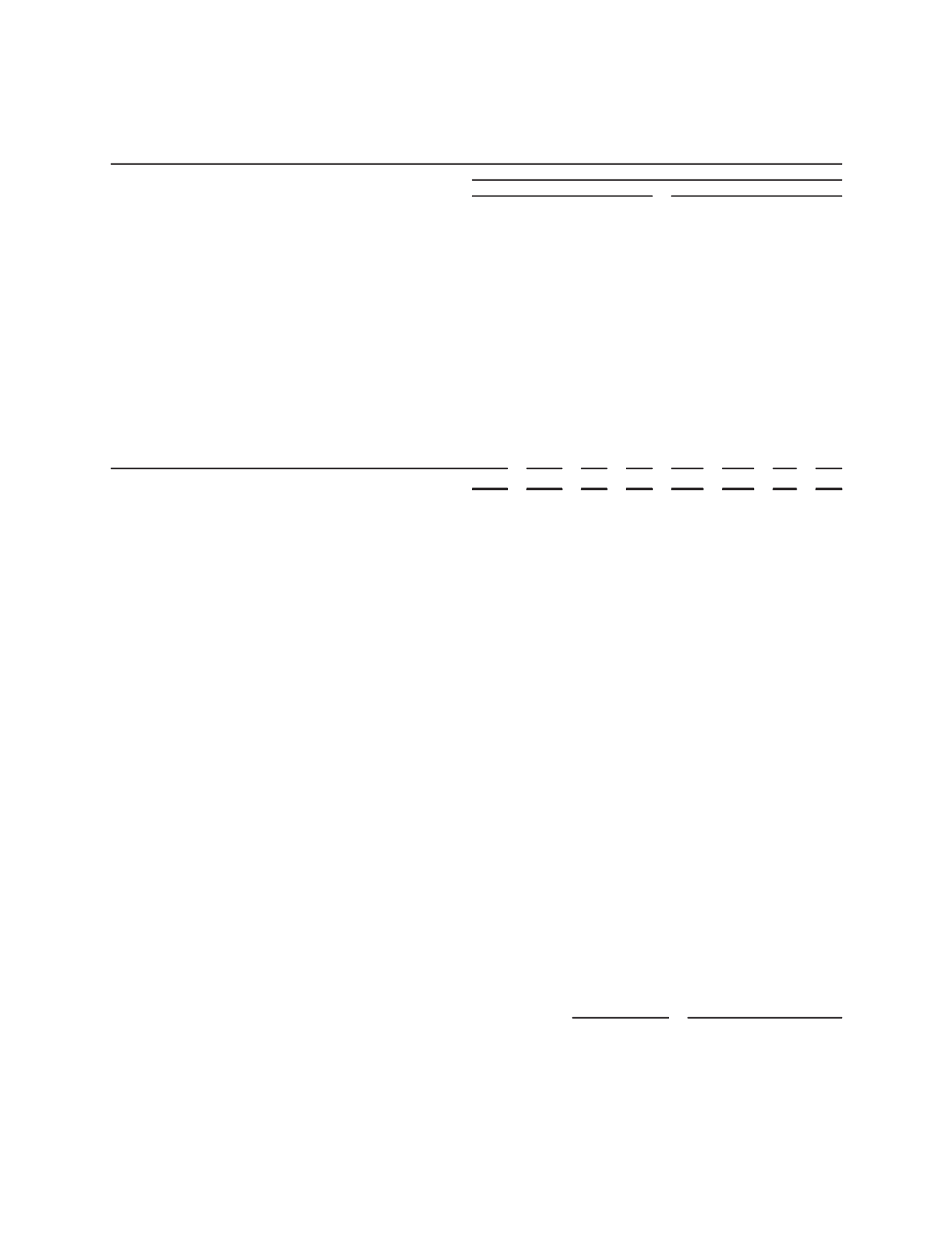

Total

Level

One

Level

Two

Level

Three

Total

Level

One

Level

Two

Level

Three

2010

2009

International Plan Assets

(Stated in millions)

Asset Category:

Cash and Cash Equivalents

$ 106 $ 106

$ – $ – $ 111 $ 111 $ – $ –

Equity Securities:

US

(a)

1,268 1,268

1,113 1,113

International

(b)

1,031 1,031

643

643

Debt securities:

Corporate bonds

(c)

289

15 274

257

11 246

Government and government-related

(d)

693

522 171

492

378 114

Government agency collateralized mortgage obligations and

mortgage backed securities

(e)

125

44

81

137

20 117

Other collateralized mortgage obligations and mortgage-backed

securities

(f)

74

74

70

70

Other Investments:

Private equity

(g)

114

114

87

87

Real estate

(h)

64

64

66

66

Total

$3,764 $2,986 $600 $178

$2,976 $2,276 $547 $153

(a) US equities include companies that are well diversified by industry sector and equity style (i.e., growth and value strategies). Active and passive

management strategies are employed. Investments are primarily in large capitalization stocks and, to a lesser extent, mid- and small-cap stocks.

(b) International equities are invested in companies that are traded on exchanges outside the US and are well diversified by industry sector, country

and equity style. Active and passive strategies are employed. The vast majority of the investments are made in companies in developed markets

with a small percentage in emerging markets.

(c) Corporate bonds consist primarily of investment grade bonds from diversified industries.

(d) Government and government-related debt securities are comprised primarily of inflation protected US treasuries and, to a lesser extent, other

government-related securities.

(e) Government agency collateralized mortgage obligations and mortgage backed-securities are debt obligations that represent claims to the cash

flows from pools of mortgage loans which are purchased from banks, mortgage companies, and other originators and then assembled into pools by

governmental and quasi-governmental entities.

(f) Other collateralized mortgage obligations and mortgage-backed securities are debt obligations that represent claims to the cash flows from pools

of mortgage loans which are purchased from banks, mortgage companies, and other originators and then assembled into pools by private entities.

(g) Private equity includes investments in several fund of funds limited partnerships.

(h) Real estate primarily includes investments in real estate limited partnerships, concentrated in commercial real estate.

The funding policy is to annually contribute amounts that are based upon a number of factors including the actuarial

accrued liability, amounts that are deductible for income tax purposes, legal funding requirements and available cash

flow. Schlumberger currently anticipates contributing approximately $600 million to $650 million to its postretirement

benefit plans in 2011, subject to market and business conditions.

Postretirement Benefits Other than Pensions

Schlumberger provides certain health care benefits to former US employees who have retired.

The actuarial assumptions used to determine the accumulated postretirement benefit obligation and net periodic

benefit cost for the US postretirement medical plan were as follows:

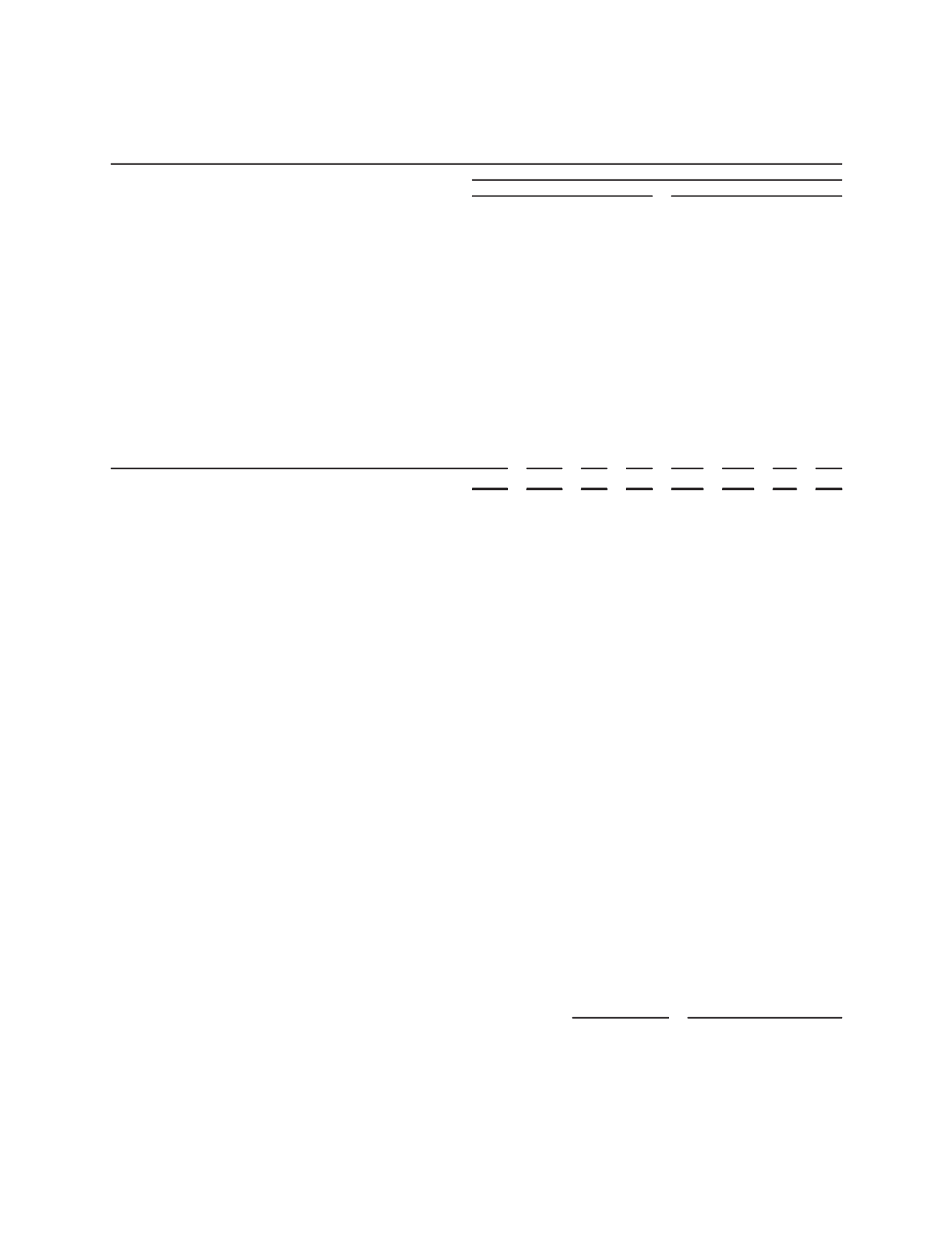

2010 2009 2010 2009 2008

Benefit Obligation

at December 31,

Net Periodic Benefit Cost

for the year

Discount rate

5.50%

6.00%

6.00%

6.94% 6.50%

Return on plan assets

–

–

8.00%

8.00% 8.00%

Current medical cost trend rate

8.00%

8.00%

8.00%

8.00% 9.00%

Ultimate medical cost trend rate

5.00%

5.00%

5.00%

5.00% 5.00%

Year that the rate reaches the ultimate trend rate

2017

2016

2016

2015

2012

69

Part II, Item 8