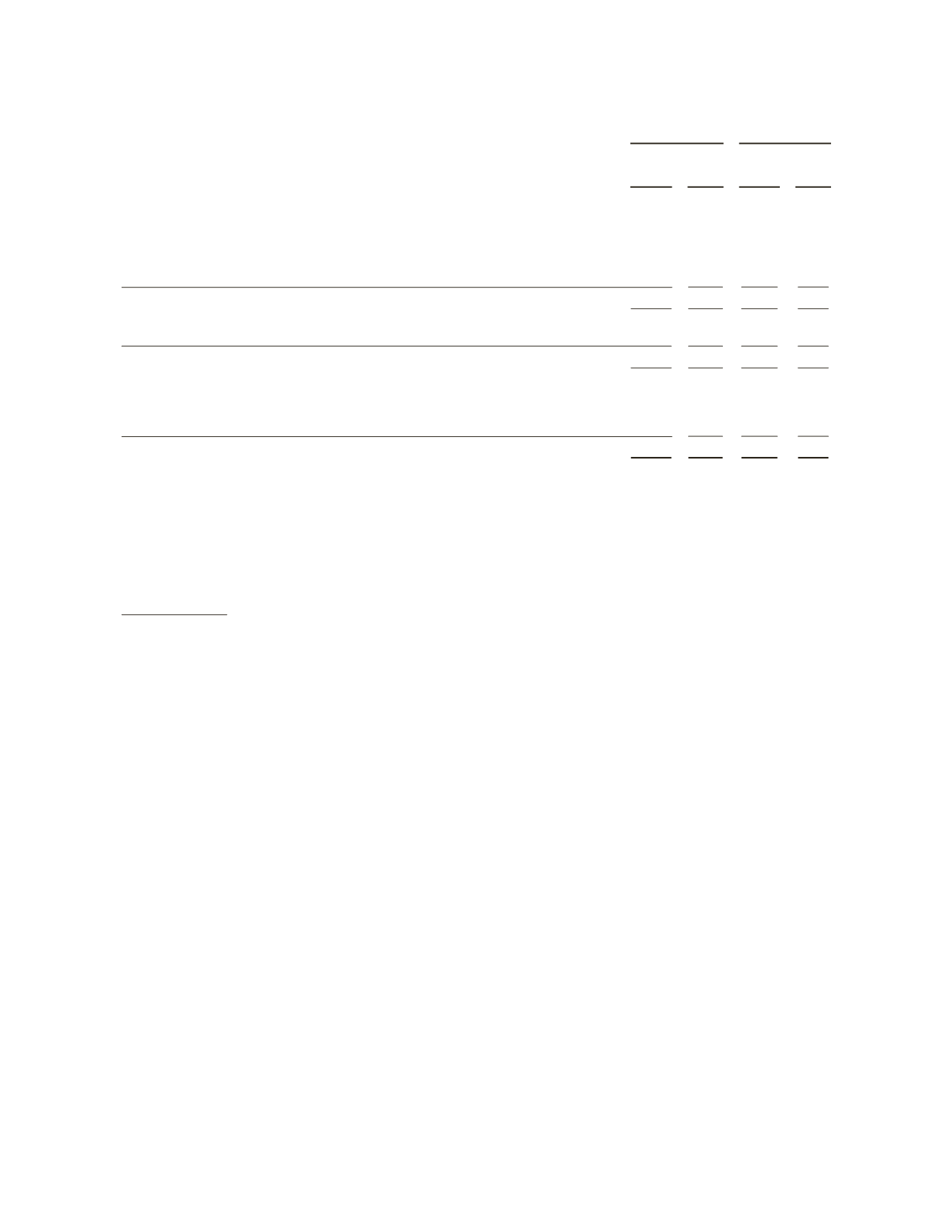

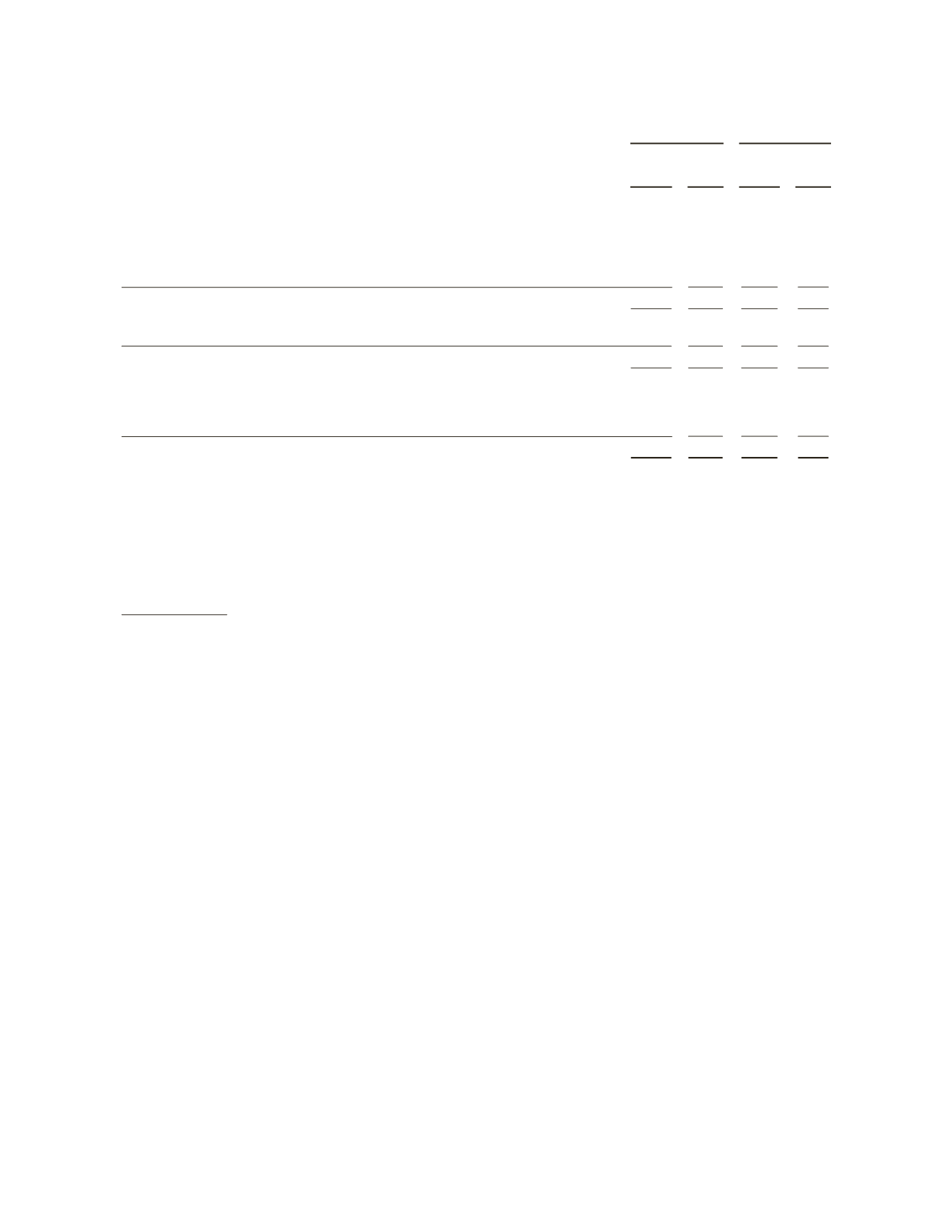

(Stated in millions)

2011

2010

Revenue

Income

before

taxes

Revenue

Income

before

taxes

Oilfield Services

North America

$12,273 $3,051

$ 6,729 $1,145

Latin America

6,453 1,072

4,985

808

Europe/CIS/Africa

9,761 1,489

8,024 1,457

Middle East & Asia

8,065 1,868

6,650 1,764

Eliminations & other

407 (175)

285

(103)

36,959 7,305

26,673 5,071

Distribution

2,621

103

774

29

Eliminations

(40)

–

–

–

2,581

103

774

29

Corporate & other

(1)

– (592)

– (405)

Interest income

(2)

–

37

–

43

Interest expense

(3)

– (290)

– (202)

Charges & credits

(4)

– (225)

–

620

$39,540 $6,338

$27,447 $5,156

(1)

Comprised principally of corporate expenses not allocated to the segments, interest on postretirement medical benefits, stock-based

compensation costs, amortization expense associated with intangible assets recorded as a result of the acquisition of Smith and certain other

nonoperating items.

(2)

Excludes interest income included in the segments’ income (2011 – $3 million; 2010 – $7 million).

(3)

Excludes interest expense included in the segments’ income (2011 – $8 million; 2010 – $5 million).

(4)

Charges and credits are described in detail in Note 3 to the

Consolidated Financial Statements

.

Oilfield Services

Full-year 2011 revenue of $37.0 billion was 39% higher than 2010 primarily reflecting the acquisition of Smith on

August 27, 2010 as well as the significantly improved activity, pricing and asset efficiency for Well Services

Technologies in North America as the market transitioned to liquid-rich plays demanding increasing service intensity

in drilling and completing horizontal wells.

Year-on-year pretax operating margin increased 75 bps to 19.8% largely due to the improved pricing and asset

efficiency for Well Services Technologies in North America and the resumption of higher-margin activity in the US Gulf

of Mexico. However, the margin expansion was tempered by activity disruptions from the geopolitical unrest in North

Africa and in the Middle East during the first quarter of 2011.

Reservoir Characterization

Revenue of $9.93 billion was 7% higher than the same period last year on stronger Wireline activity, higher

WesternGeco marine and multiclient sales, and increased SIS software sales.

Year-on-year, pretax operating margin decreased 23 bps to 24.7% led by margin declines in Wireline and Testing

Services, largely due to the revenue mix, as well as the impact of geopolitical events which prevailed during the first

quarter of 2011. The margin decline however was partially offset by a favorable WesternGeco multiclient sales mix and

improved marine vessel utilization.

Drilling

Revenue of $14.25 billion was 73% higher than the same period last year reflecting the acquisitions of Smith, in

August 2010, and Geoservices, in April 2010, partially offset by a decrease in IPM activities in Mexico. The ramp-up of

IPM projects in Iraq also contributed to the revenue increase.

Year-on-year, pretax operating margin decreased 24 bps to 16.0% largely due to the addition of the Smith and

Geoservices activities as well as the effects of the geopolitical events.

20