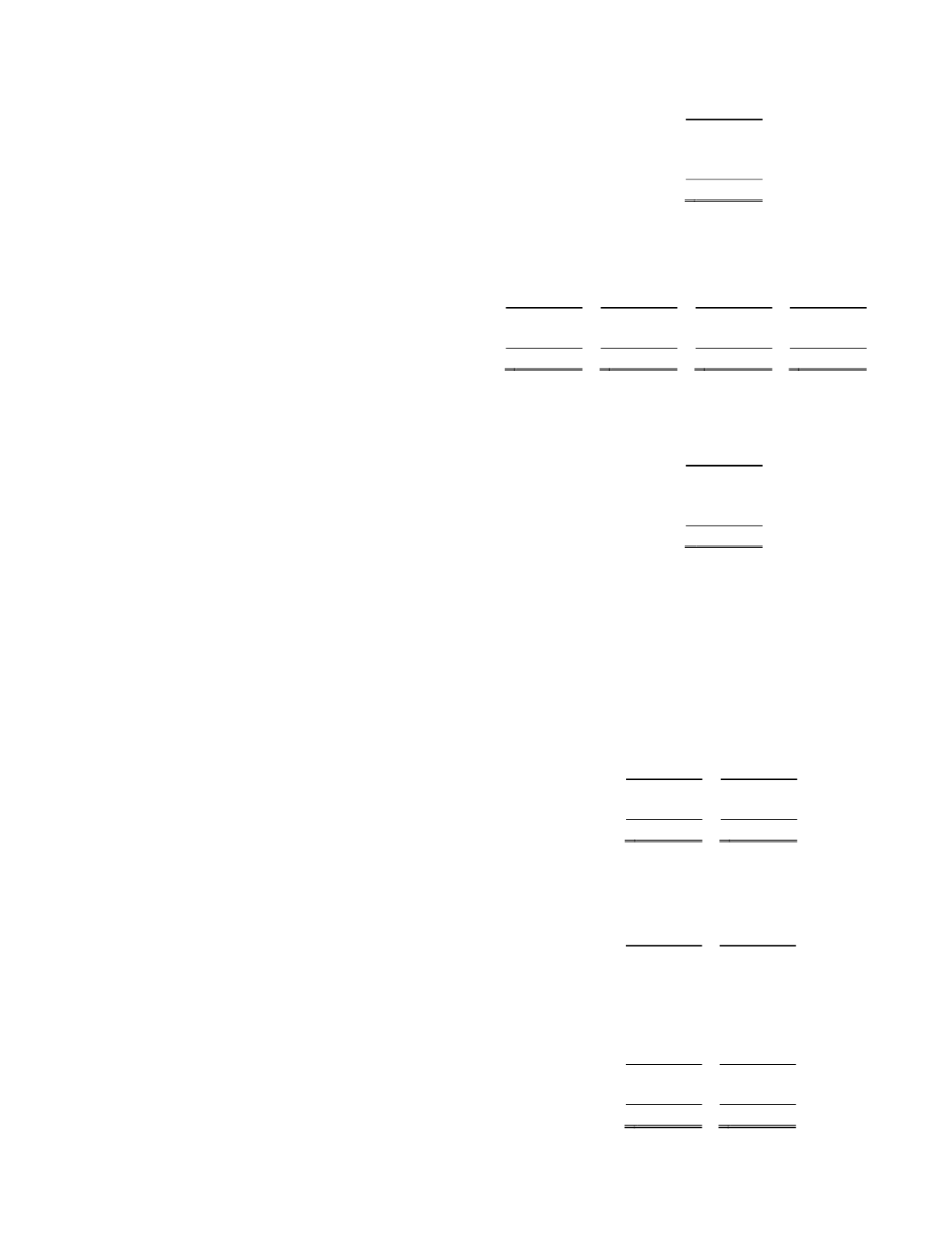

The following table summarizes the estimated fair value of available-for-sale marketable securities by contractual maturity at

December 31, 2012:

Fair Value

Due within 1 year or less ............................................................................... $

7,251

Due within 1-2 years......................................................................................

3,557

Due within 2-3 years......................................................................................

4,067

$ 14,875

6. Unbilled Receivables

Unbilled receivables consist of the excess of revenue earned in accordance with generally accepted accounting principles over

the amounts billed at contract milestones. Substantially all unbilled receivables are expected to be billed and collected within twelve

months.

7. Inventory

Inventory consisted of the following at December 31:

2013

2012

Component parts ..................................................................................... $

7,710 $

8,018

Finished goods ........................................................................................

2,180

3,066

Total inventory............................................................................... $

9,890 $ 11,084

8. Property and Equipment

Property and equipment consisted of the following at December 31:

2013

2012

Computer equipment .............................................................................. $ 59,499 $ 59,393

Computer software .................................................................................

38,097

49,088

Furniture and fixtures .............................................................................

3,648

3,457

Leasehold improvements........................................................................

9,097

8,265

Land .......................................................................................................

1,000

1,000

Vehicles..................................................................................................

82

117

Total property and equipment at cost............................................ 111,423 121,320

Less: accumulated depreciation and amortization.................................. (73,068) (72,050)

Net property and equipment ......................................................... $ 38,355 $ 49,270