FINANCIAL INFORMATION

Our results demonstrate our continued progress on financial and operating priorities to support our long-term growth strategy and business transformation.

2016 marked a number of strategic milestones for Intelsat as we continued to focus on bringing high performing, more efficient and accessible satellite technology into service. We successfully launched four new satellites, introduced our IntelsatOne® Flex and IntelsatOne® Prism managed services and continued to make progress on bringing new, innovative ground and antenna technology to market with our partners, Kymeta and Phasor.

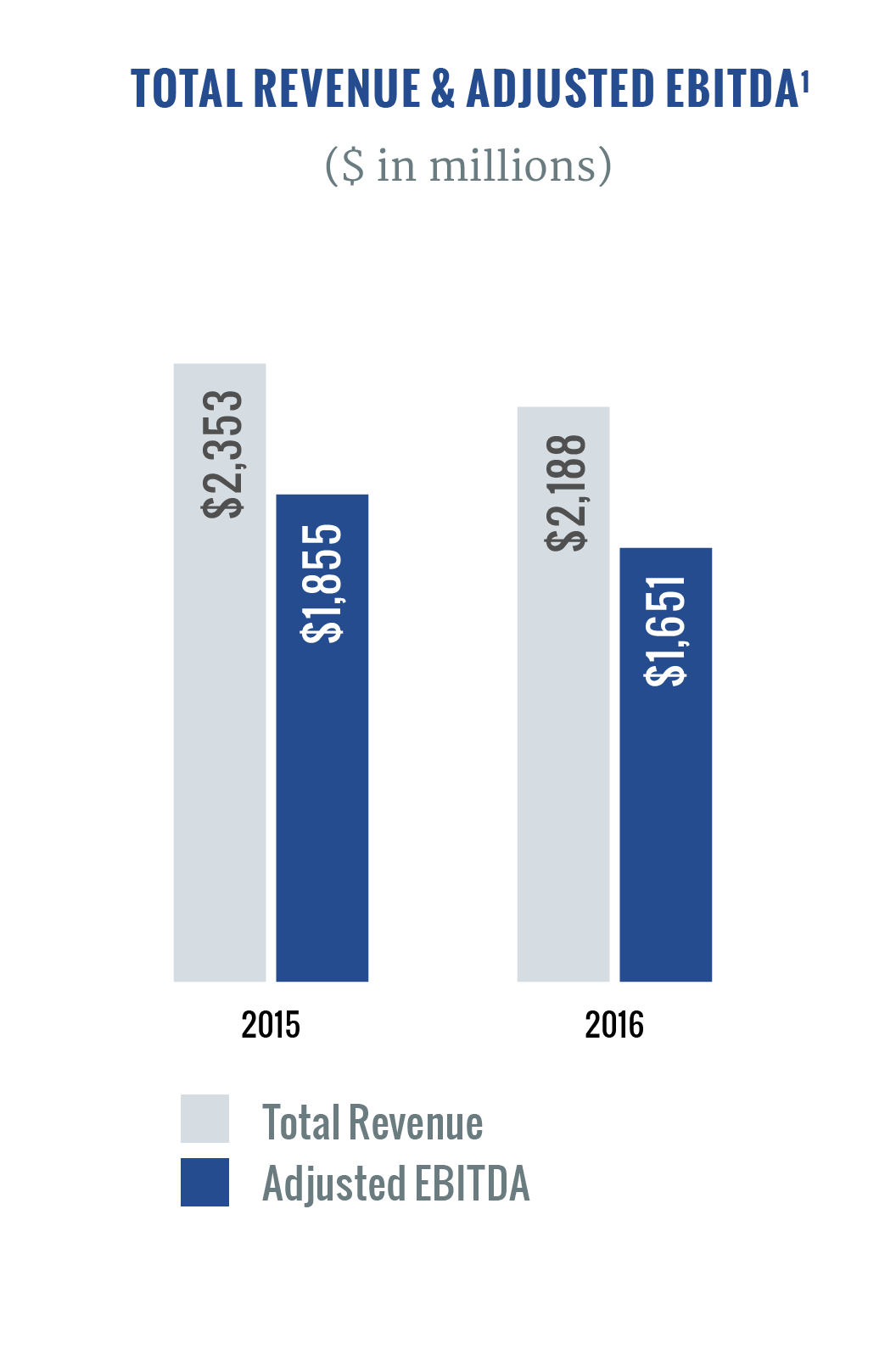

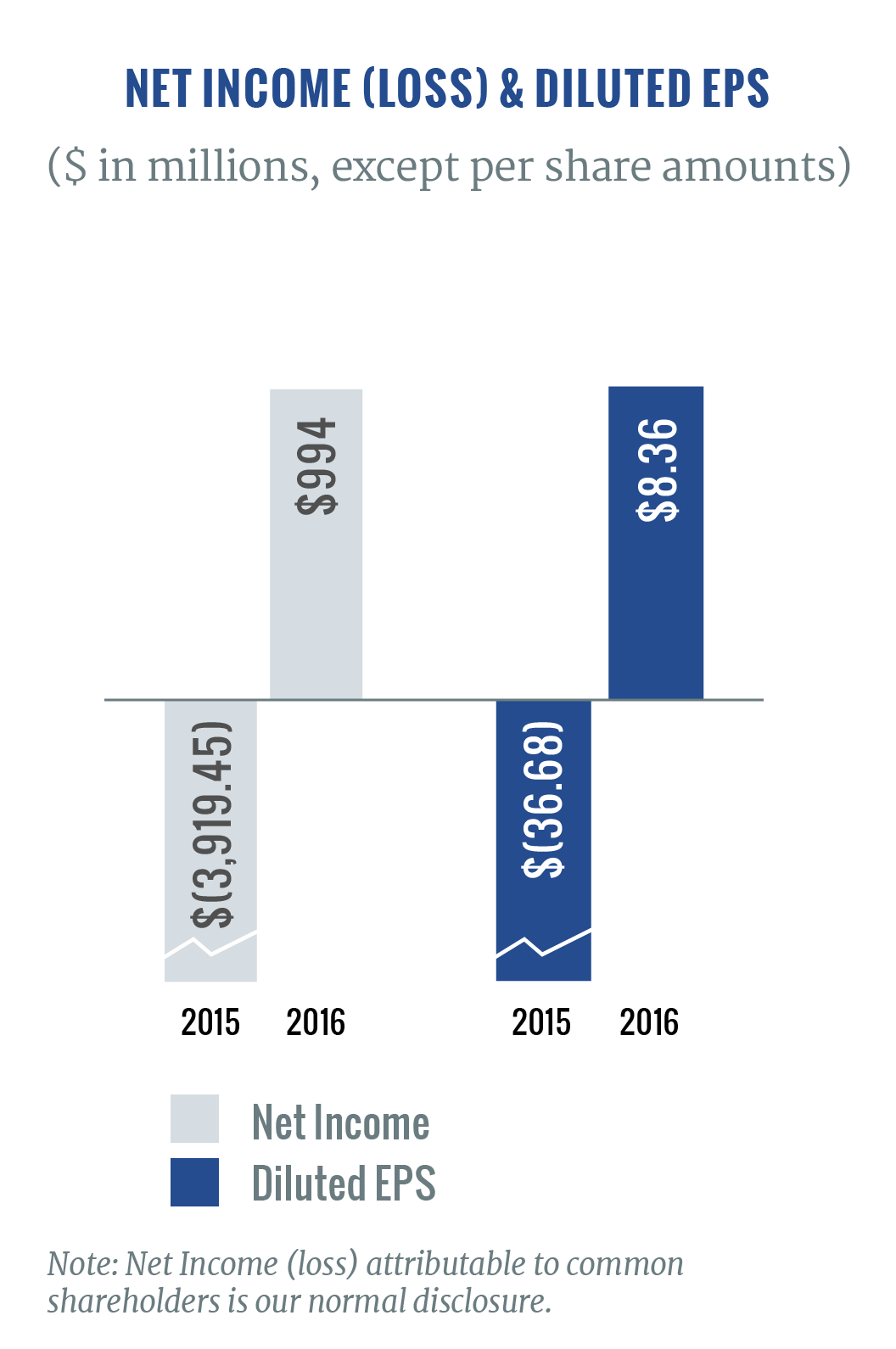

2016 revenue and Adjusted EBITDA1, of $2.188 billion and $1.651 billion, respectively, declined 7 percent and 11 percent, respectively, as compared to the prior year results, in-line with our guidance set early in 2016. 2016 results reflected continued pricing pressure resulting from oversupply conditions of widebeam capacity, reduced revenue from point-to-point telecommunications infrastructure services moving to fiber alternatives and limited new U.S. government opportunities as compared to the prior year. However, these trends were partially offset as new satellites entered service as the year progressed, including two fully committed direct-to-home satellites and two of our new Intelsat EpicNG satellites.

In 2016, we saw a decrease in our 2016 Adjusted EBITDA1 margin of 75 percent of revenue, as compared to 79 percent of revenue in 2015, reflecting an increase in bad debt, primarily related to certain customers in the Latin America region, and staff-related expenses.

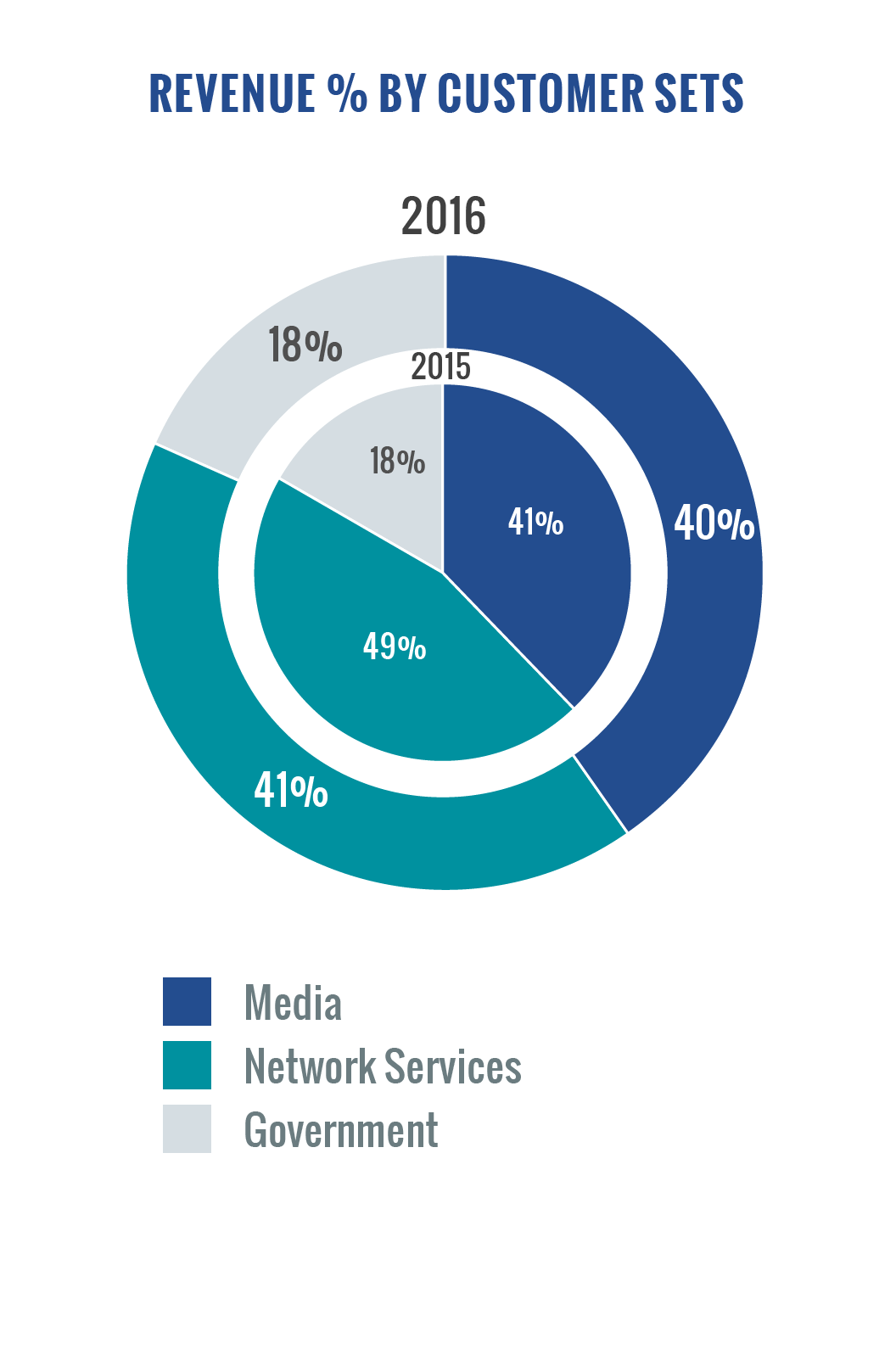

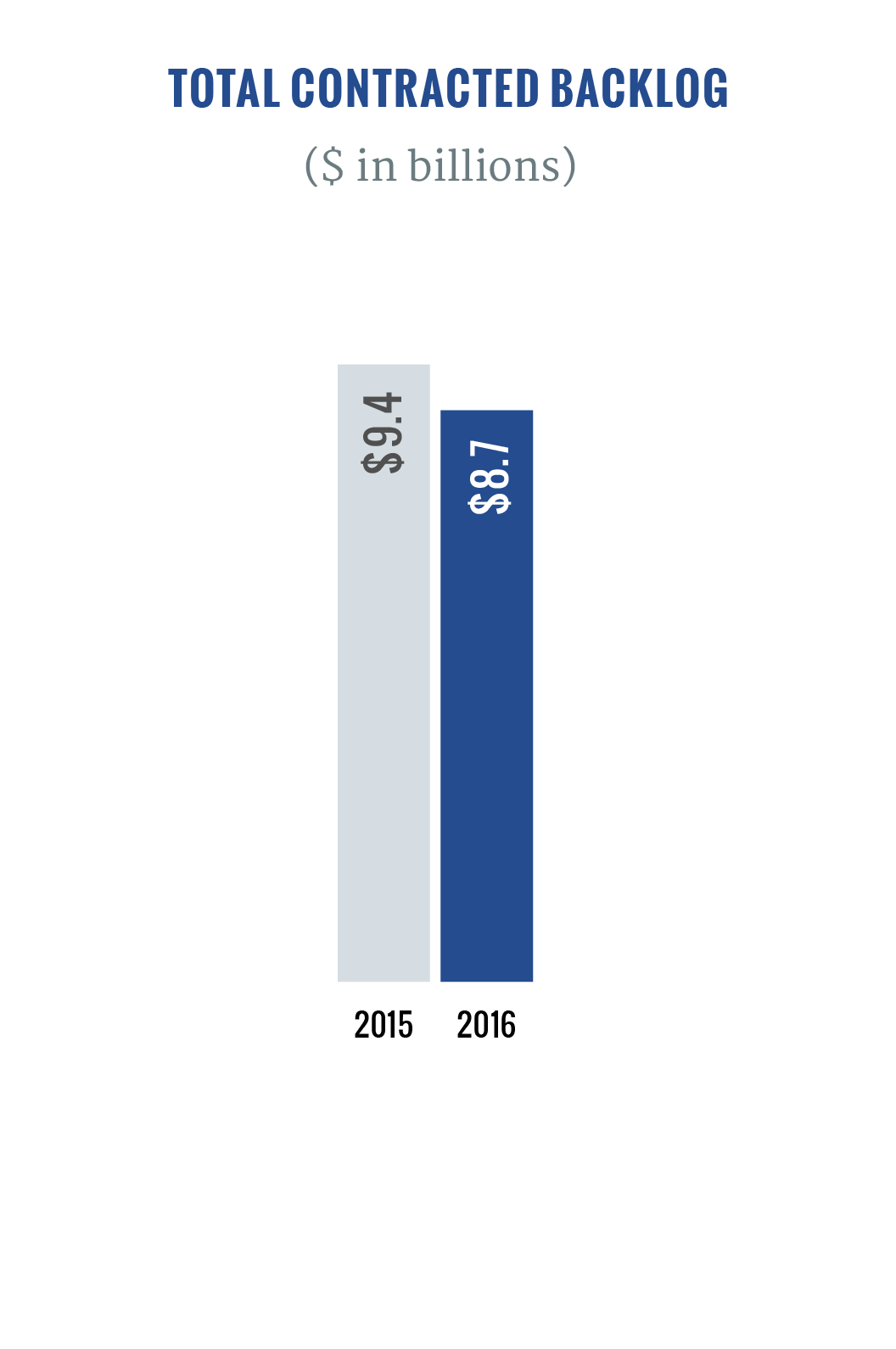

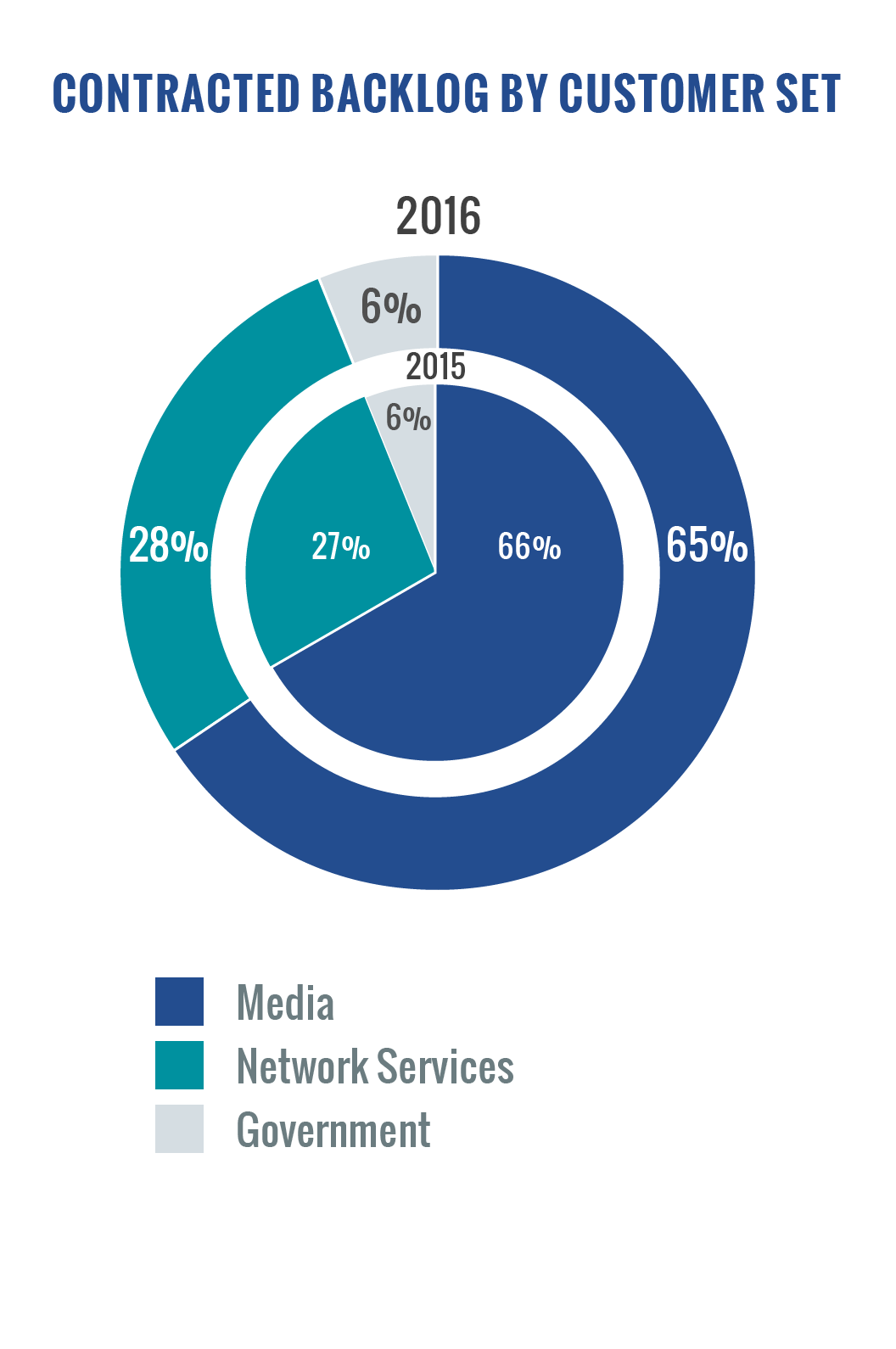

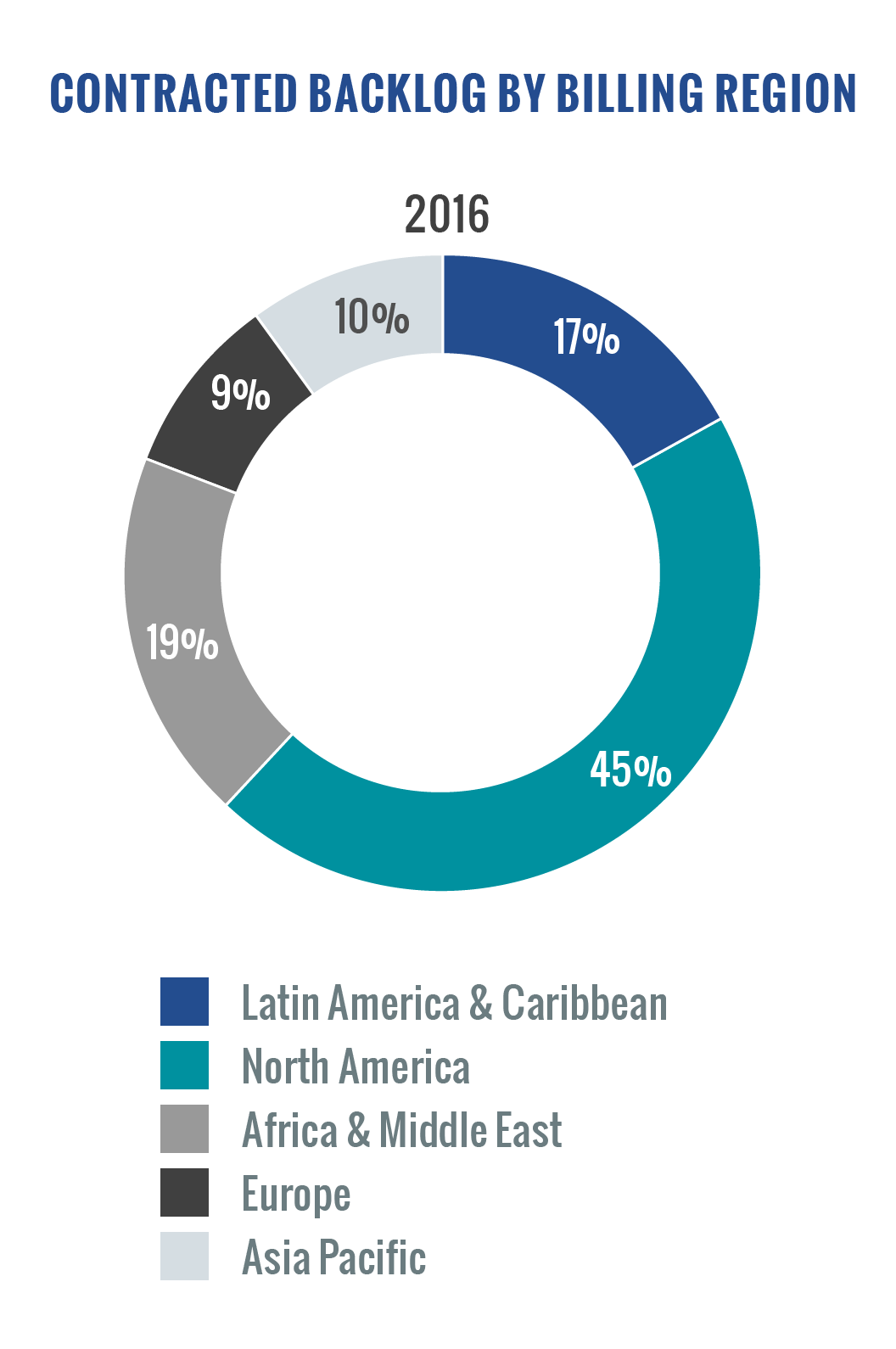

Contracted backlog ended the year at $8.7 billion, as compared to $8.9 billion at September 30, 2016. At 4.0 times trailing 12 months revenue (from January 1, 2016 to December 31, 2016), our backlog remains sizable and we believe it provides a solid foundation for predictable cash flow and investment in our business. The largest proportion of our backlog is related to our long-term media contracts.

In 2016, we invested $733 million for satellites and other property and equipment as we continue to build and launch satellites that enhance our Globalized Network.

$733 million

We invested $733 million for satellites and other property and equipment as we continue to build and launch satellites that enhance our Globalized Network.

Intelsat’s Capital Structure

Over the course of 2016, a number of our subsidiaries, including Intelsat Jackson Holdings S.A. (“Intelsat Jackson”), Intelsat Luxembourg S.A. (“Intelsat Luxembourg”), and Intelsat Connect Finance S.A. (“ICF”) conducted a number of liability management initiatives, with the objective of enhancing liquidity, addressing maturities and capturing value for our shareholders. The individual transactions are summarized below and outlined in greater detail in Intelsat’s annual report for the year ended December 31, 2016, filed with the SEC on Form 20-F in February 2017.

DEBT TRANSACTION |

|

COMPLETION DATE |

| Intelsat Jackson Senior Secured Notes Offering |

|

March 2016 |

| Intelsat Jackson Notes Repurchases |

|

May 2016 |

| Subsidiary Guarantee of Intelsat Jackson's 65/8% Senior Notes due 2022 |

|

May 2016 |

| Intelsat Jackson Tender Offers and Senior Secured Notes Issuance |

|

May 2016 |

| Intelsat Jackson Tender Offers and Senior Secured Notes Issuance |

|

July 2016 |

| Intelsat Jackson Debt Exchange and Consent Solicitation |

|

September 2016 |

| First 2018 Intelsat Luxembourg Exchange |

|

December 2016 |

| 2021 Intelsat Luxembourg Exchange |

|

December 2016 |

| 2023 Intelsat Luxembourg Exchange |

|

December 2016 |

| Intelsat Luxembourg Exchange Offer |

|

January 2017 |

1In this 2016 Annual Report, financial measures are presented both in accordance with U.S. GAAP and also on a non-U.S. GAAP basis. EBITDA, Adjusted EBITDA ("AEBITDA"), free cash flow from (used in) operations and related margins included in this Annual Report are non-U.S. GAAP financial measures. Please see the consolidated financial information found in our found in our Annual Report on Form 20-F and available on our website for information reconciling non-U.S. GAAP financial measures to comparable U.S. GAAP financial measures.