F-16

In 2013 and 2012, we evaluated the recoverability of our Platforms and Applications and Navigation reporting units’ property

and equipment, respectively, by comparing the carrying amount of the assets to future undiscounted net cash flows that we expect to

generate from these assets. As a result of our review, we recorded impairment charges of $12,565 and $12,987, respectively. See Note

1 for further discussion.

9. Acquired Intangible Assets, Capitalized Software Development Costs, and Goodwill

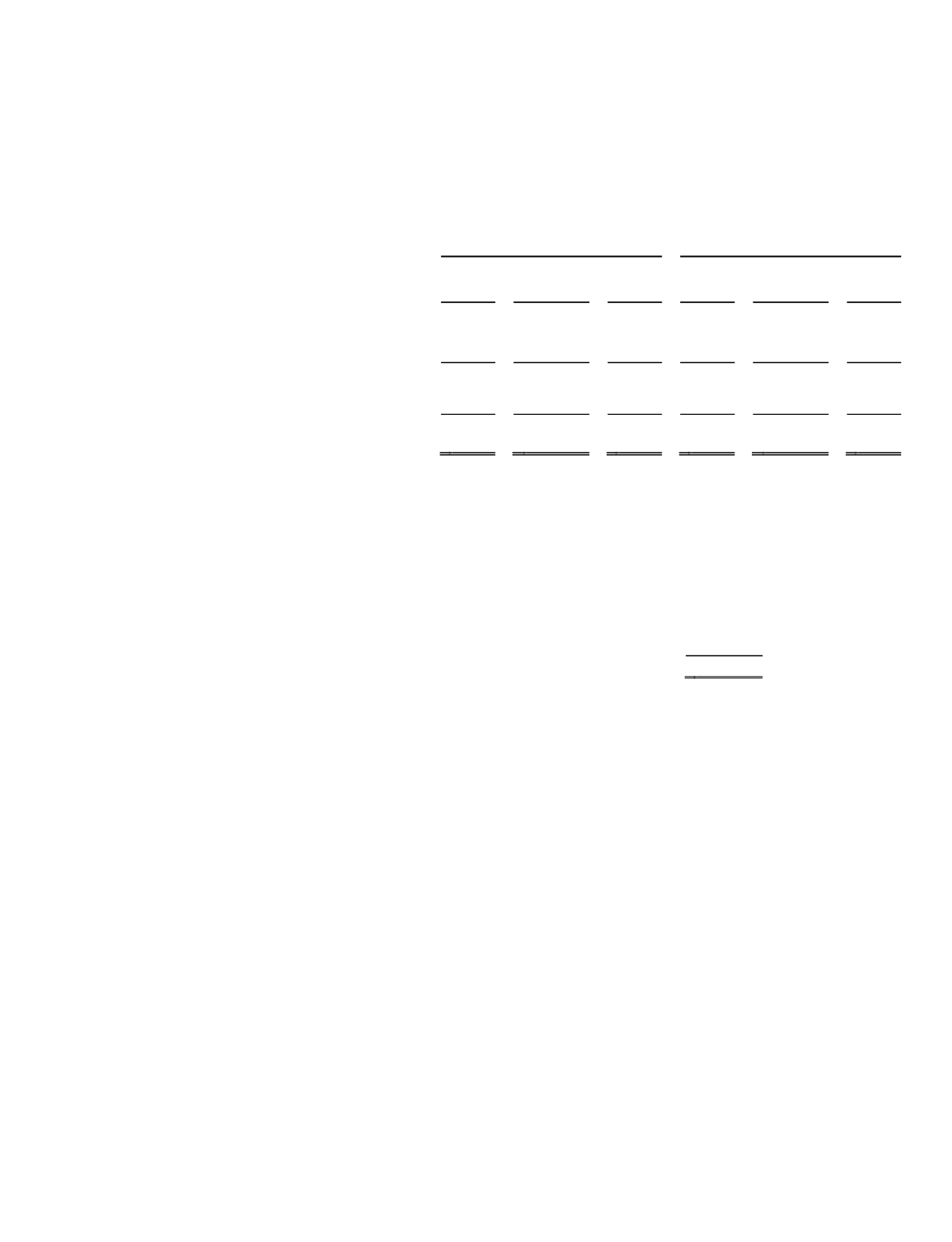

Our acquired intangible assets and capitalized software development cost balances consisted of the following:

December 31, 2013

December 31, 2012

Gross

Carrying

Amount

Accumulated

Amortization

Net

Gross

Carrying

Amount

Accumulated

Amortization

Net

Acquired intangible assets:

Customer lists and other ............................................... $31,176 $ 10,173 $21,003 $34,733 $

9,115 $25,618

Trademarks and patents ................................................

—

—

— 1,334

780

554

Total acquired intangible assets ............................................. $31,176 $ 10,173 $21,003 $36,067 $

9,895 $26,172

Software development costs ......................................... $ 5,969 $

1,791 $ 4,178 $46,246 $ 27,317 $18,929

Total acquired intangible assets and software development

costs................................................................................... $37,145 $ 11,964 $25,181 $82,313 $ 37,212 $45,101

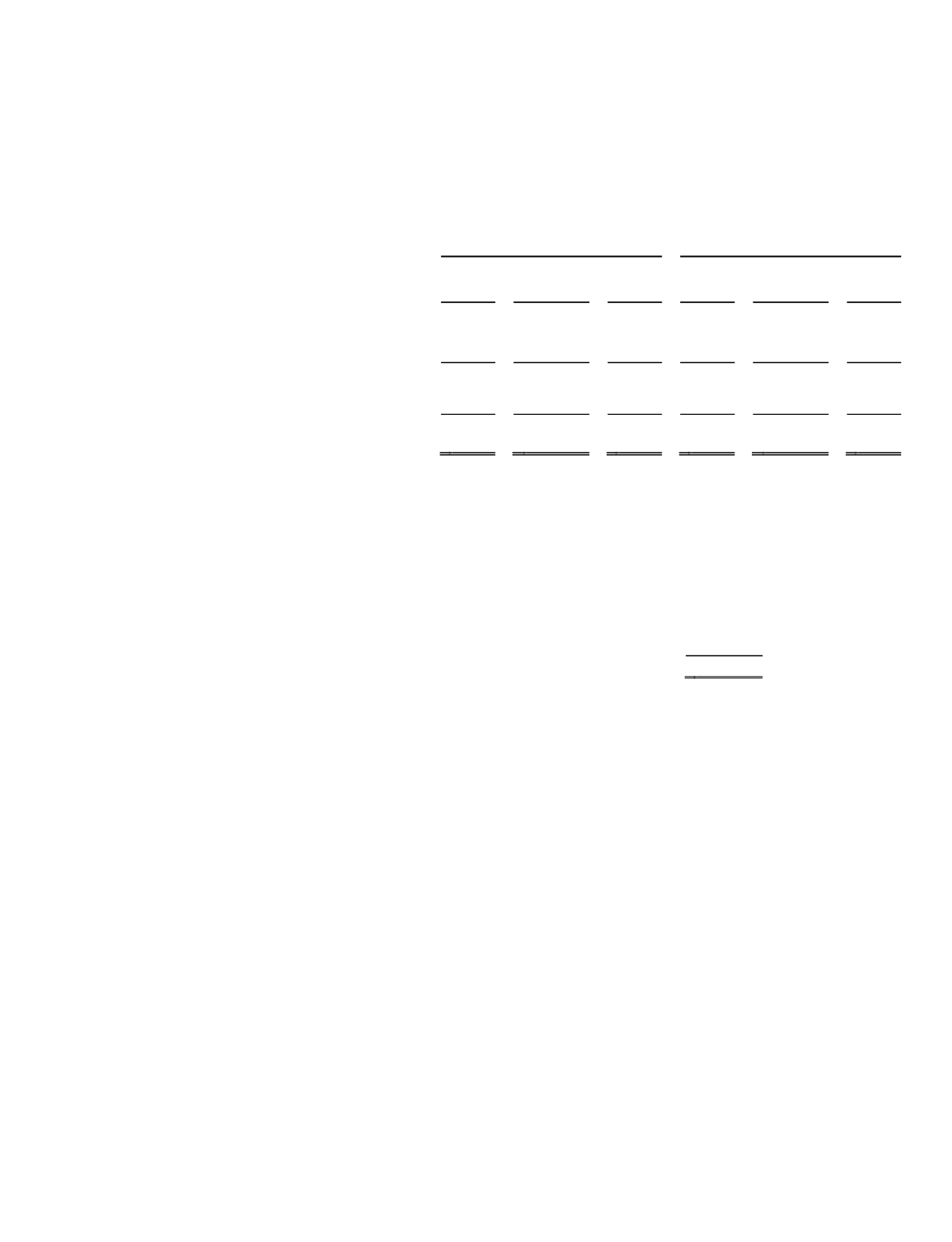

Estimated future amortization expense:

Year ending December 31, 2014 .................................................. $

3,336

Year ending December 31, 2015 ..................................................

4,632

Year ending December 31, 2016 ..................................................

4,632

Year ending December 31, 2017 ..................................................

3,856

Year ending December 31, 2018 ..................................................

3,065

Thereafter ...............................................................................................

5,660

$ 25,181

Acquired intangibles

In 2013 we recorded a $599 Platforms and Applications reporting unit impairment charge for the excess of the carrying value of

acquired intangible assets over the estimated fair value. In 2012, we recorded a $13,964 Navigation reporting unit impairment charge

for the excess of the carrying value of acquired intangible assets over the estimated fair value. The weighted average remaining

amortization period for customer lists and other as well as acquired technology included in software development costs is 3.6 years.

Capitalized software development costs

In 2013, 2012, and 2011 we capitalized $1,987, $1,890, and $2,497, respectively, of software development costs for location-

based software projects after the point of technological feasibility had been reached but before the products were available for general

release. We routinely update our estimates of the recoverability of the software products that have been capitalized as the basis for

evaluating the carrying values and remaining useful lives of the respective assets. In 2013, we recorded an impairment charge of

$9,270 related to our Platforms and Applications reporting unit. In 2012, we recorded an impairment charge related to our Navigation

reporting unit of $12,420.