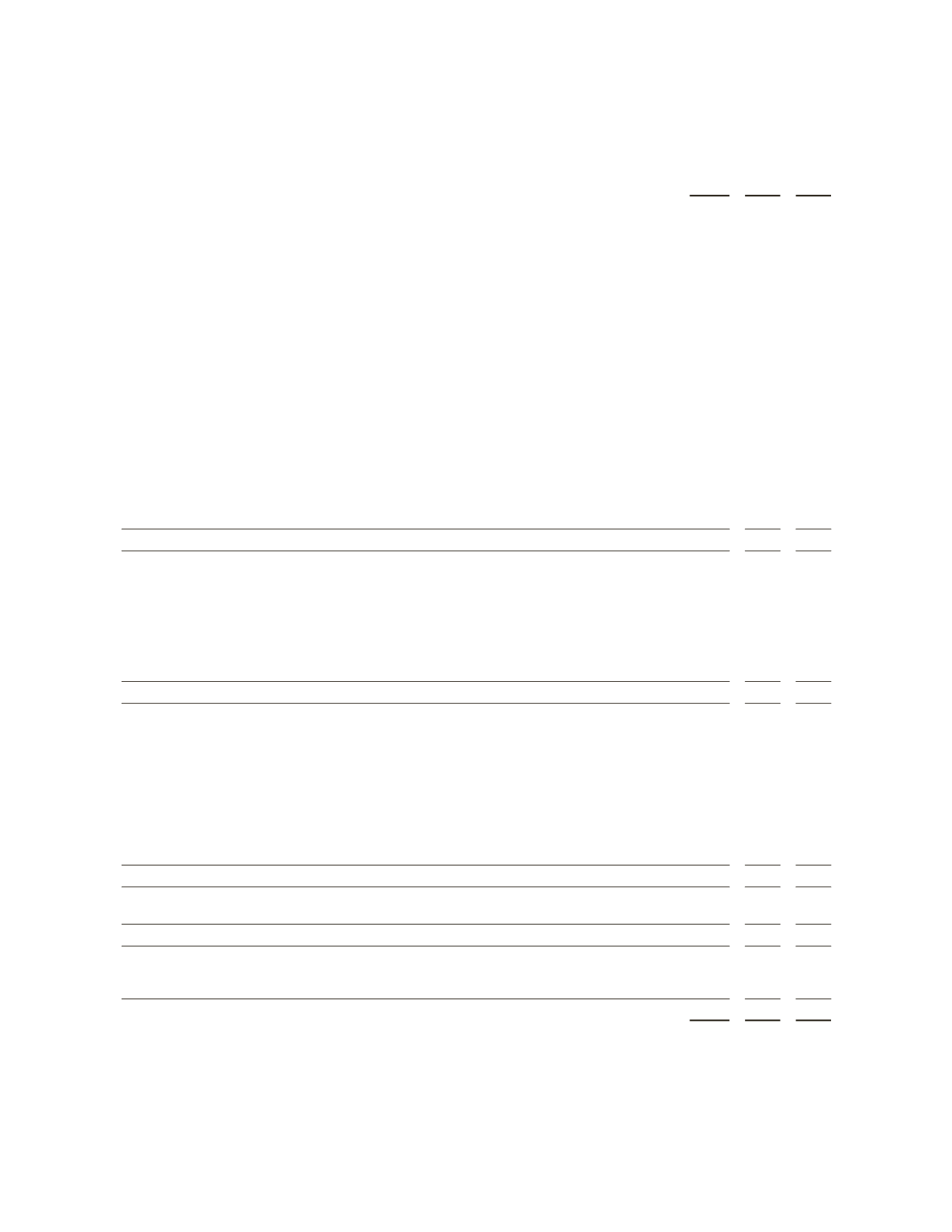

SCHLUMBERGER LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

(Stated in millions)

Year Ended December 31,

2011 2010 2009

Cash flows from operating activities:

Net Income

$ 5,013

$ 4,266 $ 3,142

(Income) loss from discontinued operations

(220)

–

22

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization

(1)

3,281

2,759 2,476

Gain on investment in M-I SWACO

–

(1,270)

–

Earnings of companies carried at equity, less dividends received

(64)

(85)

(103)

Deferred income taxes

(35)

(109)

373

Stock-based compensation expense

272

198

186

Pension and other postretirement benefits expense

365

299

306

Pension and other postretirement benefits curtailment charge

–

–

136

Other non-cash items

203

327

162

Pension and other postretirement benefits funding

(601)

(868) (1,149)

Change in operating assets and liabilities:

(2)

(Increase) decrease in receivables

(1,310)

(289)

155

(Increase) decrease in inventories

(991)

(67)

64

(Increase) decrease in other current assets

(99)

136

9

Increase (decrease) in accounts payable and accrued liabilities

708

(103)

(293)

(Decrease) increase in estimated liability for taxes on income

(544)

480

(361)

(Decrease) increase in other liabilities

168

(89)

43

Other – net

23

(91)

143

NET CASH PROVIDED BY OPERATING ACTIVITIES

6,169

5,494 5,311

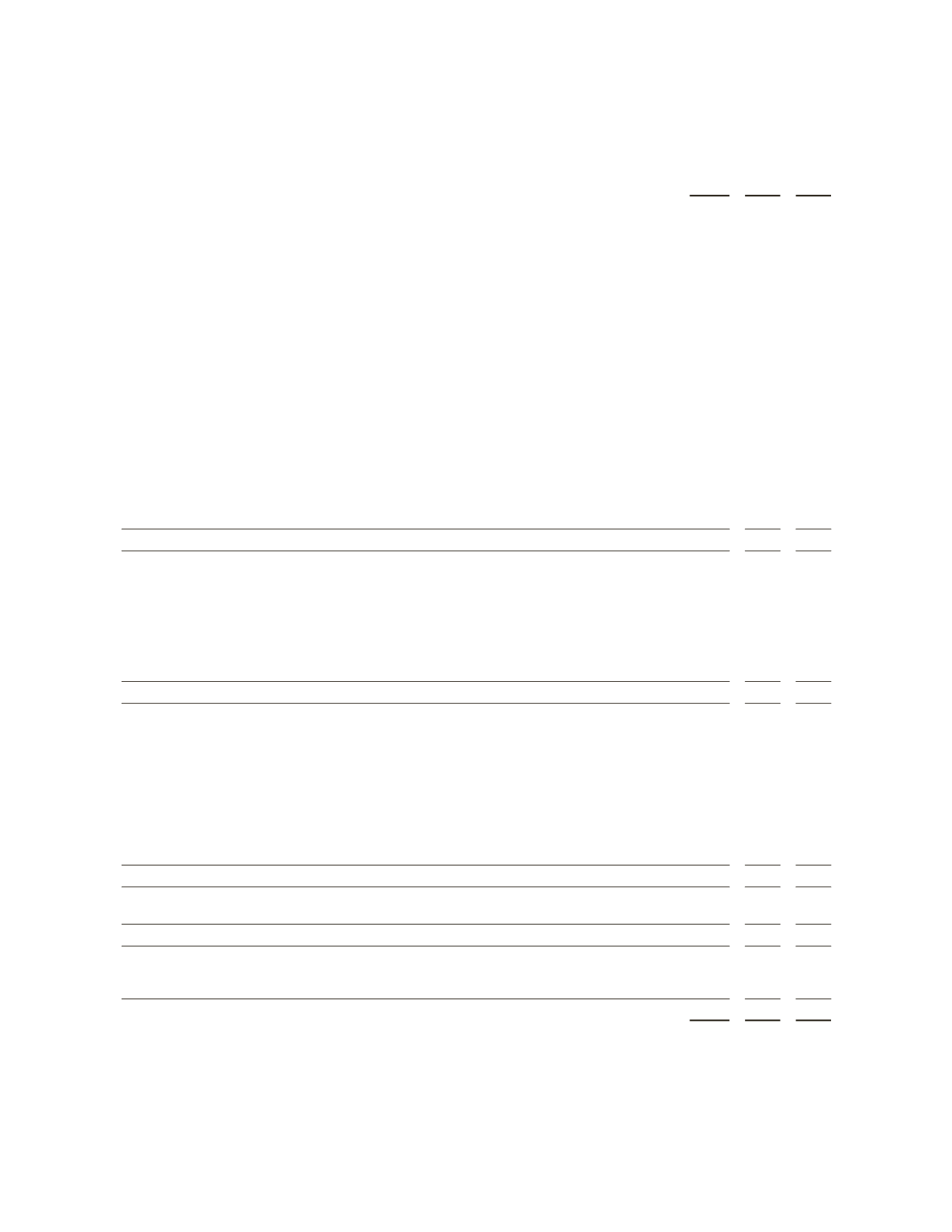

Cash flows from investing activities:

Capital expenditures

(4,016)

(2,914) (2,395)

Multiclient seismic data capitalized

(289)

(326)

(230)

Cash acquired in acquisition of Smith International, Inc.

–

399

–

Acquisition of Geoservices, net of cash acquired

–

(889)

–

Other business acquisitions and investments, net of cash acquired

(186)

(212)

(514)

Sale (purchase) of investments, net

351

1,023 (1,159)

Other

230

(19)

228

NET CASH USED IN INVESTING ACTIVITIES

(3,910)

(2,938) (4,070)

Cash flows from financing activities:

Dividends paid

(1,300)

(1,040) (1,006)

Proceeds from employee stock purchase plan

208

179

96

Proceeds from exercise of stock options

230

222

110

Tax benefit on stock options

15

14

4

Stock repurchase program

(2,998)

(1,717)

(500)

Proceeds from issuance of long-term debt

6,884

2,815 1,973

Repayment of long-term debt

(4,992)

(1,814) (1,754)

Net decrease in short-term borrowings

(119)

(68)

(111)

Other

(628)

–

–

NET CASH USED IN FINANCING ACTIVITIES

(2,700)

(1,409) (1,188)

Cash flow from discontinued operations – operating activities

–

–

(45)

Cash flow from discontinued operations – investing activities

385

–

–

Cash flow from discontinued operations

385

–

(45)

Net (decrease) increase in cash before translation effect

(56)

1,147

8

Translation effect on cash

(3)

–

–

Cash, beginning of year

1,764

617

609

Cash, end of year

$ 1,705

$ 1,764 $ 617

(1) Includes multiclient seismic data costs.

(2) Net of the effect of business acquisitions.

See the

Notes to Consolidated Financial Statements

36