F-14

and 2011, the Company’s share price was less than the warrant exercise price of $12.74, therefore no value was assigned to the

warrants in the table below because the effect of their inclusion would have been anti-dilutive.

These potentially dilutive securities consist of stock options, and restricted stock, discussed in Notes 1 and 18, using the

treasury-stock method and from convertible notes as discussed in Note 12, using the “if converted” method.

Our two classes of common stock (Class A and B) share equally in dividends declared or accumulated and have equal

participation rights in undistributed earnings. Additionally our unvested restricted stock does not contain non-forfeitable rights to

dividends and dividend equivalents. As such, unvested shares of restricted stock are not participating securities and our basic and

diluted earnings per share are not impacted by the two class method of computing earnings per share.

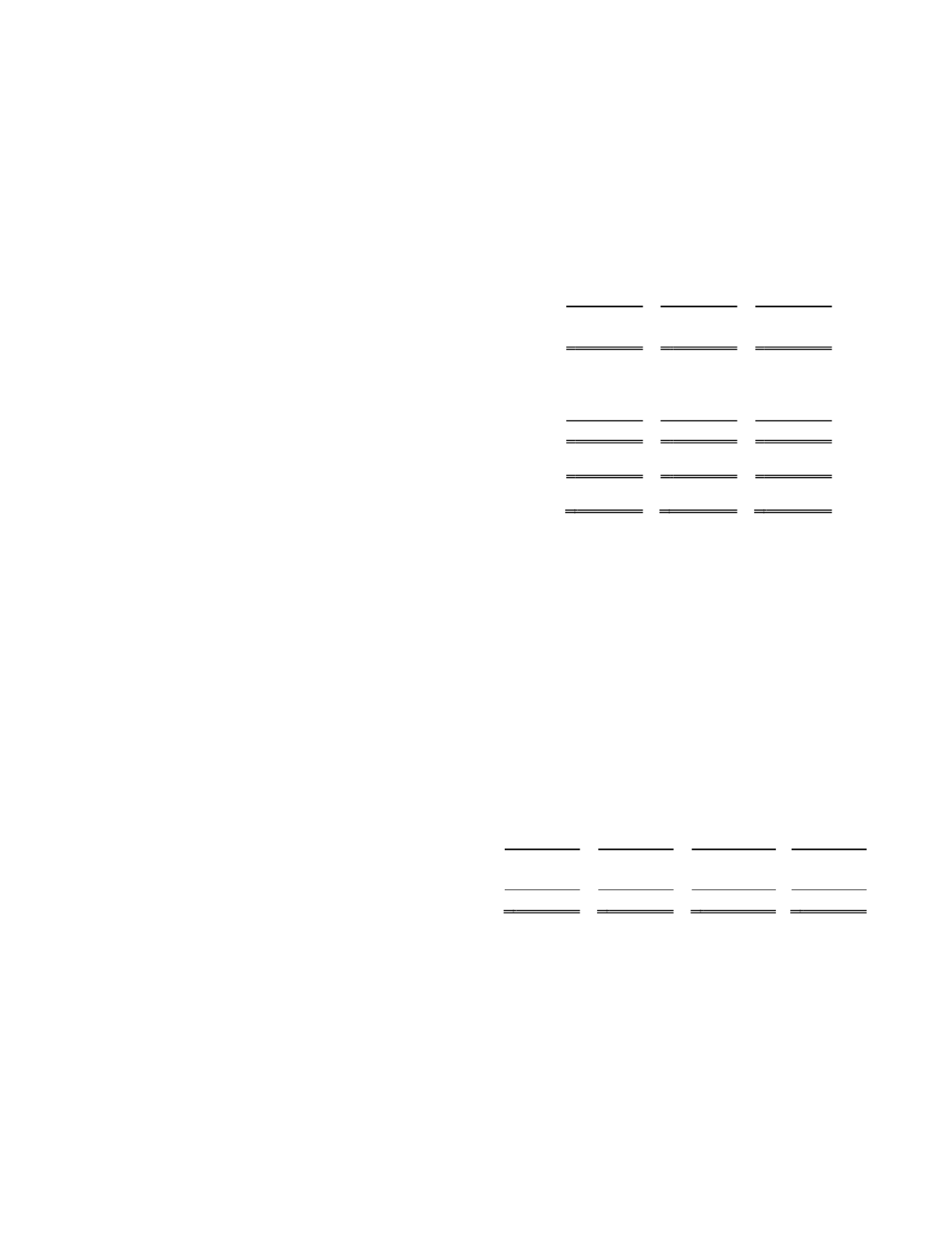

The following table summarizes the computations of basic and diluted earnings per share for the years ended December 31:

2013

2012

2011

Numerator:

Net income (loss), basic and diluted .................................................... $ (58,597) $ (97,988) $

7,004

Denominator:

Total basic weighted-average common shares outstanding .................

58,611

57,889

56,722

Net effect of dilutive stock options based on treasury stock method ...

—

—

1,859

Adjusted weighted average diluted shares ...........................................

58,611

57,889

58,581

Net income (loss) per share — basic ................................................... $

(1.00) $

(1.69) $

0.12

Net income (loss) per share — diluted................................................. $

(1.00) $

(1.69) $

0.12

4. Supplemental Disclosure of Cash Flow Information

Property and equipment acquired under capital leases totaled $6,022, $4,930, and $5,276 during the years ended December 31,

2013, 2012, and 2011, respectively.

Interest paid totaled $8,105, $6,366, and $6,675 during the years ended December 31, 2013, 2012, and 2011, respectively.

Income taxes and estimated state income taxes refunded during the year ended December 31, 2013 totaled $497. Income taxes

and estimated state taxes paid during the years ended December 31, 2012 and 2011 totaled $1,248, and $491, respectively.

5. Marketable Securities

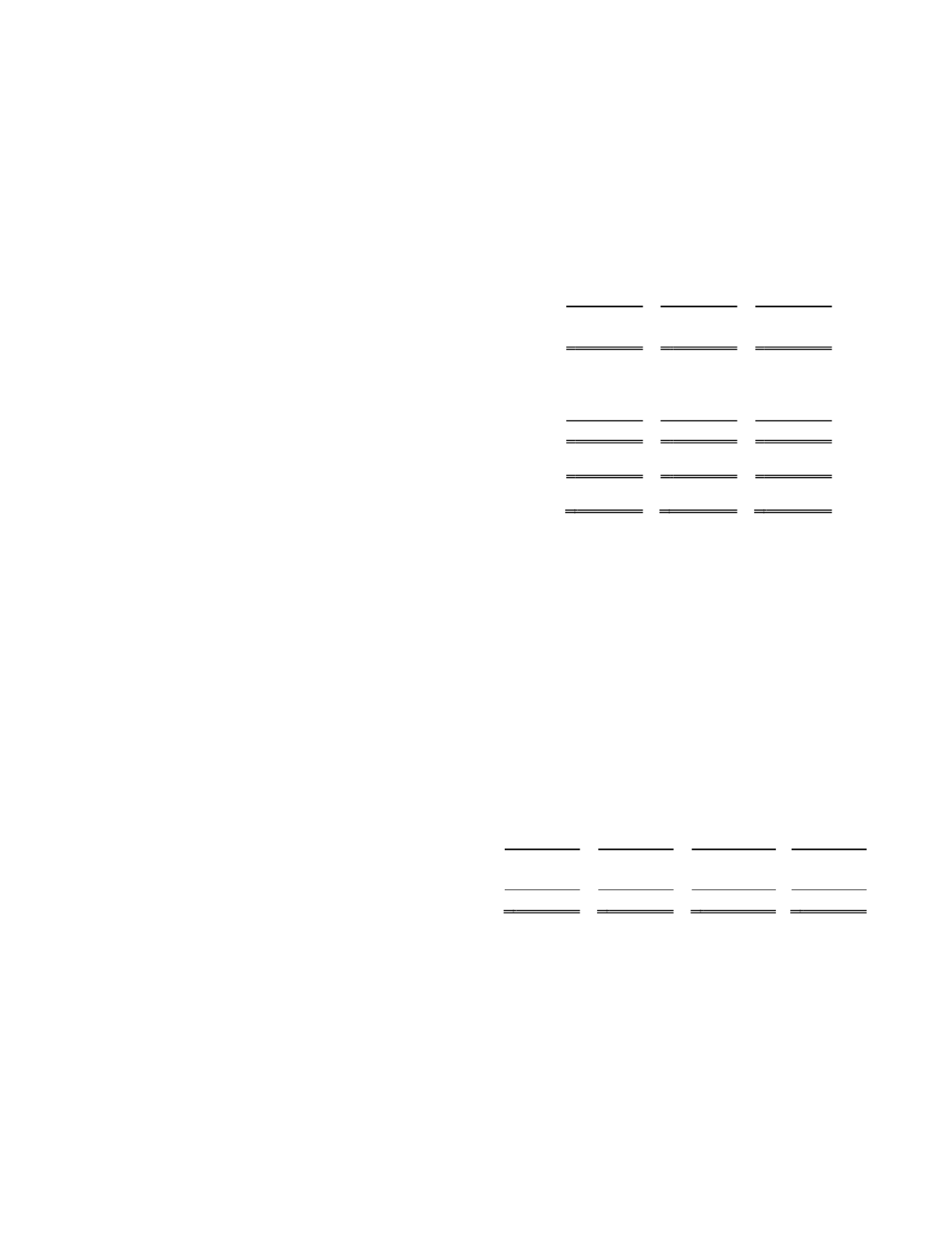

The following is a summary of available-for-sale marketable securities at December 31, 2013:

Amortized

Cost Basis

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

Corporate bonds ......................................................................... $ 18,798 $

41 $

(6) $ 18,833

Mortgage-backed and asset-backed securities............................

1,170

1

—

1,171

Total marketable securities ............................................... $ 19,968 $

42 $

(6) $ 20,004