Š

Capital expenditures were $4.0 billion in 2011, $2.9 billion in 2010 and $2.4 billion in 2009. Capital

expenditures are expected to approach $4.5 billion for the full year 2012.

Š

During 2011, 2010 and 2009 Schlumberger made contributions of $601 million, $868 million and $1.1 billion,

respectively, to its postretirement benefit plans. The US pension plans were 87% funded at December 31, 2011

based on the projected benefit obligation. This compares to 95% funded at December 31, 2010.

Schlumberger’s international defined benefit pension plans are a combined 88% funded at December 31, 2011

based on the projected benefit obligation. This compares to 92% funded at December 31, 2010.

Schlumberger currently anticipates contributing approximately $600 million to its postretirement benefit

plans in 2012, subject to market and business conditions.

Š

There were $321 million outstanding Series B debentures at December 31, 2009. During 2010, the remaining

$320 million of the 2.125% Series B Convertible Debentures due June 1, 2023 were converted by holders into

8.0 million shares of Schlumberger common stock and the remaining $1 million of outstanding Series B

debentures were redeemed for cash.

As of December 31, 2011, Schlumberger had approximately $4.8 billion of cash and short-term investments on

hand. Schlumberger had separate committed debt facility agreements aggregating $4.1 billion with

commercial banks, of which $2.8 billion was available and unused as of December 31, 2011. This included $3.5

billion of committed facilities which support commercial paper borrowings in the United States and Europe.

Schlumberger believes that these amounts are sufficient to meet future business requirements for at least the

next 12 months.

Schlumberger had $0.9 billion of commercial paper outstanding as of December 31, 2011.

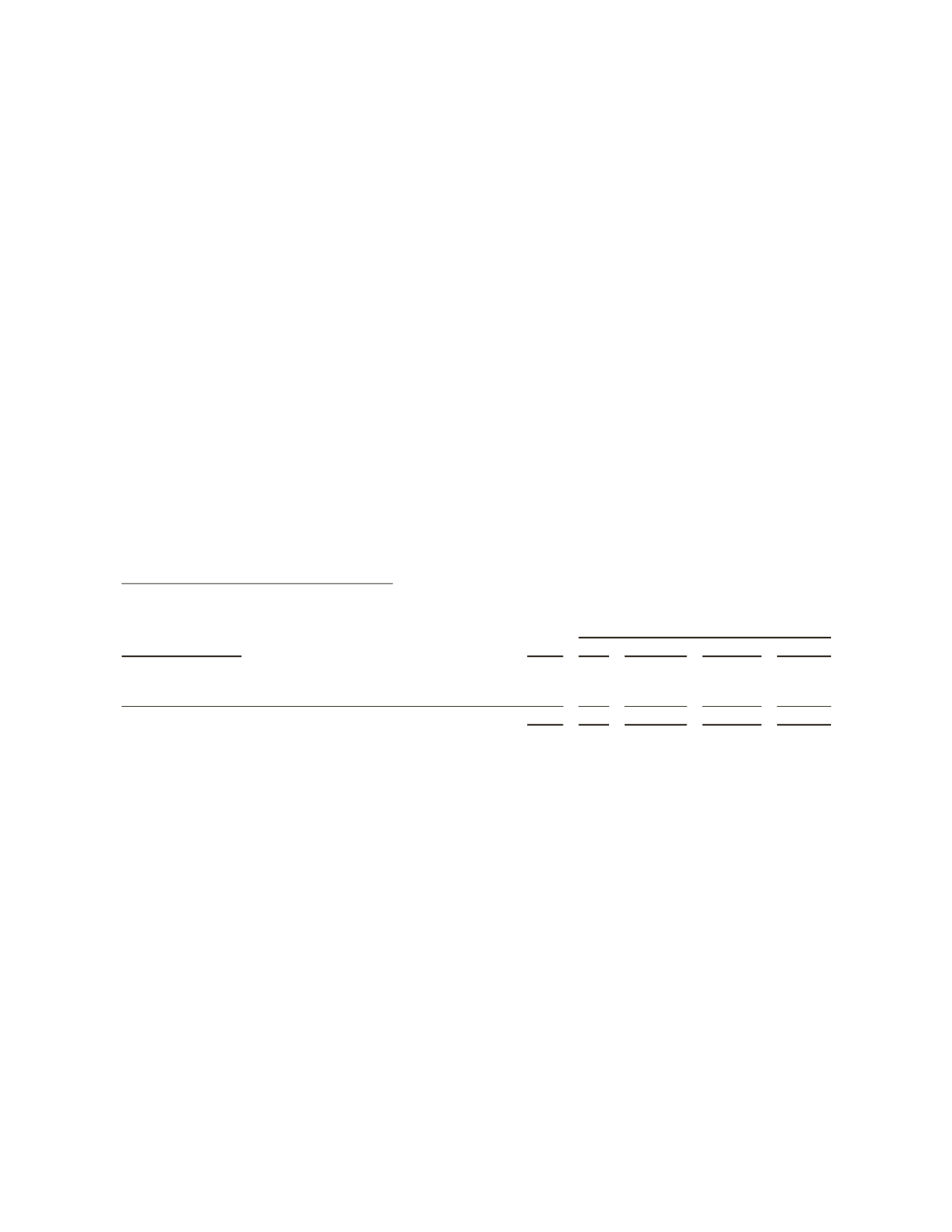

Summary of Major Contractual Obligations

(Stated in millions)

Payment Period

Contractual Obligations

Total

2012 2013 – 2014 2015 –2016 After 2016

Debt

(1)

$ 9,933 $1,377

$2,773

$3,089

$2,694

Operating Leases

1,429

313

420

255

441

Purchase Obligations

(2)

3,707 2,647

386

298

376

$15,069 $4,337

$3,579

$3,642

$3,511

(1)

Excludes future payments for interest.

(2)

Represents an estimate of contractual obligations in the ordinary course of business. Although these contractual obligations are considered

enforceable and legally binding, the terms generally allow Schlumberger the option to reschedule and adjust its requirements based on business

needs prior to the delivery of goods.

Refer to Note 18

Pension and Other Benefit Plans

of the

Consolidated Financial Statements

for details regarding

Schlumberger’s pension and other postretirement benefit obligations.

As discussed in Note 14

Income Taxes

of the

Consolidated Financial Statements

, included in the Schlumberger

Consolidated Balance Sheet

at December 31, 2011 is approximately $1.35 billion of liabilities associated with uncertain

tax positions in the over 100 jurisdictions in which Schlumberger conducts business. Due to the uncertain and complex

application of tax regulations, combined with the difficulty in predicting when tax audits throughout the world may be

concluded, Schlumberger cannot make reliable estimates of the timing of cash outflows relating to these liabilities.

Schlumberger has outstanding letters of credit/guarantees which relate to business performance bonds, custom/

excise tax commitments, facility lease/rental obligations, etc. These were entered into in the ordinary course of

business and are customary practices in the various countries where Schlumberger operates.

27