Dear Stockholders

Fiscal 2010 was a year of outstanding performance for Sally Beauty Holdings. It was a year in which we continued to strengthen the Company’s financial position, invest in growth, and de-lever the balance sheet.

During the year, important milestones were set: we opened our 4,000th store,

increased consolidated net earnings by 45%, topped $1 billion in annual sales at

Beauty Systems Group (BSG) and reached a record annual gross margin of 53% at Sally

Beauty Supply. We also executed on our strategic objectives in fiscal 2010, including

growth of 145 stores, gross margin expansion of 100 basis points, and a reduction in

our long-term debt by $125 million.

I am proud of our extraordinary associates around the world who helped deliver this

terrific performance, and I am pleased to share with you the following fiscal year 2010 results:

Consolidated Financial Results

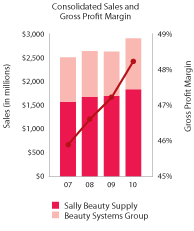

Consolidated net sales in fiscal year 2010 grew 10.6% to $2.9 billion, driven by strong performance in both our business segments. Consolidated same store sales grew 4.6% compared to 1.8% in fiscal 2009. Gross profit margin was 48.2% (expansion of 100 basis points), and net earnings finished the year at $143.8 million, an increase of 45.1%. Diluted earnings per share reached $0.78 for a year-over-year growth of 44.4%. We generated over $217 million in net operating cash, which funded our investments in company growth and reduction in long-term debt.

We reduced debt by $125 million, ending the fiscal year with a remaining balance of $1.56 billion compared to $1.68 billion of debt at fiscal year-end 2009.

In fiscal year 2010, we grew our store base by 3.7% for a total count of 4,059 stores, including 404 international Sally Beauty Supply stores located in the United Kingdom, Ireland, Belgium, France, Spain, Germany and Chile. Looking ahead, we expect a higher percentage of our store growth to come from outside the United States. In fiscal year 2011, we believe we can achieve consolidated store growth of 4% to 5%.

Sally Beauty Supply

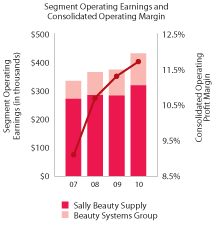

Net sales at our Sally Beauty Supply segment were $1.8 billion, an increase of 8.2%. Sales growth was driven by same store sales growth of 4.1%, higher transaction volume and average ticket, and improvement in our international businesses. Gross margin reached a record annual high of 53.2%, an increase of 140 basis points over fiscal 2009. The consistent shift in product and customer mix continues to boost our gross margin performance. Segment operating earnings were $320.5 million, up 12.9% from $283.9 million in fiscal 2009. Segment operating margins reached 17.5% of sales, up 80 basis points from 16.7% in fiscal 2009.

On the marketing side for Sally Beauty Supply, we continue to realize positive results from our customer acquisition strategy. Our targeted marketing efforts reached just over 20 million prospective customers this year, resulting in an increase in Beauty Club Card memberships. Our data shows that the average sale for a Beauty Club Card member is consistently higher, and the member shops more often than a non-Beauty Club Card member. We expect to continue similar investments in our target marketing efforts in fiscal 2011 and beyond.

Beauty Systems Group (BSG)

Our Beauty Systems Group segment grew net sales 14.9% over fiscal 2009 and topped the $1.0 billion mark to reach $1.1 billion. This strong performance was primarily driven by 6.2% growth in same store sales, acquisitions, and 36 net new stores. Gross margin reached 39.6%, up 90 basis points from fiscal 2009. Gross margin performance was driven by favorable customer and product mix. Segment operating earnings were $112.5 million, up 22.8% over $91.6 million in fiscal 2009. Operating margins improved by 70 basis points to reach 10.4% of sales. BSG’s efforts to rationalize costs and leverage Selling, General & Administrative Expenses (SG&A) contributed to our strong margin performance. BSG ended the fiscal year with 1,027 stores, including 159 franchises, and 1,051 distributor sales consultants.

Our strategy at BSG remains the same — to continue store expansion both organically and through acquisitions to increase our footprint in existing geographies and new territories.

Looking Ahead

We enter fiscal year 2011 with great results behind us and a great future ahead. I look forward to the upcoming year because I know we have the right team in place and a strong foundation for growth. We will stay on course with our stated strategic objectives and direct our resources to the greatest potential for long-term growth, profitability and shareholder return.

Our strategic objectives remain unchanged:

• To grow our annual store base 4% to 5% and, when appropriate, make strategic and synergistic acquisitions;

• To improve margins and increase profitability;

• And lastly, to continue to de-lever our balance sheet.

We are grateful for your continued support of Sally Beauty Holdings, Inc.

Gary G. Winterhalter

President and Chief Executive Officer