The development of new hotels is the engine behind Rezidor’s growth. We are one of the fastest-growing hotel companies worldwide and focus on profitable, asset-light growth. Our key regions for future development are the emerging markets of Russia/CIS and the African continent.

Focus on emerging markets

Russia/CIS and Africa are exciting, up-and-coming markets with enormous natural resources, increasingly stable political and economic systems, considerably improved infrastructure, a high GDP growth. Last, but not least, they have an imbalance of supply and demand in terms of internationally branded hotel rooms. In many African capitals, the existing hotel inventory is old and dated. These countries are a perfect fit for our business model: we expand our portfolio mainly through management contracts that have limited or no downside, allowing us to maintain complete control of the high quality of our brands.

In the 1990s, Rezidor was one of the first international hotel operators to enter Russia, and our pioneering spirit has paid off. Today, we are the leading international player in the hospitality markets of Russia, the CIS and the Baltics – with our own fully fledged branch office in Moscow. We have 36 hotels with 9,600 rooms in operation, and a further 26 properties with 5,900 rooms under development. In 2010, we opened a new flagship: the luxurious Radisson Royal Hotel, Moscow. Housed in one of the famous “Seven Sisters” skyscrapers, the former Hotel Ukraina, re-opened its doors after a complete three-year renovation.

In Africa, the Radisson Blu Hotel Waterfront, Cape Town opened in 1999 – the basis for a portfolio that has now grown to 36 hotels and more than 8,000 rooms in operation and under development across this vast continent of 57 countries. Our African success story is supported by our joint venture with four Nordic Government Funds (AfriNord), which help finance projects through mezzanine debt. In 2010, Rezidor also extended its partnership agreement with the Mvelaphanda Group, a powerful South African company with Black Economic Empowerment credentials, which will facilitate our further growth in this strategic market.

A balanced portfolio

Despite the still fragile economic climate, 2010 has been another good year for Rezidor and our third consecutive record year of rooms opened. We signed 40 hotels with 8,100 rooms and opened 32 hotels with 7,200 rooms – bringing our total portfolio of properties in operation and under development to more than 400 hotels with 87,000 rooms in over 60 countries.

Our business is not just about signing and opening hotels; it is all about signing and opening the right hotels to create a diversified portfolio that balances risk and reward. We do business in different regions, and have different contract types. We operate classic city and business hotels and have increased our airport hotel portfolio – today, we are one of Europe’s leading airport hotel operators. We are building up a sophisticated resort selection, and – with Hotel Missoni – have entered a new niche market, taking advantage of the trend towards boutique and fashion hotels.

Besides new-build hotels, conversions are an increasingly important part of our business. The global downturn makes the financing of new construction projects a challenge – conversions and especially strategic portfolio transactions, which we actively seek, are an attractive alternative way to grow, and generate immediate cash flow. Between 2008 and 2010, about 40% of our openings were conversions. Park Inn by Radisson offers extremely efficient conversion packages and is our bestseller, but Radisson Blu also is suitable for high-quality conversions of upper-upscale hotels.

A strong pipeline

Our ever-expanding pipeline is one of the strongest in the industry. Contrary to many of our competitors which consolidated their business during the global downturn we further grew our portfolio during the crisis. Both Radisson Blu and Park Inn by Radisson have today the largest pipelines in Europe in their respective market segment, and across Europe, the Middle East and Africa more than 20,000+ rooms are scheduled to come on line over the next three to four years. More than 95% of Rezidor’s pipeline consists of high-margin, fee-based management and franchise contracts – once these hotels open, our EBITDA margin will improve by 2 to 2.5%, supporting our 12% overall target.

In this economic climate, where project cancellations are widespread, it is imperative for companies to not only grow their pipelines, but also protect them. We constantly work with owners and do our upmost to ensure that our projects are completed with only minimal delays.

A global alignment

Together with Carlson, the brand owner of Radisson, Park Inn and Country Inn and Rezidor’s largest shareholder, we are also looking beyond the borders of Europe, the Middle East and Africa – the region where we are Carlson’s masterfranchisee. We support Carlson’s strategy, “Ambition 2015”, which is fuelled by an investment programme of up to USD 1.5 billion, and are working with Carlson on the worldwide development of Radisson as a vibrant, contemporary and globally consistent first-class brand. With our new breed Radisson Blu hotels, Rezidor has set high standards in Europe, the Middle East and Africa – a level that Carlson now aims to reach for flagship properties worldwide. The first upper-upscale Radisson Blu hotels in the Americas and Asia-Pacific were announced in 2010. They will enhance the brand’s image and also open up more market segments to Rezidor: one of our targets is a higher share of US travellers. Park Inn by Radisson will also see global growth: Carlson is currently targeting key markets such as the United States, Mexico and India.

Sales and marketing

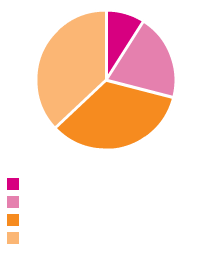

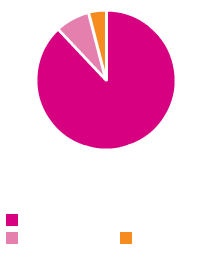

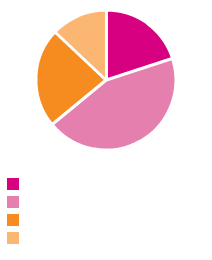

Click to viewOur contract types

Click to viewContract types

In operation

Under development

Regions

In operation

Under development